European and U.S. futures are rising as traders are feeling comfortable with the Federal Reserve’s new approach towards their monetary policy framework. As expected, the Fed has adopted a new strategy to tackle inflation. Rather than worrying about the price pressure, the Fed is focusing more on the long-term price stability target and this means that interest rates are likely to remain lower for longer.

The Fed has prepared themselves and investors to expect the economy to run a little hotter and both inflation and employment could overshoot their targets. What level of inflation could be deemed as hotter though? The answer is simply that the Fed isn’t going to tie themselves down to any number just yet. Their average inflation target is 2% and it is unlikely that they will provide more clarity on this.

The Dovish Approach

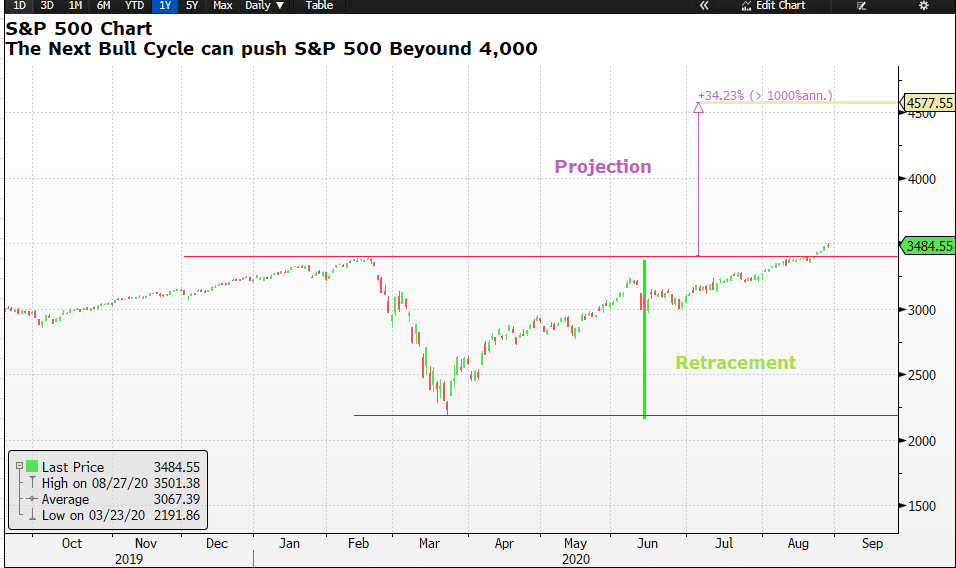

The dovish approach adopted by the Fed has filled up the fuel tanks for the continuation of the stock market rally and as such we experienced another record high for the U.S. stocks yesterday. Traders know that now they are very much in a Goldilocks scenario, an ideal state for an economy, meaning that any feeble reading of economic reading is likely to reaffirm the stance that the Fed is watching their back.

Any improvement in the economic numbers will also comfort them because they know the Fed is comfortable in letting the economy run a little hotter. In simple terms, the Fed is not going to back peddle on their interest rate policy—the lower interest rate is here to stay, for now.

Change Was Coming

The fact is that the Fed has been thinking of altering their approach towards inflation even before the pandemic hit the economy. The coronavirus situation fast-tracked the Fed’s thinking process and gave them a strong reason that they need to act now to adapt a new approach to handle inflation. The Fed chairman, Jerome Powell, also confirmed yesterday that the Fed isn’t going to change its monetary policy stance anytime soon. The review of the Fed’s monetary policy is going to take place every five years or so.

The Bounce

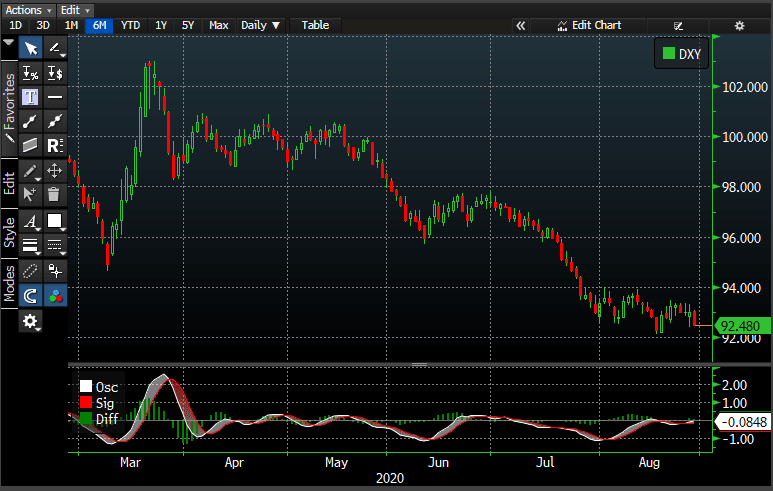

Investors are asking themselves why they witnessed such a bounce in the dollar index yesterday. Well, there was little to no element of surprise when it came to the Fed statement. It was very clear that the Fed is going to alter their path of interest rate and this is what pretty much happened.

Also, the Fed’s chairman made it clear that he is pleased to see a recovery in the U.S. economy which has panned out better than expectations. Powell’s message provided support for the dollar index.

Having said that, traders are still not fully sure if the downtrend in the dollar index has come to an end. If traders continue to favor risker assets, it is likely that the dollar index may fall further. The Fed chairman made it clear that the coronavirus-related sectors aren’t going to recover overnight. It is going to take a long time for these sectors to recover and more than a reasonable amount of time for the millions of Americans who find themselves out of a job.

Hence, the dollar index trading chart below is likely to remain in a downtrend and any recovery may be short lived for the dollar index.

What About Gold?

This means that the Gold price is also in a Goldilocks scenario. We saw a massive pop in the gold price yesterday because of the Fed’s monetary policy announcement. The gold price spiked all the way to 1972 mark before it retraced. The retracement of the gold price made it clear that there is ample support for the Gold price and traders aren’t willing to allow the price fall below the 1900 mark. Currently, gold is trading at 1941.