It has certainly been a busy week for global financial markets thanks key economic data and earnings from some of the largest companies in the world.

Overall sentiment remains supported by upbeat results despite lingering worries about the U.S. banking sector. Stocks in Europe gained this morning after reversing losses while US equity futures are pointing to strong open. Interestingly, the encouraging first-quarter results from Microsoft, Alphabet, and Meta have failed to inspire Nasdaq bulls with the index down 1.5% this week. In the currency space, the dollar is on standby ahead of the US GDP and jobless claims data this afternoon. We see a similar theme on the yen ahead of the Bank of Japan (BoJ) rate decision on Friday, the first with new governor Kazuo Ueda. Looking at commodities, oil is stabilizing while gold seems to be waiting for a fresh fundamental spark.

With the new trading month around the corner, here are some potential setups to watch out for.

DXY to resume downtrend?

The Dollar Index (DXY) remains trapped within a range on the daily charts. Support can be found around the 100.80 regions and resistance at 102.00. A breakout could be on the horizon with the pending US economic data acting as a potential catalyst. Weakness below 100.82 could encourage a decline toward 100.46 and 100.00, respectively. Should prices break above 102.00, this may open the doors toward 103.00.

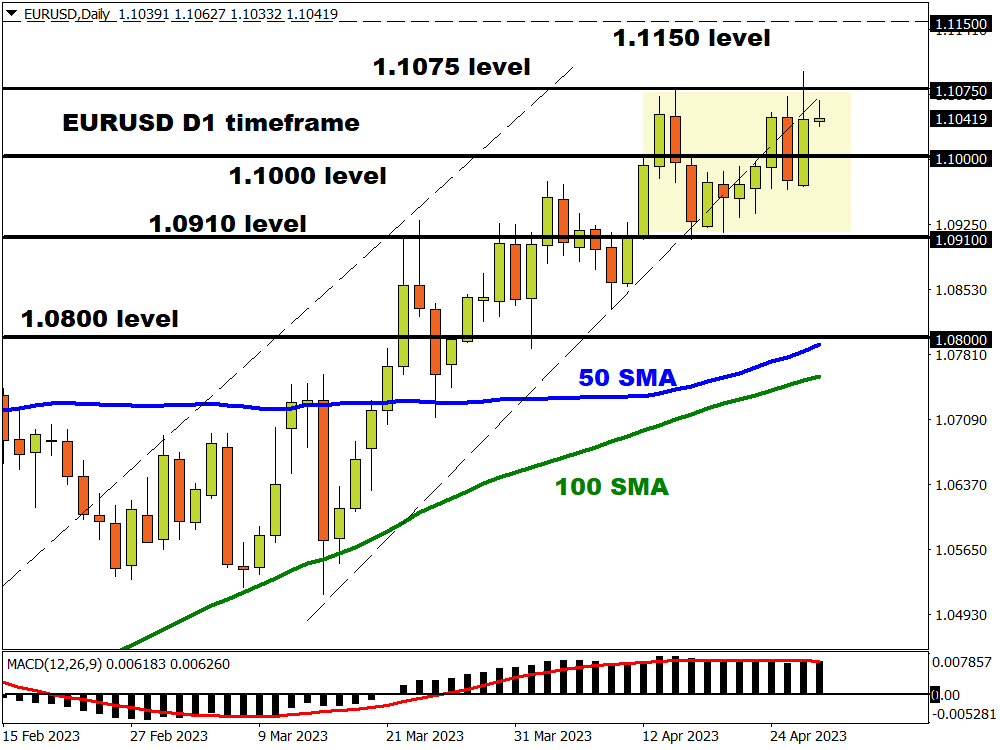

EURUSD capped below 1.1075?

Euro bulls have struggled to conquer the 1.1075 level on repeated occasions. Although the trend remains bullish, bears could jump back into the scene if prices slip back below 1.1000. Such a development may inspire a steeper decline towards 1.0910 and potentially lower. Should 1.1075 prove to be unreliable resistance, the next key level of interest can be found at 1.1150.

