Is Tesla Stock Going Up or Down?

Tesla stock plunged in U.S. pre-market trading today, dropping as much as 12%. The sell off is mainly due to the disappointment around the fact that Tesla didn’t become part of the S&P 500 index.

As of the Friday close, the stock was down nearly 25% from its all-time high. There are strong chances that the selloff may become even more intense today.

Optimism and Speculations

There has been enormous, some might say unwarranted optimism surrounding Tesla. Speculators have been pushing the stock higher, mainly because they believed that the electric carmaker would become a part of the major U.S. stock index, the S&P 500.

The index represents the top 500 American stocks. Investors believed that by becoming part of this major index, Tesla stock would have then attracted new capital, and it would have become a part of many hedge funds.

The smart money has always been skeptical about Tesla’s valuation, and it generally stayed away from investing in the company. However, the hopes were that whether smart money liked it or not, it didn’t really matter because when Tesla would become part of the S&P 500 index, hedge funds would have no option but to invest in Tesla’s stock, especially the ones which track this index.

No To Tesla, Yes To Etsy

On Friday, the S&P 500 put cold water on Tesla’s hopes of joining the S&P 500 index. However, it did add an online retailer, Etsy, as well as the semiconductor-equipment manufacturer Teradyne and Catalent, a medical technology company.

Etsy stock is trading up in U.S. pre-market trading. It soared as much as 3.7%.

Why Was Tesla Not Added To The S&P 500 index?

Tesla has posted several quarters of profit. This year, in July, it posted its fourth consecutive quarterly profit. The company was under the impression that this would be the last hurdle to face before becoming a constituent of the S&P 500 index. However, there are some questions around the automakers’ profitability calculation method. Perhaps, this was the reason that Tesla stock did not become part of the index.

Is Tesla Stock Going To Crash?

The big question among investors and traders is, what is Tesla’s fair price, and how deep can this selloff go?

Tesla’s Bubble Burst?

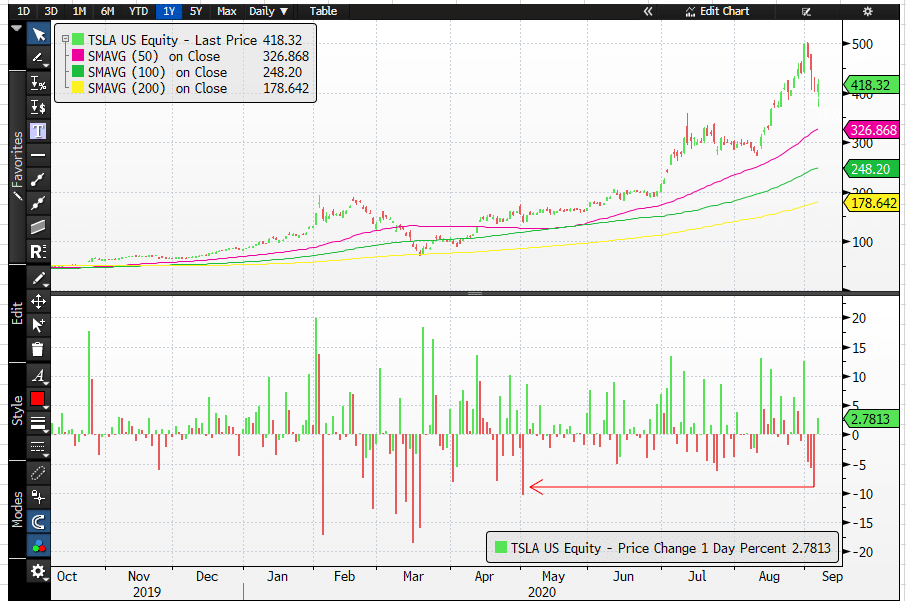

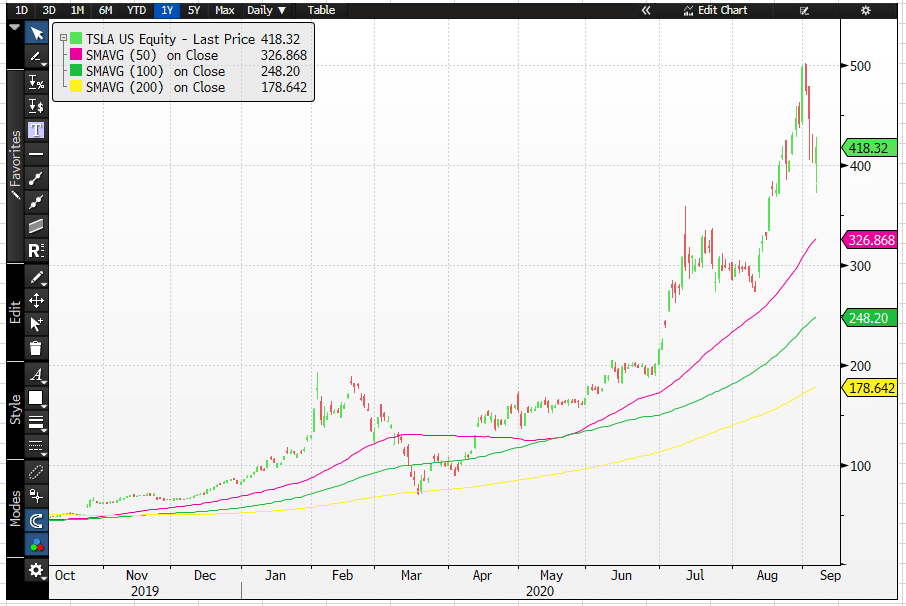

Tesla’s bubble has finally burst—especially if we look at today’s pre-market selloff. Tesla shares are down over 30%. This is a very sizable correction. However, the stock price is likely to continue its downward journey, and the first immediate support could be near the 50-day simple moving average, which is trading at $326.

For technical analysts and institutional investors, the 50, 100, and 200-day simple moving averages represent critical price levels, and they usually participate near these critical price levels.

The trading chart below shows the Tesla stock price, and the second panel shows the one-day percentage change in price. On September 3rd, the stock saw the biggest selloff since April this year. Today, if the current selloff continues to build up, it can easily surpass the September 3rd selloff.