Even as anticipation mounts ahead of the US jobs data due later today, investors may be bracing for more volatility in the week ahead thanks to another round of risk events.

All eyes will be on the incoming US inflation data as well as speeches from financial heavyweights and other risk events which could spark some fresh action across markets.

Monday, May 8

- UK bank holiday honouring Charles III coronation

- EUR: Germany industrial production, ECB Chief Economist Philip Lane speech

Tuesday, May 9

- CHN: China trade, money supply

- AUD: Australia consumer confidence

- EUR: ECB Chief Economic Philip Lane speech (IMF)

- USD: Fed New York President John Williams speech

- US President Joe Biden debt ceiling talks

Wednesday, May 10

- EUR: Germany April CPI (final)

- USD: US April CPI

Thursday, May 11

- CNH: China PPI, CPI

- GBP: UK BOE rate decision & press conference

- USD: US PPI, initial jobless claims

- G7 finance ministers meet in Japan

Friday, May 12

- GBP: UK Industrial production, Bank of England Chief Economist Huw Pill speech

- USD: University of Michigan consumer sentiment, Fed speeches

The April US consumer price index (CPI) report published on Wednesday 10th May will be exactly one week after the Federal Reserve raised rates and signalled a pause in further increases.

Given how Fed Chair Jerome Powell has left the door open to further tightening if incoming economic data warrants, this could add more spice to the report.

Markets are forecasting:

- CPI year-on-year (April 2023 vs. April 2022) to rise 5.0% - slowest pace in almost 2 years.

- Core CPI year-on-year to cool 5.4% from the 5.6% in the prior month.

- CPI month-on-month (April 2023 vs March 2023) to rise 0.4% from 0.1% in the prior month.

- Core CPI month-on-month to cool 0.3% from the 0.4% in the prior month.

Ultimately, further evidence of inflation slowing down could reinforce expectations around the Federal Reserve pausing and eventually cutting interest rates. Should inflation remain sticky, this could rekindle bets around the Fed leaving interest rates higher for longer.

Expectations are rising over the Federal Reserve cutting interest rates with the chance of a 25-basis point cut in July currently priced at 53%, according to Fed funds futures! It will be interesting to see how the incoming inflation data shapes market expectations around the central bank's next move.

With all of the above discussed, here’s how these 3 assets could react to the US CPI report

- USD Index

The past few months have been rough and rocky for the dollar as investors weighed the prospects of the Federal Reserve pausing and then eventually cutting interest rates. More pain could be in store for the dollar if US inflation cools more than expected in April.

- A soft inflation print may drag the USD Index toward the 100.72 level. Should prices experience a bearish breakout, this could open the doors toward 100.

- A sticky inflation print could throw a lifeline to dollar bulls, propelling back above 101.50 with 102.34 acting as a key level of interest.

