The Eurozone will report its Flash CPI report for February. Expectations are that the YoY print will drop to 8.2% vs a January reading of 8.6%. If the print is “as expected”, it will be the fourth consecutive drop since peaking in October 2022 at 10.6%. However, the Core CPI is expected to remain unchanged at 5.3%. This reading excludes the cost of energy, food, alcohol, and tobacco. The January core CPI reading was a record high! Will it continue to rise this week? In addition, the ECB will release the Monetary Policy Meeting Minutes from its February 2nd meeting. Recall that the ECB increased interest rates by 50bps, bringing the key interest rate to 3%. The central bank said in December that a series of 50bps rate hikes was ahead, and members have recently discussed their interest to raise rates by another 50bps in March. However, after March, most members say they are hawkish, but will be data dependent. Watch to see if this message is reflected in the Minutes.

Last week, Japan released it CPI for January at 4.3% YoY vs an expectation of 4.2% YoY and a December reading of 4% YoY. The Core CPI was 4.2% YoY vs a January print of 4%. Both the highest inflation readings for Japan since 1981. On Friday, Tokyo will release its February CPI print. The Tokyo inflation gauge is said to be a good predictor of Japan’s overall inflation. Expectations are for a headline print of 4.0% YoY vs a previous print of 4.0% YoY. The Core reading is only expected to be 3.3% YoY vs a January reading of 4.3% YoY. Note that the BoJ targets 2% inflation and still maintains its ultra-lose monetary policy. BoJ Governor Kuroda has long said that inflation will begin to fall soon, and if the Tokyo expectations are any kind of guide, he may be right. In addition, his probable successor in April, Kazuo Ueda, has stated that he expects to maintain the BoJ’s dovish Monetary Policy for now. But he also said that he expects to do a Monetary Policy Review earlier in his term rather than later. If Tokyo inflation continues to rise, watch to see if either Kuroda or Ueda begin to change their tune?

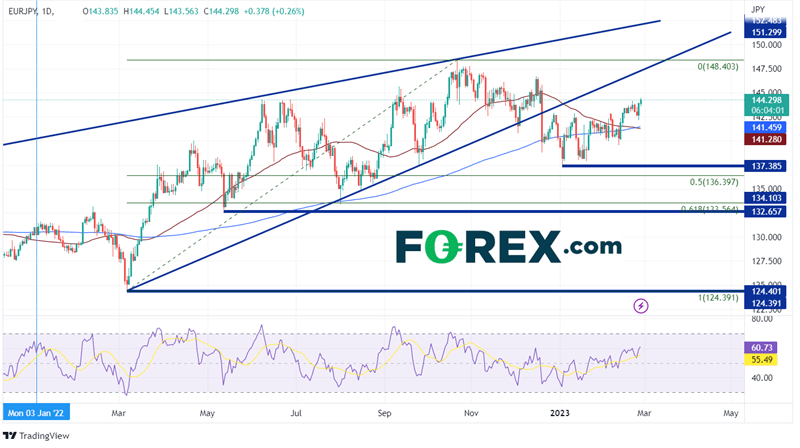

EUR/JPY had been rising in an ascending wedge formation since making lows on March 7th, 2022 near 124.40. The pair moved aggressively higher and reached a high of 148.40 on October 21st, 2022. Since then, EUR/JPY pulled back and on December 20th, 2022, the pair fell below the bottom, ascending trendline of the wedge, as price approached the apex. The pair made a near-term bottom, just above the 50% retracement level from the March 7th, 2022 lows to the October 21st, 2022 highs at 137.38 on January 3rd, and has been moving higher since, breaking above both the 50 Day and 200 Day Moving Averages to high of 144.45 on Monday.

Source: Tradingview, Stone X

On a 240-minute timeframe, one can see how EUR/JPY trading to the recent high of 144.16 and pulled back, forming the bottom trendline of a rising triangle pattern. The pair bounced from a low print on February 23rd at 142.15 and began moving higher, taking out the 144.16 highs on Monday. The first resistance level is at the highs from December 19th, 2022, at 145.83, then the highs from December 15th at 146.72. Above there, EUR/JPY can move to the bottom of the long-term wedge (see daily) near 147.07. However, if price moves lower, the first support is at the rising trendline from the February 10th low at 142.60. The February 23rd low is just under the trendline at 142.15, and then a confluence of support at the lows from February 13th, the 50 Day Moving Average and the 200 Day Moving Average (see daily) between 141.28 and 141.52.

Source: Tradingview, Stone X

With CPI data out of the EU and Tokyo, along with the ECB Minutes, EUR/JPY could be volatile this week. In addition, comments from either BoJ Governor Kuroda or his potential successor, Ueda, could move the Yen aggressively. Manage risk accordingly.