Welcome to Technical Tuesday, a weekly report where we highlight some of the most interesting markets that will hopefully appease technical analysts and traders alike.

In this week’s report, we are getting technical on gold, USD/CAD and FTSE. So, there is something for everyone.

- Gold in oversold bounce from key support

- USD/CAD eyes bullish breakout

- FTSE breaks bull trend

Gold in oversold bounce from key support

Gold has staged an oversold bounce off key support around $1805, a level which was previously resistance back in August 2022. However, it is not out of the woods just yet, as the metal faces overhead resistance starting around $1825.

I think gold has upside potential in the medium-term outlook. As an inflation hedge, it hasn’t done as well as one would have expected in the last year or so. This has been mainly because of rising bond yields and a strong US dollar. So, in the short-term there is a risk it could fall further lower until the market fully prices in US interest rates rises. In recent weeks, we have seen quite a shift in market direction in favour of the dollar and yields, with most foreign currencies, gold, and US equities falling out of favour. Those moves were as a result of the market changing its expectations for interest rates outlook swiftly higher.

Clearly, some traders must now be wondering whether those expectations have been priced in and may be looking to load up on gold again, and people who have been shorting gold might be looking to book profit. But we do need to see evidence that the dollar has topped before turning bullish on gold again.

Source: StoneX and TradingView.com

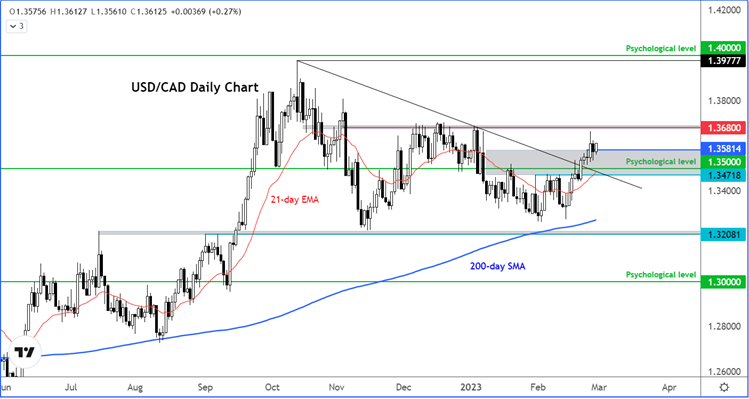

USD/CAD eyes bullish breakout

The USD/CAD has risen despite a sharp recovery in oil prices and weaker-than-expected US data. We saw CB Consumer Confidence plunge to 102.9 against expectations of 108.5, while the Richmond Manufacturing Index printed -16 versus -5 expected. The data certainly weighed on the greenback against some of the other major currencies, but not the CAD. Earlier, Canadian GDP came in a touch softer than expected as output fell 0.1% month-over-month in December against a flat reading expected.

The USD/CAD has already broken its bearish trend line on the daily time frame and has held above the key 1.35 handle for several days now. It now needs to create a higher high above 1.3680 for confirmation. If we see a clean breakout above this level, then this may pave the way for a run towards the highs of last year just below the 1.40 handle next.

However, if the USD/CAD instead goes back below the broken trend line and support around 1.3470 to 1.3500, then this would completely nullify the bullish bias.

Source: StoneX and TradingView.com

FTSE breaks bull trend

All good things come to an end: the FTSE’s strong bullish trend line has broken. After rallying to a fresh record high, the FTSE has today broken below its rising trend line that had been in place since October. Consequently, we may see some further profit-taking in the days ahead. The bulls will want to see a clean break back above 7950 resistance to re-establish control, or a key reversal pattern at lower levels first.

Source: StoneX and TradingView.com

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R