Last week, the US released the January Core PCE, said to be the Fed’s favorite measure of inflation. The reading was 4.7% YoY, an increase from December’s (revised higher print) of 4.6% YoY. This backs the Fed’s view that rates need to continue to be raised and will stay higher for a longer period of time. However, much of the world is also experiencing continued inflation. This week, inflation data will be released from Australia, the EU and Japan. In addition, markets will hear from BoJ Governor nominee Ueda and the BOE’s Bailey. Although Ueda wasn’t hawkish last week, will he change his tune this week? And will Bailey be hawkish? Also watch other economic data, as the US ISM Manufacturing and Services PMIs will be released. Watch for continued volatility as we approach month end!

Inflation

Inflation readings have been coming in strong recently. Just Friday, the January US Core PCE came in at 0.6% MoM and 4.7% YoY, both stronger than in December. Japan’s CPI for January was also released on Friday. Headline inflation increased from 4% YoY to 4.3% YoY, while the ex-food and energy reading was 3.2% YoY vs a December print of 3%. This week, Australia, the EU, and Tokyo will release inflation data. Australia’s monthly CPI Indicator is expected to be 7.9% for January vs a December reading of 8.4%. The headline EU CPI is expected to be 8.2% YoY vs a January reading of 8.6% YoY. The EU Core CPI is expected to be 5.3% YoY vs 5.3% YoY previously. And Tokyo’s February headline CPI is expected to be 4.0% YoY vs a previous reading of 4.4% YoY. The ex-food and energy reading is expected to be 1.6% YoY vs 1.7% YoY in January. (Note that Tokyo CPI is thought be a leading indicator for Japan CPI as a whole.) But what if these prints are higher than expected? What if these prints are even higher than the previous month? Keep an eye on yields for each country as they should provide clues as to where the currency is headed next.

Speakers

On Friday, BoJ Governor nominee Ueda spoke to the Diet regarding his nomination for BoJ Governor. Current BoJ Governor Kuroda’s term will come to an end in April. Therefore, the March BoJ meeting will be his last. Although Ueda said last week that current monetary policy is appropriate, he also said that a policy review will be conducted early in his tenure. Could he change his tune? In addition, Bank of England Governor Bailey will speak on Wednesday at the Cost of Living Conference. Audience Q&A is expected. The BoE is expected to hike between 25bps and 50bps at its March meeting. However, it does have February’s inflation data to look at before its meeting. This may give a better indication closer to the BoE meeting on March 23rd.

Earnings

It may feel like the end of earnings season is near, but this week is one of the busiest weeks of the period. Retailers will be front and center this week with Target, Macys, and Dollar Tree reporting. In addition, big names to release this week include AMC, Nio, Rivian, and Best Buy. Other important earnings to be released this week are as follows:

ZM, TGT, AMC, HPQ, KSS, LOW, WB, DLTR, NIO, SNOW, CRM, BBY, HPE, DELL, M

Economic Data

As mentioned, the inflation data due out this week could cause volatility in the markets. In addition to the inflation data, New Zealand, Japan, Australia, and Germany will release Retail Sales, China and the US will release their respective PMIs (in addition to the global final readings from S&P Global/CIPS), and the US will release Durable Goods. Other important economic data releases due out this week are as follows:

Monday

- New Zealand: Retail Sales (Q4)

- Australia: Company Gross Profits (Q4)

- EU: Economic Sentiment (FEB)

- US: Durable Goods (JAN)

- US: Pending Home Sales (Jan)

Tuesday

- Japan: Retail Sales (JAN)

- Japan: Industrial Production Prel (JAN)

- New Zealand: ANZ Business Confidence (FEB)

- Australia: Housing Credit (JAN)

- Australia: Retail Sales Prel (JAN)

- Japan: Housing Starts (JAN)

- Switzerland: KOF Leading Indicators (FEB)

- Canada: GDP Prel (JAN)

- US: S&P/Case-Shiller Home Price (DEC)

- US: CB Consumer Confidence (FEB)

- US: Richmond Fed Manufacturing Index (FEB)

- US: Dallas Fed Services Index (FEB)

Wednesday

- Global: Manufacturing PMIs Final (FEB)

- New Zealand: Building Permits (JAN)