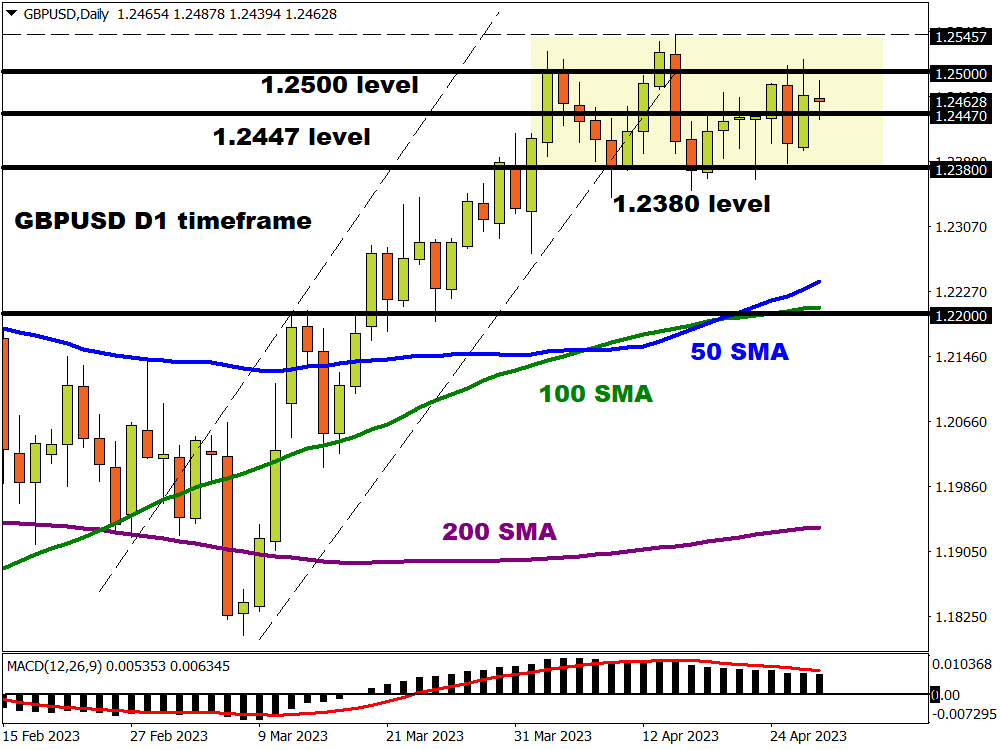

GBPUSD trapped within a range

A breakout could be pending on the GBPUSD. It has been same the old story for the currency pair with prices trading within a very wide range. Support can be found at 1.2380 and resistance around 1.2500. Should prices slip back below 1.2380, the next key level of interest can be found at 1.2200. A breakout above 1.2500 may signal an incline back towards 1.25457.

