The Australian Dollar is the best-performing G10 currency against the US dollar so far today.

AUDUSD soared by as much as 0.92% and breached the 0.6680 level, before paring some of its gains at the time of writing.

The Reserve Bank of Australia (RBA) delivered an unexpected 25-basis point hike, raising its Cash Rate Target to 4.10%.

The RBA has now surprised markets for a second straight meeting.

In its policy statement, the Australian central bank highlighted that, while it felt inflation was past its peak, it would require some time for it to return to the target range of 2 to 3%.

The hike gave the bank greater confidence that inflation will return to target within a reasonable timeframe. But policymakers added that some further tightening may be required.

As we know, traders and investors tend to bid up the currency of the country that’s expected to have higher interest rates.

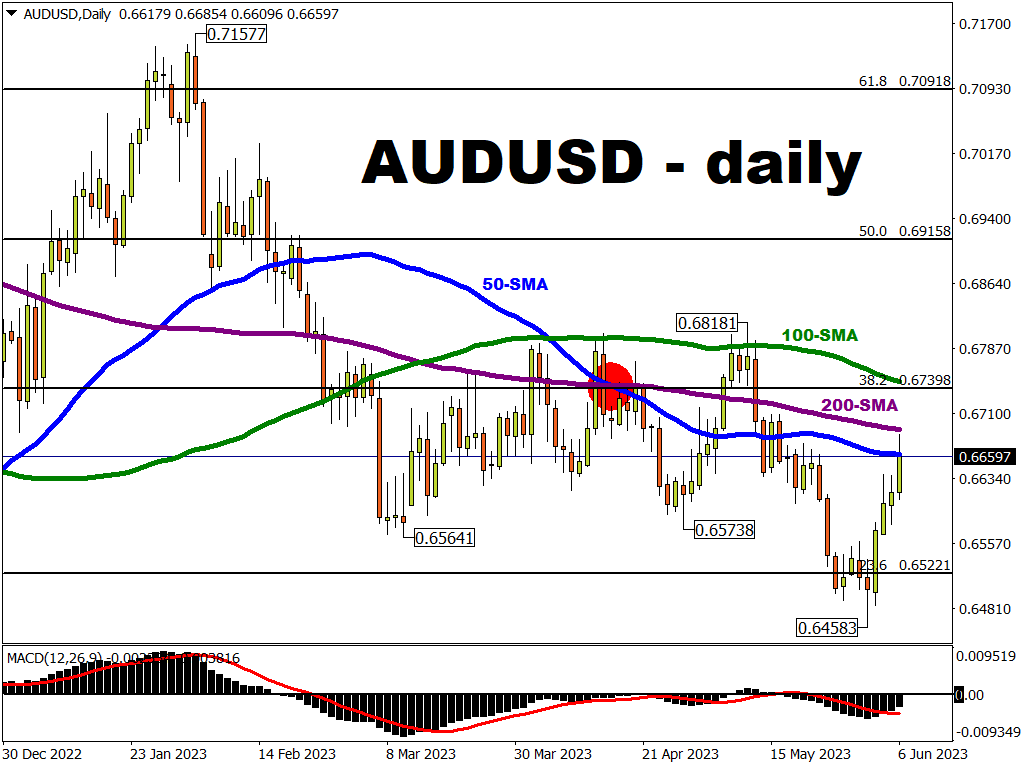

Hence, the aussie jumped on the surprise RBA decision and is back trading in its range that it had held from March to late May.

After falling to a low below 0.65 and last seen in November 2022, the major is heading towards its 200-day simple moving average (SMA) at 0.6692.

A break above its 200-day SMA may embolden Aussie bulls to pursue greater heights.

AUD also taking advantage of softer USD

The US dollar didn’t like yesterday’s softer ISM Services Index which indicated that the US economy is at a standstill after falling to 50.3 from 51.9.

After the headline held just above the 50 boom/bust line, with the exception of December 2022, this was the worst reading since May 2020.

The USD index (which measures the US dollar's performance against a basket of its G10 peers such as the EUR, JPY, and GBP) has held on to losses from yesterday (Monday, June 5th).

The greenback could remain in a sideways pattern until next week's pivotal US inflation data release as well as the crucial Fed rate decision.