The euro has weakened against the US dollar by about 2.7% so far this month, as we see out the final days of May.

Could June herald better fortunes for EURUSD?

The first 2 days of the new month will feature some tier-1 events on either side of the Atlantic that may jolt global FX markets:

(1) Thursday, June 1: Eurozone May CPI

What markets want to know:

If higher-than-expected inflation would in turn force the European Central Bank (ECB) to persist with more rate hikes.

And if so, that should prompt a recovery in EURUSD.

Market expectations:

The Eurozone’s headline inflation, as measured by the consumer price index (CPI), is forecasted to come in at 6.3%.

If so, that would be notably lower than April’s 7% figure.

Otherwise, a lower-than-expected CPI print on Thursday may ease bets surrounding ECB rate hikes, with such prospects then likely to translate into more euro declines in the CPI’s aftermath.

(2) Friday, June 2: US May nonfarm payrolls data

What markets want to know:

If there’s enough “destruction” in the US jobs market to allow the Fed to ease up on its rate hikes.

If so, that should lead to a weaker US dollar and a higher EURUSD.

Market expectations:

-

Economists are forecasting that 190,000 new jobs were added to the US economy in May, which would be its lowest tally since before the pandemic.

-

Furthermore, the unemployment rate is expected to tick higher to 3.5%, relative to April’s 3.4% unemployment rate.

- Also, wage growth in May is expected to slow to 0.3% compared to April 2023 (month-on-month), which would be notably slower than April’s 0.5 month-on-month advance (compared to March 2023).

However, the US dollar may strengthen and drag EURUSD lower if the US jobs market continues to demonstrate its resilience.

Such resilience may be derived from either a higher-than-expected NFP headline number / lower-than-3.5% unemployment rate / faster-than-expected wage growth.

(3) All of this week: US debt ceiling developments

What markets want to know:

Whether the US Congress can approve a deal before the June 5th deadline to avert a catastrophic default.

If so, EURUSD could fall further as faith is restored in US assets and the dollar.

Market expectations:

Republicans and Democrats are in a race against time to pass the tentative deal that was reached over this past weekend between US President Joe Biden (Democrat) and House Speaker Kevin McCarthy (Republican).

Both sounded optimistic that they would garner enough support from their respective party members.

Otherwise, failure to raise the debt ceiling before the US government runs out of cash would all but seal a recession for the world’s largest economy.

EURUSD tends to climb in June

Beyond the macroeconomic events listed above, euro bulls (those hoping EUR will move higher) will also be hoping that history will be on their side once more.

Since the euro’s launch in 1999, EURUSD has posted its third-highest monthly advance on average in June:

-

June = average monthly climb of 0.34%

-

April = average monthly climb of 0.45%

- December = average monthly climb of 1.50%

Euro bulls will be hoping that such seasonality could restore the bloc currency’s year-to-date gains.

At the time of writing, EURUSD has only climbed by a paltry 0.09% so far this year, and is precariously close to completely snuffing out its year-to-date gains over the immediate future.

From a technical perspective ...

-

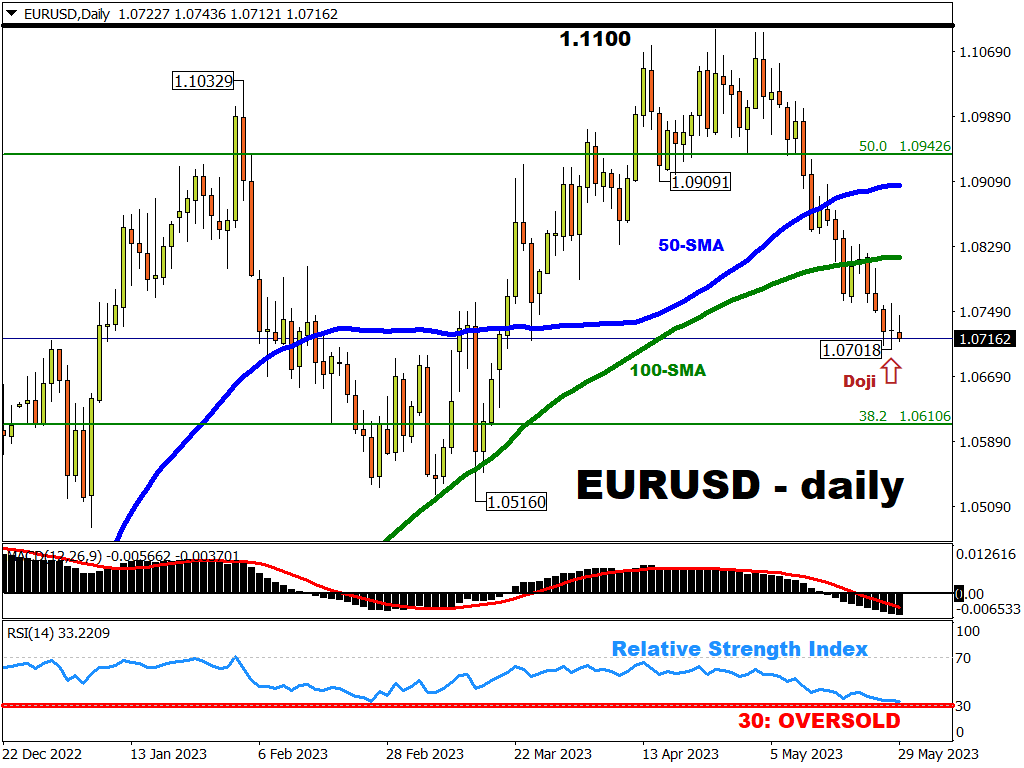

The formation of a long-legged doji candle on the daily charts last Friday (May 26th) may signal that EURUSD could see a trend reversal soon.

To be fair, that reversal did play out earlier today (Monday, May 29th), only for EURUSD to unwind its early morning gains in a session likely with thinned-out liquidity given the UK/US extended weekend.

- Also, further declines in EURUSD may see its 14-day relative strength index (RSI) break below the 30 threshold that denotes oversold conditions.

Such a technical event (RSI crossing below 30) may trigger a technical rebound for EURUSD.

Should these technical signals fail, traders may have to rely on fundamental forces to trigger a reversal in the euro’s fortunes.

This week’s forecasted range

From current levels, Bloomberg’s FX model points to a 75% chance that EURUSD will trade within the 1.0610 – 1.0833 range over the next one-week period.

Furthermore, analyst expectations are concentrated towards the upper end of that range.

Key levels

Potential Support:

-

1.07018 (intraday low on Friday’s doji candle)

-

1.06556 (mid-February cycle low)

- 1.06106 (38.2% Fibonacci retracement level from EURUSD’s long-term downtrend; also lower limit of Bloomberg model’s forecasted range)

Potential Resistance:

-

1.07587 (intraday high on Friday’s doji candle)

-

100-day simple moving average (SMA)

- 1.0833 (upper limit of Bloomberg model’s forecasted range)

Ultimately, the world's most-traded FX pair appears to have enough reasons to make potentially outsized moves this week.

And depending on how these fundamental and technical forces play out, they should present trading opportunities for investors and traders across global financial markets.