- Australia: GDP Growth Rate (Q4)

- Australia: Monthly CPI Indicator (JAN)

- China: NBS Manufacturing PMI (FEB)

- China: Non-Manufacturing PMI (FEB)

- China: Caixin Manufacturing PMI (FEB)

- Germany: Retail Sales (JAN)

- Germany: Unemployment Change (FEB)

- UK: BoE Consumer Credit (JAN)

- UK: Mortgage Approvals (JAN)

- UK: BOE Governor Bailey Speech

- Germany: CPI Prel (FEB)

- US: ISM Manufacturing PMI (FEB)

- US: Crude Inventories

Thursday

- Australia: Building Permits Prel (JAN)

- Japan: Consumer Confidence (FEB)

- EU: Unemployment Rate (JAN)

- EU: CPI Flash (FEB)

- US: Unit Labour Costs Final (Q4)

- US: Nonfarm Productivity Final (Q4)

Friday

- Global: Services PMI Final (FEB)

- New Zealand: ANZ Roy Morgan Consumer Confidence (FEB)

- Japan: Unemployment Rate (JAN)

- Japan: Tokyo CPI (FEB)

- Australia: Home Loans (JAN)

- China: Caixin Services PMI (FEB)

- Germany: Trade Balance (JAN)

- EU: PPI (JAN)

- Canada: Building Permits (JAN)

- Canada: Labor Productivity (Q4)

- US: ISM Non-Manufacturing PMI (FEB)

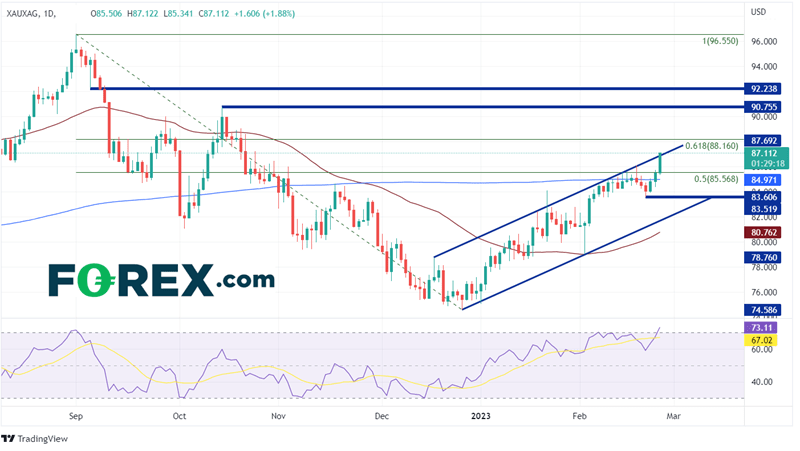

Chart of the Week: Gold/Silver Ratio (XAU/XAG)

Source: Tradingview, Stone X

With the US Dollar and Interest Rates rising, precious metals have been taking the brunt of it. However, the Gold/Silver (XAU/XAG) ratio has been moving higher in an orderly channel since December 27th, 2022. When the Gold/Silver ratio is rising, Gold is outperforming Silver. However, when the ratio is declining, Silver is outperforming Gold. Therefore, if one is bullish the ratio, he or she can buy equal dollar amounts of gold and sell silver. Conversely, if one is bearish the ratio, one can sell Gold and buy Silver. On Friday, the ratio pushed about the 50% retracement from the highs of September 1st, 2022 to the lows of December 27th, 2022 at 85.57. XAU/XAG also pushed above the top trendline of the channel near 87.00. First resistance is at the 61.8% Fibonacci retracement from the same timeframe at 88.16. Above there, the ratio can move to resistance at 90.76, then 92.24. However, notice the RSI is in overbought territory, indicating the possibility of a pullback. First support is just below at the 200 Day Moving Average near 84.97. Below there, horizontal support crosses at the February 21st lows of 83.61, then the bottom trendline of the channel hear 81.75.

Recent inflation data has shown that high rates aren’t going away anytime soon and probably will even go higher! With more inflation data out this week, in addition to central bank speakers, markets may get more clues as to just how hawkish central banks are or will be. However, after the central banks meetings in mid-March, traders will be wondering if it’s time for them to turn a bit less hawkish or even pause interest rate increases.

Have a great weekend!