US futures

Dow futures +0.08% at 33595

S&P futures -0.05% at 4270

Nasdaq futures +0.15% at 14576

In Europe

FTSE -0.00% at 7633

Dax +0.02% at 15999

- OECD upwardly revise the growth outlook

- Stocks muted amid a quiet economic calendar

- Netflix rises 3% on broker upgrade

- Oil rises supported by tighter supply

OECD raises the global growth forecast

US stocks muted, pointing to a largely untrained open on Wednesday as investors weigh up global economic uncertainty and look ahead to next week’s Federal Reserve interest rate meeting.

The OECD upwardly revised its forecast for global growth this year and now expects global GDP of 2.7%, up from 2.6%. They noted that lower energy prices and the reopening of China's economy should help growth.

However, the data comes after trade data from China showed that exports contracted by more than expected, highlighting the headwinds that the post-pandemic recovery is facing and the uneven growth in the world's second-largest economy.

US economic data has been mixed after a much more robust than expected U.S. jobs report, but the ISM services PMI was stronger than forecast.

The US economic calendar is relatively quiet, so attention is turning to the US Federal Reserve interest rate decision next week, with the market pricing in an almost 80% probability that the central bank will keep interest rates on hold in June but are expected to resume hikes at the July meeting.

Corporate news

Stitch-Fix rises 7.5% premarket after the online personal styling company posted stronger than forecast Q3 results, thanks to efficiencies across the business.

Netflix is rising over 3% premarket after JP Morgan upwardly revised its price target to $470, offering a potential 18% upside. They cited that the password-sharing crackdown could boost revenue.

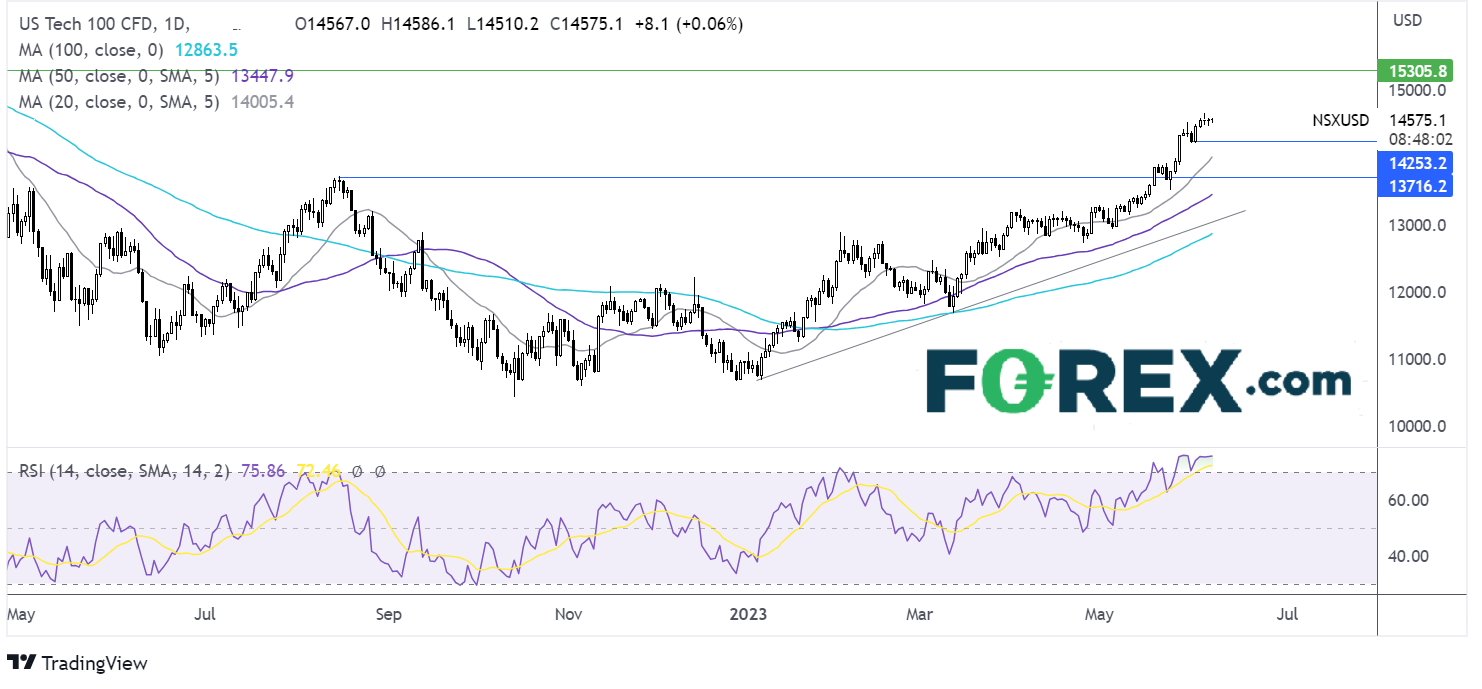

Nasdaq100 outlook – technical analysis

The Nasdaq continues to trend higher, extending its runup from the start of the year. The RSI is far into overbought territory, so buyers should be cautious. 15260, the March ’22 high remains the target for the bulls. Near-term support can be seen at 14200, the June low, ahead of 14000, the round number, and 13700, the August ’22 high.

FX markets – USD falls, EUR gains

The USD falls after gains in the previous session as choppy trading continues. This week is quiet regarding economic data, so attention is on the US Fed meeting next week.

EUR/USD is rising despite weaker t despite weaker than expected German industrial production data, which showed that output rose by 0.3%, less than the 0.6% expected. The data comes after the German manufacturing PMI contracted at the fastest pace in three years in May.

GBP/USD is rising despite a lack of fresh fundamental drivers. This week is a quiet week for UK macroeconomic data. However, the pound is supported by hawkish BoE bets, with the market expecting the peak rate to reach 5.4% from its current 4.5%.

EUR/USD -0.13% at 1.0730

GBP/USD -0.21% at 1.2401

Oil rises despite weak China data.

Oil prices are increasing as investors continue weighing up Saudi Arabia’s oil production cut against concerns over slowing global growth after China’s trade data disappointed.

Oil prices had risen over 3% at the start of the week after Saudi Arabia announced that it would reduce oil output by 1 million barrels per day in July. Additional Saudi production cuts could deepen the unexpected shortfall in July, supporting the oil price.

However, concerns over slowing global growth are keeping gains in oil limited. China trade data show that exports shrank much faster than expected in May as foreign demand cooled and imports fell albeit at a slower pace which raises concerns over domestic demand.

Meanwhile, API data shows that U.S. oil inventories fell by more than expected in the previous week. However, gasoline inventories rose by around 2.4 million barrels, and distillate inventories are up by 4.5 million barrels raising concerns over consumption, particularly as the summer driving season ramps up.

WTI crude trades +1.14% at $70.16

Brent trades at +1.06% at $75.08

Learn more about trading oil here.

Looking ahead

15:00 BoC rate decision

15:30 EIA oil inventories