The alliance of 23 oil-producing countries will meet on Sunday, June 4th, to decide how much oil they’ll pump out into the world.

This critical decision could rock oil prices at the onset of the coming week, which also features these major events on the global macroeconomic calendar:

Sunday, June 4

- OPEC+ meeting

Monday, June 5

- CNH: China May Caixin services PMI

- EUR: Eurozone April PPI; May services PMI (final); ECB President Christine Lagarde speech

- US: US April factory orders; May ISM services index, services PMI (final)

- Apple’s Worldwide Developers Conference (WWDC) begins

Tuesday, June 6

- AUD: Reserve Bank of Australia rate decision

- EUR: Eurozone April retail sales; Germany April factory orders

Wednesday, June 7

- AUD: Australia 1Q GDP; RBA Governor Philip Lowe speech

- CNH: China May forex reserves, external trade

- EUR: Germany April industrial production

- CAD: Bank of Canada interest rate decision

- Crude: US weekly crude inventories

- OECD releases global economic outlook

Thursday, June 8

- JPY: Japan 1Q GDP (final)

- AUD: Australia April trade balance

- EUR: Eurozone 1Q GDP (final)

- USD: US weekly initial jobless claims

Friday, June 9

- CNH: China May CPI and PPI

- CAD: Canada May unemployment

Why is the OPEC+ decision important?

These 23 countries combined account for about 40% of the total global supply of oil.

The levels of oil supplied to the world, relative to global demand, is a crucial equation that determines prices.

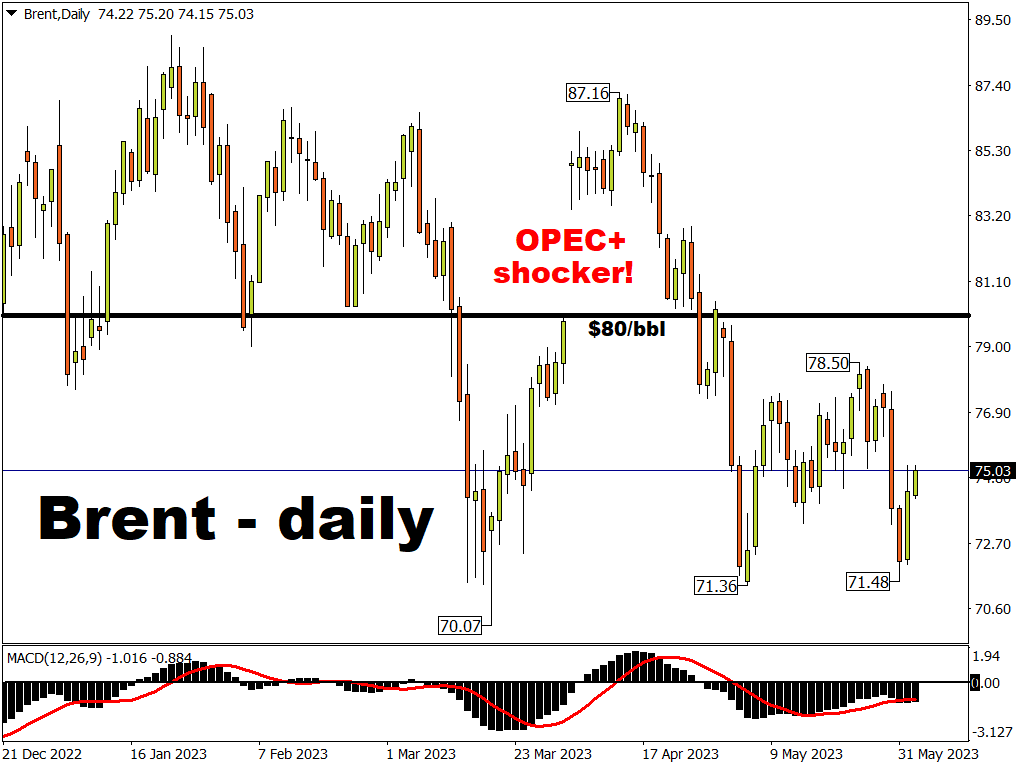

To demonstrate how much sway OPEC+ has over oil prices, one merely has to consider the gap up in Brent prices a couple of months ago!

On April 2nd (also a Sunday), OPEC+ shocked global markets by announcing a production cut of about 1.2 million barrels per day (bpd) starting in May through end-2023.

That unexpected decision sent Brent skyrocketing when markets kicked off trading for that week, peaking at $87.16 on April 12th before since unwinding all of those gains (more on this shortly).

Still, that early-April shocker signalled to markets that OPEC+ would rather see oil prices above $80/bbl, rather than below that psychological mark.

But why have oil prices fallen since?

Generally, prices tend to fall when supply is greater than demand (as appears to be the case at present, due to persistent Russian oil output).

And fallen, they have.

-

Brent oil dropped by 9.16% in May, its largest monthly drop since September 2022.

- US crude fell by 11.32 last month, its largest monthly decline since November 2021.

Markets fear that global demand is still too weak to absorb the existing global supplies, despite the OPEC+ production cuts.

We’ve already seen this week how China’s manufacturing sector fell into a deeper contraction in May. Note that China is the second-largest economy in the world, and also its largest oil importer.

Furthermore, central banks globally have been hiking interest rates in order to “destroy demand”, to subdue red-hot inflation. Markets are concerned that those rate hikes would ultimately trigger a recession, which implies much less demand for oil.

What are markets expecting for the June 4th OPEC+ decision?

The alliance is expected to stand pat on its production levels.

OPEC+ likely wants to wait it out and see how its prior production cut filters through global markets.

Still, the fact that oil is trading well below $80/bbl may raise the chances of yet another OPEC+ output cut.

Saudi-Russian tensions to resurface?

The de facto leaders of OPEC+, namely Saudi Arabia and Russia, issued contrasting statements in the lead up to this meeting:

-

Last week, Saudi Energy Minister Prince Abdulaziz bin Salman sent out a warning to short-sellers (those betting that oil prices will go down further), to “watch out”. Such comments suggest that another output cut is coming.

- However, just a few days later, Russia’s Deputy Prime Minister Alexander Novak said that he doesn’t think there will be “any new steps” taken at this weekend’s meeting.

Such conflicting rhetoric are merely the latest tell-tale signs of what has been a long-fraught relationship between Saudi Arabia and Russia within OPEC+.

Recall back to the onset of the global pandemic in 2020, it was the tensions between these two oil giants that led to the gap down in Brent, as prices careened into sub-$20/bbl territory.

Despite the output cuts pledged collectively in April 2023, industry data suggests that Russia’s oil output has not materially dropped since, despite insisting it has followed through with its own 500,000 (bpd) reduction.

According to data from Bloomberg and analytics company Kpler, crude shipments from Russian ports are anywhere from 320,000 to over 480,000 bpd (or about 8%) higher than back in February.

OPEC shuns top news outlets

Adding to the drama surrounding this weekend’s meeting, OPEC chose not to invite journalists from Bloomberg, Reuters, and Wall Street Journal from covering this highly-awaited event. No reason was given.

This shroud of mystery is only ramping up the uncertainty surrounding the June 4th OPEC+ meeting.

How might Brent react next week?

Should there be another unexpected production cut, Brent could race back towards $80/bbl.

This would greatly depend on the size of the cuts announced, and the likelihood of it being implemented in the real world (as opposed to being mere politically-correct mathematical adjustments).

However, if OPEC+ stands pat, as widely expected by the markets, then oil prices are set to continue languishing under the weight of demand-side fears.