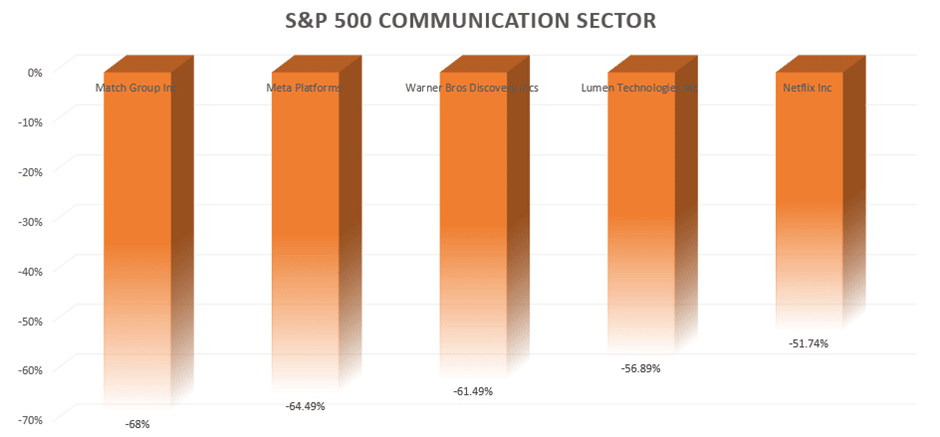

- Communication Sector

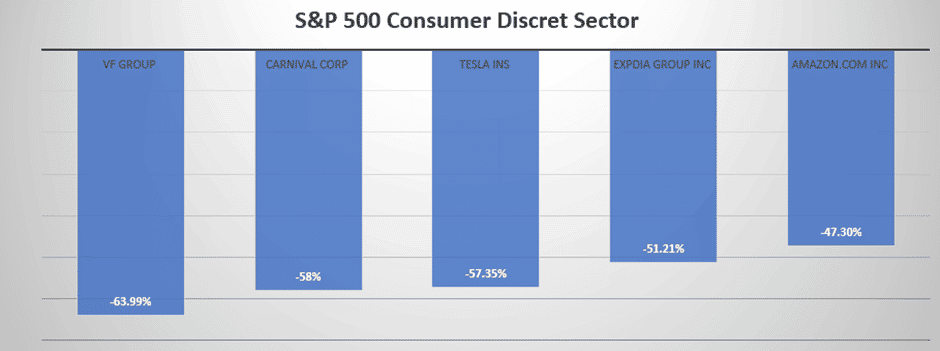

- Consumer Discretionary Sector

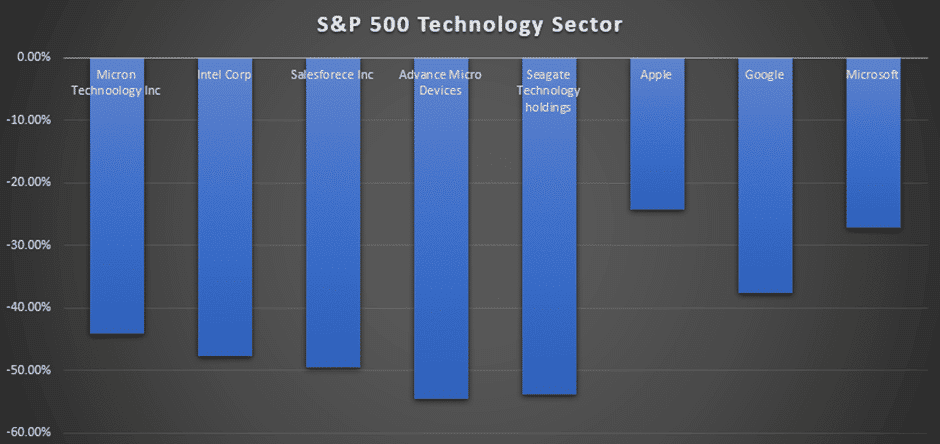

- Tech Sector

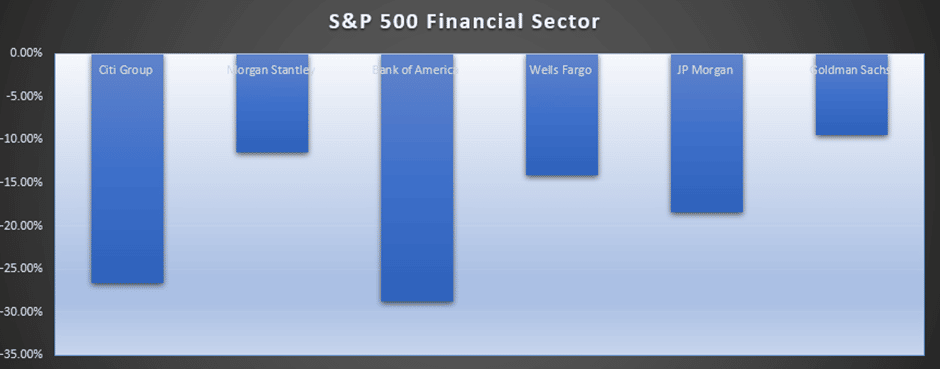

- Financial Sector

- Consumer Staples

- Energy Sector

No Santa Claus Rally this year? It’s looking like traders aren’t going to get their Christmas miracle. In fact, 2022 has been immensely difficult year for the US stock market. We have seen the S&P 500 losing its value by nearly 19.17% year-to-date (YTD). The Dow Jones Industrial Average is down by 9.41% while the Nasdaq has led the losses and dropped over 31% YTD. Most of the sell-off took place because of the hawkish monetary policy adopted by the Fed in the US and inflation hitting its peak reading in nearly 40 years.

