The dollar caught our attention this morning after touching its highest level in five weeks against other major currencies.

It looks like dollar bulls may be back in the driver’s seat, especially after the solid rebound witnessed last week. But the key question is whether the US Dollar Index can maintain this bullish momentum or if this is just another dead cat bounce.

The low down…

After being suppressed by increasing Fed cut bets, the dollar has fought back with a vengeance thanks to political uncertainty and inflation worries. Concerns continue to mount over the US debt ceiling debate while a recent survey revealed that five-year inflation expectations among US consumers have jumped to a 12-year high.

Given how these forces already influencing the dollar, this could be another volatile week for the currency and here are 3 reasons why:

- Safe-haven demand

The messy mashup of political uncertainty and global growth fears could send investors rushing towards the dollar’s safe embrace.

- Ongoing drama revolving around the debt limit saga is likely to leave investors on edge. Last Friday, the US Congressional Budget Office warned that the US faced a “significant risk” of defaulting in early June without a debt ceiling increase. Talks between US President Joe Biden and top lawmakers have been postponed to this week. Should the ongoing stalemate result in elevated uncertainty and turbulence across markets, this could increase the appetite for the dollar.

- Concerns still linger over global economic growth. Throughout this week, investors will be presented with key economic reports from major economies ranging from Europe, the United Kingdom, and China among many others. A set of disappointing figures may fuel risk aversion as growth fears intensify, and the flight to safety may propel the dollar higher.

- Fed speeches + US data

After US annual inflation dipped below 5% in April, investors will be keeping a very close eye on Fed speeches and data for more clues on the Fed’s next move.

- A host of Fed speakers could influence the dollar’s near-term trajectory. Although US inflation has dipped below 5%, the jobs market remains tight with core and headline monthly inflation data still sticky. If policymakers strike an overall hawkish note, this could support the dollar further. However, any whiff of doves or further hints the Fed pausing may empower dollar bears.

- It will be wise to keep an eye on the latest US retail sales figures, industrial production, and US weekly initial jobless claims. A disappointing set of reports may fuel expectations around the Fed cutting rates down the road, weakening the dollar. If the figures exceed forecasts, it may fuel speculation around the Fed keeping rates higher for longer.