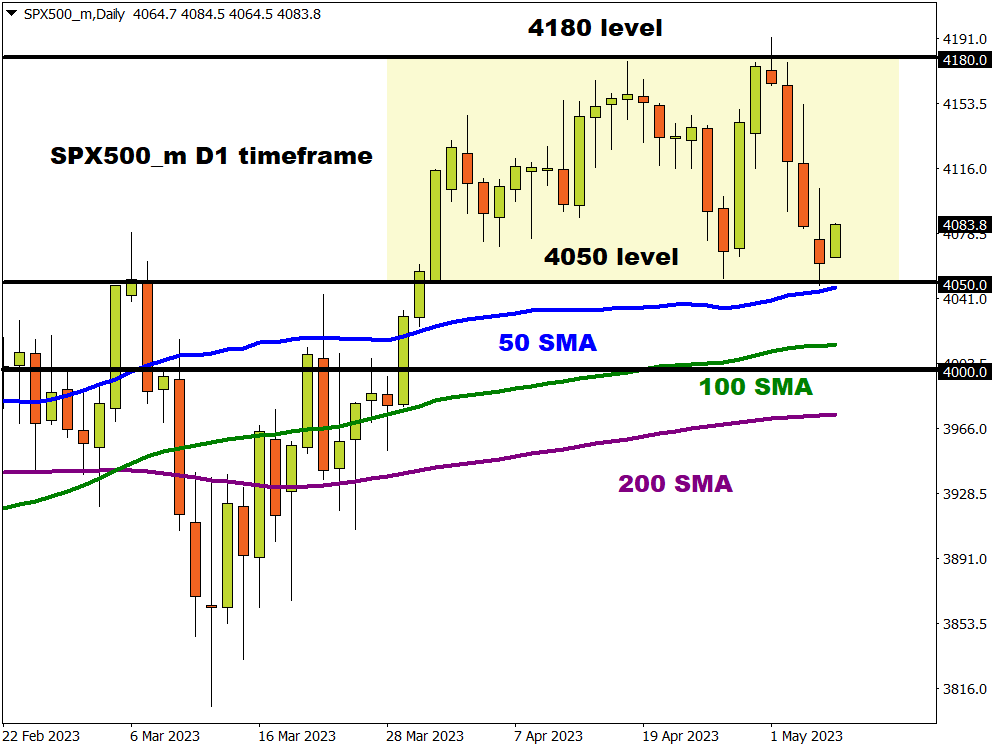

- SPX500_m

After being trapped within a range for the past few weeks, could a breakout be on the horizon for the SPX500_m?

- If the inflation numbers beat expectations, this may trigger a bearish breakout on the SPX500_m – taking prices below the 4050-support level.

- Should the inflation numbers come in lower than market forecasts, SPX500_m bulls could be injected with renewed confidence as expectations intensify over the Fed ending its rate cycle. This could send the index back toward the 4180 resistance level and beyond.

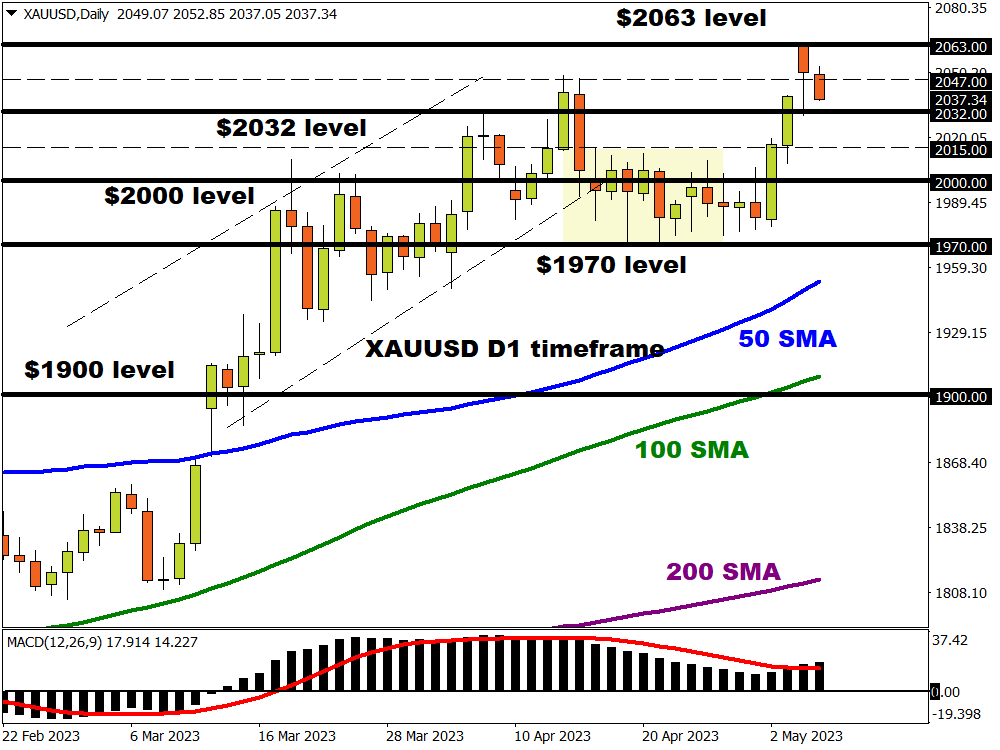

- Gold

It may be wise to fasten your seatbelts for potential volatility on gold due to its high sensitivity to inflation data and US interest rate expectations. The precious metal remains bullish on the daily charts despite prices pulling back from near-record highs.

- A soft inflation report could sweeten appetite for the zero-yielding asset as bets rise over the Fed cutting rates in 2023. This development could push the metal back towards the 2023 high of $2063 with bulls eyeing $2070 and the all-time high at $2075.

- A stronger-than-expected inflation number could drag gold prices back toward the psychological $2000 level.