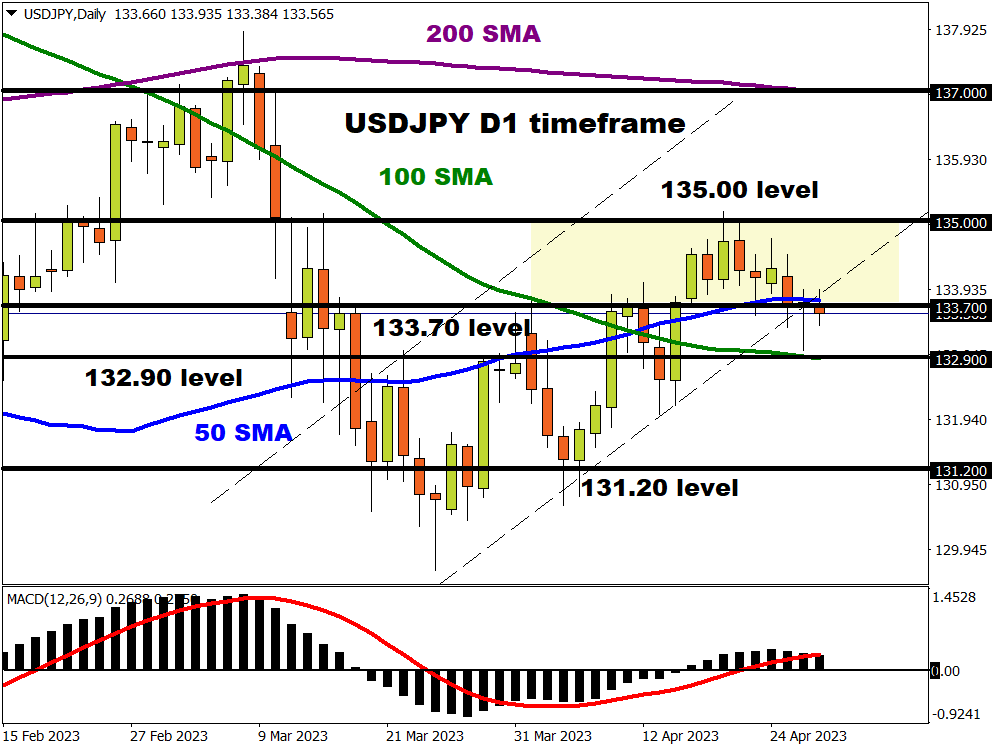

USDJPY waits on BoJ decision

Where the yen concludes this week may be influenced by the BoJ rate decision on Friday morning. The USDJPY is trading marginally below the 133.70 support level as of writing. Sustained weakness below this level could inspire a selloff towards 132.90. A move back above 133.70 could open the doors back towards 135.00 and 137.00 – where the 200-day SMA resides.

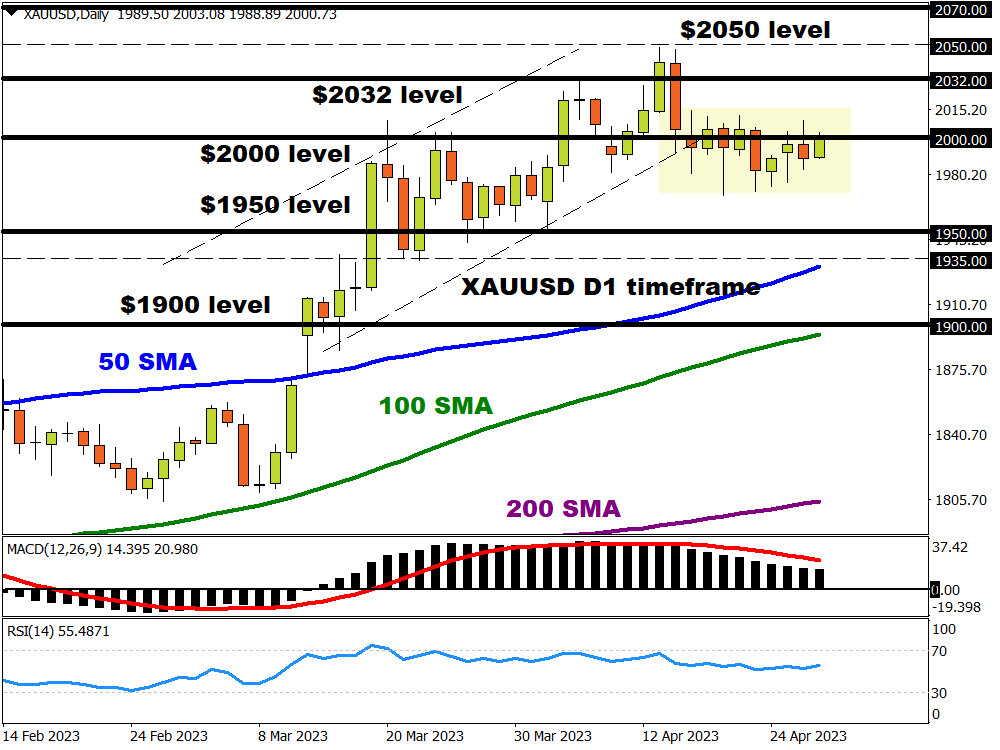

Commodity Spotlight - Gold

Gold remains trapped within a sticky range. Price action suggests that a fresh catalyst is needed to trigger a bullish or bearish breakout. A strong move above $2000 may inspire a push toward $2032 and $2048. If prices remain below $2000, gold could test $1950 and $1935.