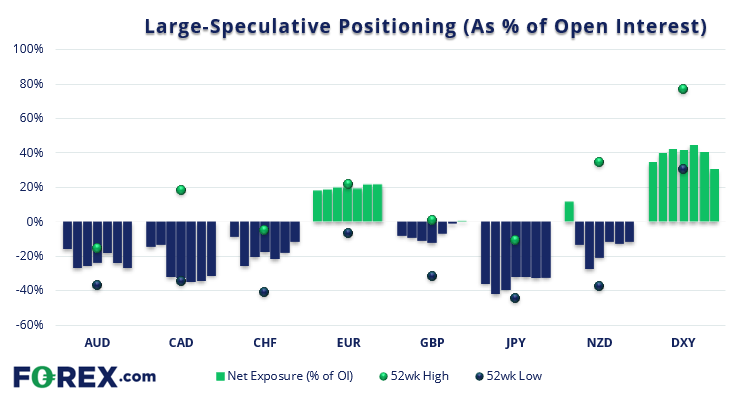

Commitment of traders – as of Tuesday 18th April 2023:

- GBP futures traders flipped to net-long exposure for the first time since February 2022

- Large speculators reduced net-short exposure to CAD futures by -18%

- Net-short exposure to AUD futures rose to a 2-week high

- Traders were their least bullish on DXY futures since July 2021

- Net-short exposure to the 10-year treasury note was at its most bearish level since October 2018

- Net-short exposure to the 2-year note fell to its most bearish level in 6-weeks

This content will only appear on Forex websites! Read our guide on how to interpret the weekly COT report

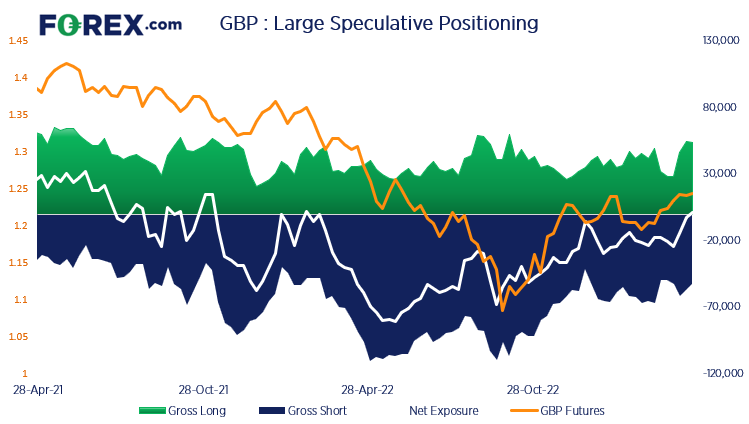

Commitment of traders – British pound futures (GBP):

Large speculators flipped to net-long exposure for the first time since February 2022, thanks to another set of hot wage and employment figures released on Tuesday (the cut off point for the weekly report, which is released the following Friday). And given that inflation data remained in double digits and the British pound is the second strongest FX major this year (behind CHF), we suspect traders will become increasingly net-log this week.

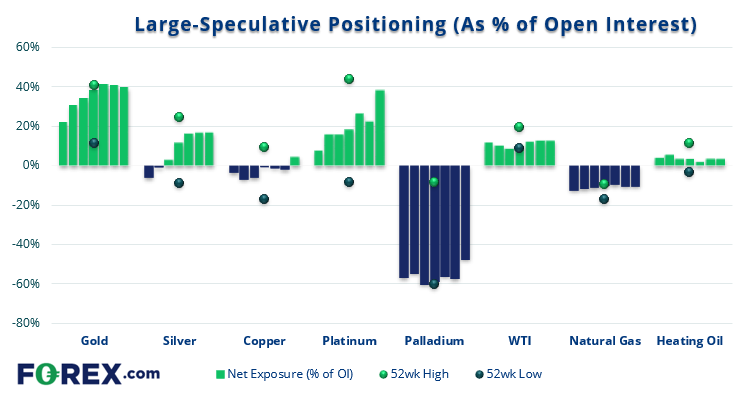

Commitment of traders – as of Tuesday 18th April 2023:

- Traders flipped to net-long copper futures for the first time in 11 weeks

- Net-long exposure to silver futures rose to an 11-week high

- Net-short exposure to palladium futures fell at its fastest weekly rate in over four years

Commitment of traders FAQs

What is the COT report?

The Commitments of Traders, or COT, report is a weekly publication that shows the aggregate holdings of different participants in the US futures market. It provides a snapshot of trading commitments as of Tuesday of that week in order to increase the transparency of exchanges.

COT reports are used across markets, so you’ll be able to obtain reports on forex, gold, indices and more.

How do you read the Commitments of Traders report?

The Commitments of Traders report is read in tables, in which each row will tell you the market and each column looks at the open interest, long positions and short positions. You’ll also be able to see which actors have taken positions, including dealers, institutions or funds.

The COT is a key data source for traders, as it can provide guidance on whether to go long or short on each market.

What is the COT report release time?

The COT report is released every Friday at 15:30 Eastern Time on the CFTC website. That’s 20:30 GMT or Saturday at 7:30 AEST. We provide up-to-date coverage of the COT report so that you can get expert analysis each week, as quickly as possible.

How to trade with FOREX.com

Follow these easy steps to start trading with FOREX.com today:

- Open a Forex.com account, or log in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.