European and U.S. stock futures are trading slightly lower after the massive sell-off led by Big Tech stocks yesterday. There is no doubt that the U.S. stock market went too far and too quickly, and a retracement was due. However, many question – is there more of this? The answer depends on the outcome of the most important economic event for this week which due later, the U.S. NFP data

The Numbers

The US NFP data is the most important economic data set because it gives us more clear and accurate information about the U.S. economy’s health. Since the pandemic hit the U.S., this is the first time that the U.S. unemployment rate is expected to fall in a single digit.

The U.S. unemployment rate forecast is expected to fall to 9.8% against the previous reading of 10.2%. The U.S. unemployment rate trend for the past few months has been to the downside, but the unemployment rate falling to a single-digit is a big deal for the U.S. economy.

What About The Stock Market?

If the U.S. number beats the forecast or even matches the forecast today, we may likely see a recovery in the U.S. stock market. The sell-off in the stock market, which we saw yesterday, may reverse some of its losses. However, if the U.S. NFP number disappoints the markets today and traders think that the U.S. economic recovery has become even more fragile, then we could see an even bigger sell-off.

Be Aware of Noise

It is important to keep in mind that a soft number could also be because of the second wave of Coronavirus in the U.S., which is now under much better control. Hence, it is critical to note that the U.S. NFP data’s noise could bring higher volatility in the market. Speaking of the volatility index, it surged over 26% yesterday, and today we could easily see similar gains if the economic data fails to meet the expectations.

How About The Dollar, Euro, and Sterling?

In the currency market, it is all about the dollar index. The dollar index is trading higher ahead of the U.S. NFP number. The upside for the dollar index is minimal. Only a powerful reading for the U.S. NFP is likely to bring substantial gains.

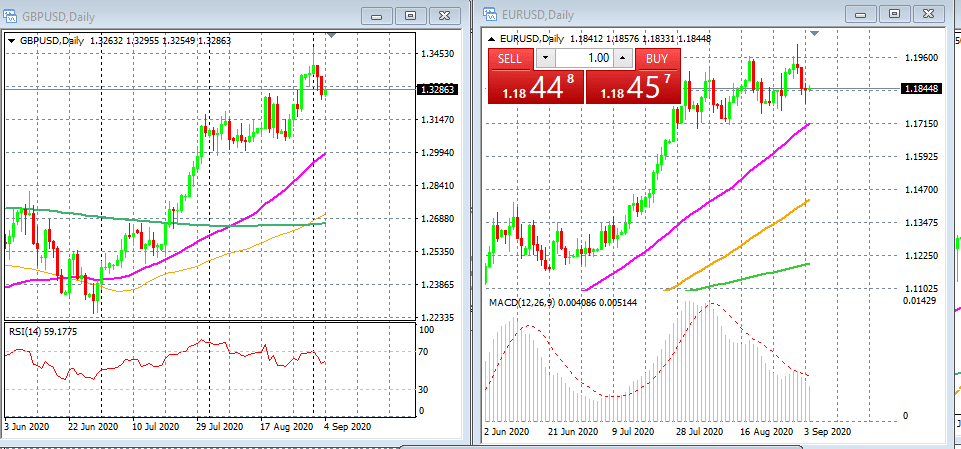

If the number is soft, traders will anticipate that the Fed is going to remain accommodative for a longer period of time. If the number matches the forecast, investors will consider that a gradual recovery. This isn’t likely to change the Fed’s stance, either, which means that we could see a bit of reversal for the Euro and Sterling against the dollar today. Both pairs have been under tremendous selling pressure for the last two days when the EUR/USD crossed above the 1.20 mark, and GBP/USD went above the 1.34.

The trading chart below shows the price action for Sterling-dollar and Euro-dollar. The pink line is the 50-day SMA, the orange is 100-day SMA, and 200-day SMA is in green.

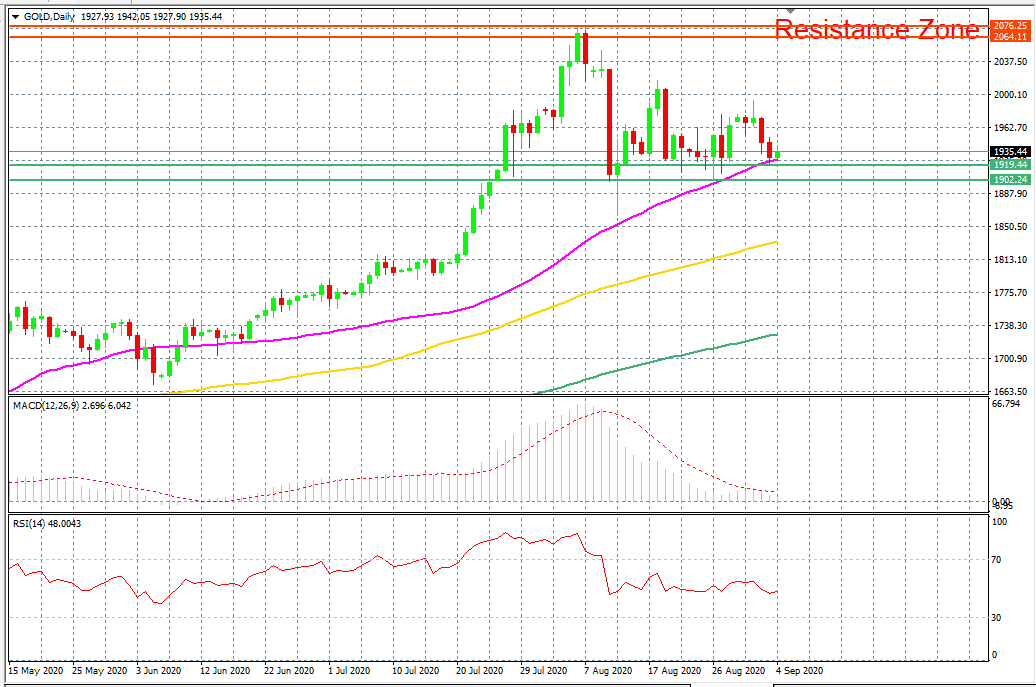

What About Gold Price?

As for the gold trading, the critical factor is that the battle is still on between the gold price and the 50-day SMA on a daily time frame. Today’s US NFP number is likely to bring higher volatility for the precious metal. The immediate support is at $1,900, while the resistance is at $1,950.