- USDInd Bullish breakout

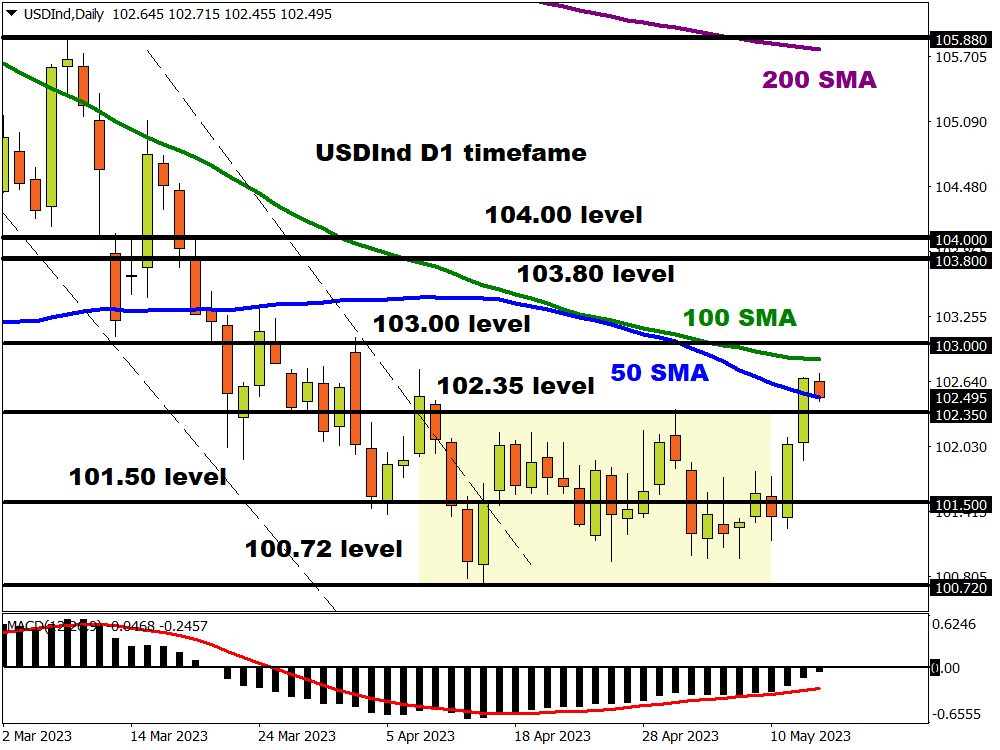

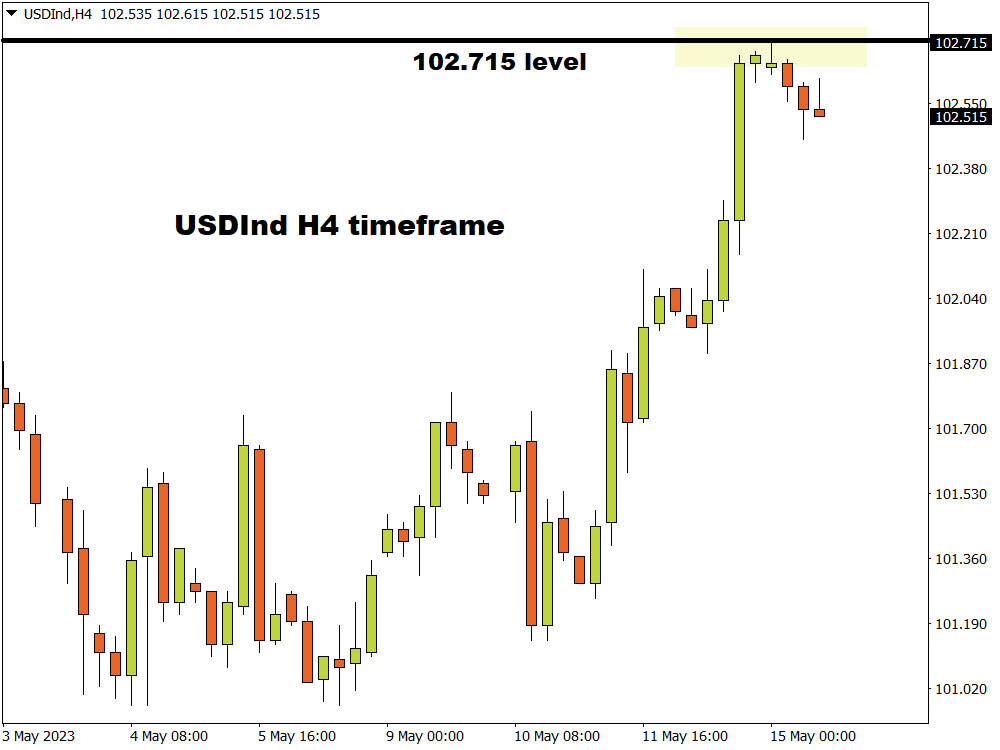

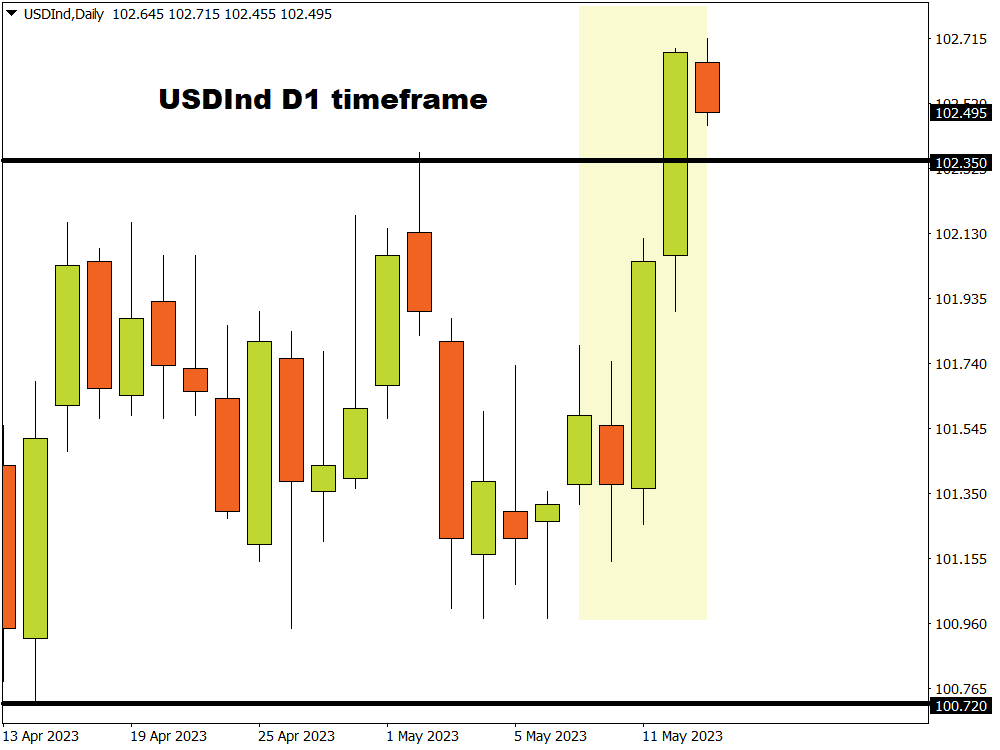

Dollar bulls marked their territory after securing a strong daily and weekly close above the 102.35 resistance level.

Nevertheless, the resistance around 50 and 100-day SMA could still weaken bulls before prices test the 103.00 level. Should prices push above this point, the next key level of interest on the US Dollar Index can be found at around 103.80 and 104.00. Alternatively, a decline back under 102.35 could signal a selloff towards 101.50 and 100.72, respectively.