Economic recovery in the UK has hit a new obstacle as London goes into the most rigid Covid restriction. This means that millions of Londoners are pushed to stay in-doors once again, and businesses are going to lose the most critical season of the year. It wasn’t expected that restaurants and other hospitality places would be jam-packed over the holiday period. Still, the fact that the capital has gone into tier 3 restriction means that tourists aren’t going to favour London for holidays as well. In other words, the lifeline has been cut for the hospitality sector, and more businesses are going to come under stress.

All of this is coming at a time when businesses are already fragile, and this last blow may just knock many of them out. Yes, it is true that we have coronavirus vaccine in the UK, but the fact is that it will still take a very long time before the vaccine will be available for the general public. Currently, it is mainly for elders and front line workers.

As for the US stocks, there is still a lack of commitment among traders and investors. We are just not seeing the same sort of enthusiasm among traders that we saw before. This has led to the longest losing streak for the S&P 500 since September. The index has lost nearly 1.5% of the value from its hit all-time high. Given the fact that we are running into a holiday period, it is very likely that the volume in the market will remain thin. Investors know that over a longer period, things will improve due to the coronavirus vaccine. However, it is the short-term resurgence of the coronavirus cases, which is making them re-evaluate the situation or at least not convincing them to place large bullish bets.

China’s economic data confirmed once again that the second biggest economy in the world is on solid recovery footing. Industrial output and retail sales both made investors comfortable.

President-elect, Joe Biden has asked Americans to accept the election results after the Electoral College sealed his victory. Investors are positive about Joe Biden becoming the next president of the United States, as they know that he will improve the US reputation in the world and try his best to restore relations with China.

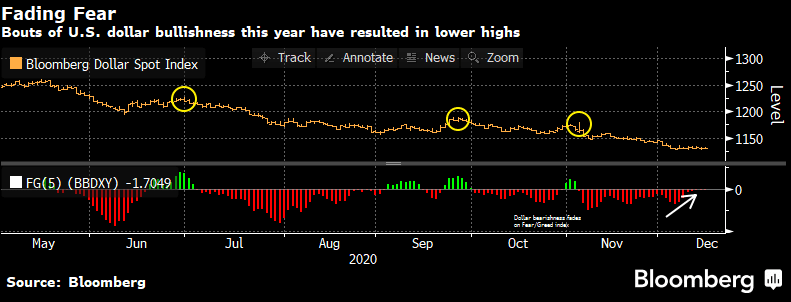

In the currency market, dollar weakness continues, and the dollar index is trading near or below its two year low. This weakness in the dollar index has helped other currencies such as the Sterling and the Euro.

In the cryptocurrency space, Bitcoin rose slightly above the 19,500-price level but failed to mark another record high. The fact that the price is still consistently trying to break above the all-time high is an appositive thing for Bitcoin. As long as Bitcoin price stays above the 18K price level, hopes are that we could touch the 20K price before the end of this year.