Here is the overall performance of the S&P sectors YTD.

Communication Sector

This year, shares of companies that provide communication services have lost 40.13% of their value YTD. This group of businesses carried a substantial amount of debt, which, when combined with rising interest rates and subsequent increases in the amount of interest payable each month, was a significant strain on the company’s finances. It is also common for communications firms to have large dividend payout ratios, which may make it difficult to reduce payouts at a time when shareholders anticipate receiving money. This industry has had a dreadful year as a direct consequence of all of these different issues.

Here are some of the stocks that investors widely hold, and they are down over 50% YTD.

Consumer Discretionary Sector

This sector is down over 35% YTD. Remember, this particular sector represents discretionary spending, and we know that with inflation and interest rates hitting multi-decade highs, disposable income was massively adversely impacted. Consumers have been struggling to keep up with their cost of living, making cuts wherever possible. Hence we saw this sector coming under tremendous selling pressure.

Here are the well-known names in this sector, which are down over 40% YTD.

Tech Sector

The S&P 500 tech sector declined by 27.21% YTD. Due to the slowdown in economic activity and the strong potential of a recession taking place in the US as the Fed continued to hike interest rates aggressively, we saw a large number of companies cutting CAPM. As a result, we saw a large number of companies experiencing their stocks tanking.

Below is the list of the stocks which are in the top 10 worst-performing stocks in this sector.

Financial Sector

This particular sector, which many thought would do well, failed to impress on the scoreboard, declining by over 14% YTD. The Fed in the US increased the rates a number of times and at the most aggressive rates in decades. This brought enormous volatility in the sector, which made many banks report a decent profit on their trading business. However, fear of economic recession and the health of their balance sheet, given the rise in the interest rate, made many questions the health of their balance sheet. Nonetheless, the sector performed not so badly this year, and it is certainly off its year’s lows.

Here is the performance of the stocks for some of the well-known names in this sector.

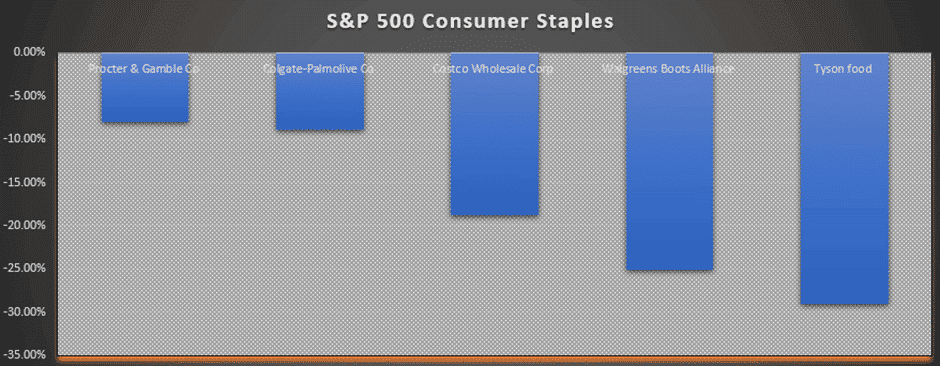

Consumer Staples

This particular sector, most of the time, acts as a darling for investors and traders under the threats of economic slowdown. This year, we saw this sector coming as the third-best performing sector but still recorded losses of over 3% YTD. Generally, this sector does experience a higher percentage of M&A activity in the period of economic distress as valuations fall to a more reasonable level. However, this year, we have seen very few, if any, meaningful transactions taking place. Here is the list of the more known stocks which are in the worst-performing list.

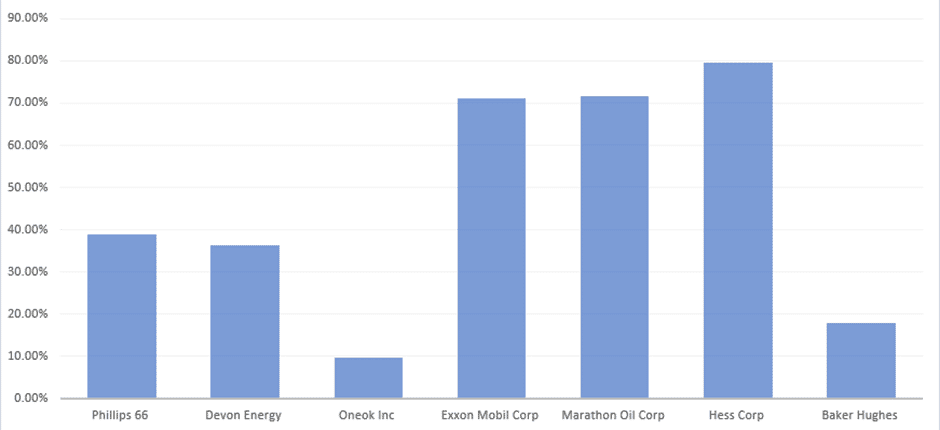

Energy Sector

If there is one sector that has provided a massive tailwind for even a novice trader, it is the energy sector. All you had to do was to join the trend or buy and hold for this year.

The war in Ukraine pushed energy prices close to their record levels, and we saw Brent oil prices topping at $130. Geopolitical tensions are still very much anchored in place as Russia has occupied new territory this year that belonged to Ukraine, and currently doesn’t seem like Russian President Mr. Putin is going to back down from his current stance.

Overall, the energy sector performed really well, and it was the top-performing sector for the S&P, scoring gains of 51%. Here are the most prominent names which, despite being on the worst performance list, scored very decent gains. I have also mentioned more of the well-known energy stocks which performed extremely well this year.

So that wraps up 2022. We hope you’ve managed to make the most of the volatility and here’s to looking forward to 2023!