Yen traders are eagerly anticipating the slightest policy clues that may emanate tomorrow (Friday, 24 February), when Bank of Japan (BoJ) Governor nominee, Kazuo Ueda, addresses parliament.

For context, back in December, there were feverish expectations that the BoJ is paving the way for its first rate adjustment since sending its benchmark rate to negative 0.1% back in 2016. Such “hawkish” expectations have since been unwound, with the US Dollar also reasserting itself this month.

However, in the lead up to tomorrow’s keenly-awaited remarks, the bullish sentiment surrounding the Yen has reached a two-week high already in the options market.

Hence, if Ueda even remotely hints that policy changes are afoot if/when he takes helm of the central bank in April, that could see the Yen soaring while dragging USDJPY below 134.

At the time of writing, markets are pricing in a 52% chance that USDJPY will hit the 134.0 mark by Monday, 27 February.

READ MORE:

(January 4th, 203): JPY listed as one of 3 potential winners in 2023

(December 20th, 2022): Why is the Japanese Yen soaring?

(April 21st, 2022): Why is the Yen so weak?

Oh, and there's also the Fed's preferred inflation gauge, the PCE deflator due out tomorrow.

A higher-than-expected print above the market forecasted 5% year-on-year advance for January could reinvigorate the US Dollar and send USDJPY charging higher once more.

From a technical perspective …

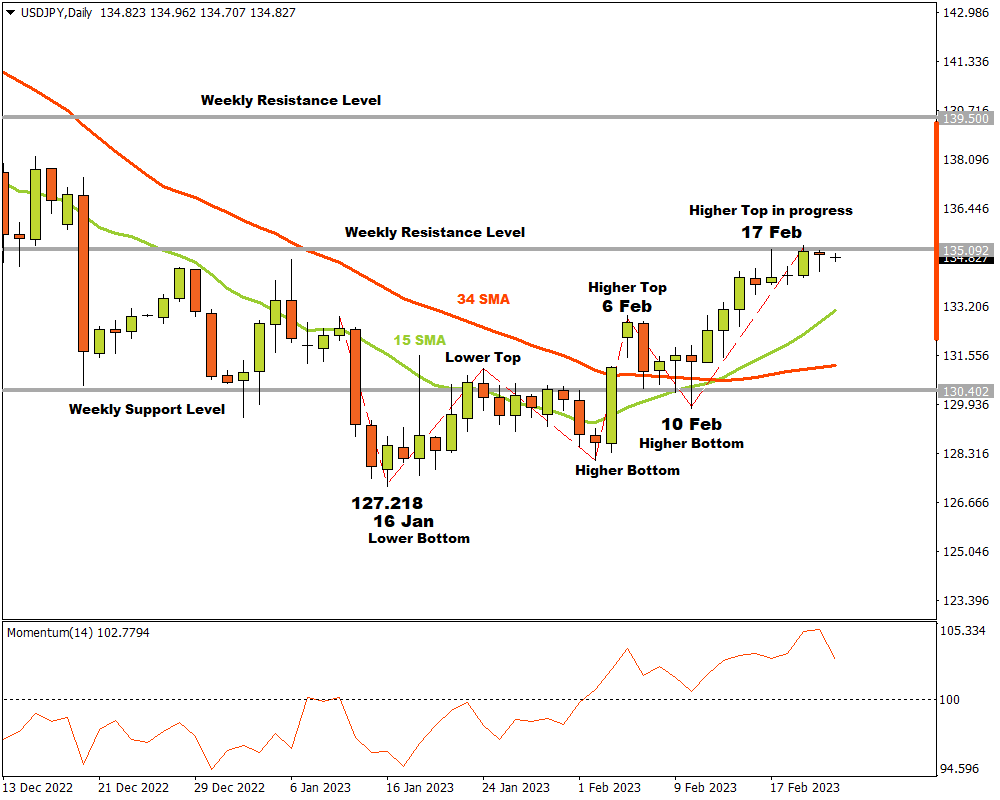

The USDJPY currency pair on the D1 time frame started a new uptrend when the market structure changed after a last lower bottom formed at 127.218 on 16 January.

After the bottom at 127.218, the currency pair broke through the 15 and 34 Simple Moving Averages and the Momentum Oscillator cut through the 100 baseline into bullish territory.

Alert technical traders would have noticed this clear indication that the bulls might challenge the bears for market dominance.

A higher top that was established on 6 February at 132.903 settled the matter and an early stage of a new trend was confirmed.

The bears tried one last time to take back the lead in the market but they could not break through a weekly support level around 130.402.

The bulls continued their victory march when a higher bottom formed on 10 February, before then aiming at the next weekly resistance level and reaching it uncontested on 17 February.

The bears started a possible correction wave in the uptrend after 17 February but could not gain a proper foothold and the bulls are retesting the weekly resistance level to see if they can prolong their victory march.

If the bulls break through the weekly resistance level then more bullish action may well be possible and if the bears manage to break to the downside, then a correction wave in the downtrend is likely.

Until a change in market structure that involves a lower top and lower bottom is confirmed, the bulls are firmly in command of the USDJPY currency pair, that is ...

unless Ueda has something to say about it before the weekend.