Gold prices have shaken many investors this week as the precious metal price fell from its record high of $2,075 to $1,863. The short selling of gold has made many investors reconsider their stance towards trading gold.

The gold price is on track to record its first weekly decline since June, and investors are asking themselves, do they need to worry about this?

Is Gold Price Trading Up Or Down?

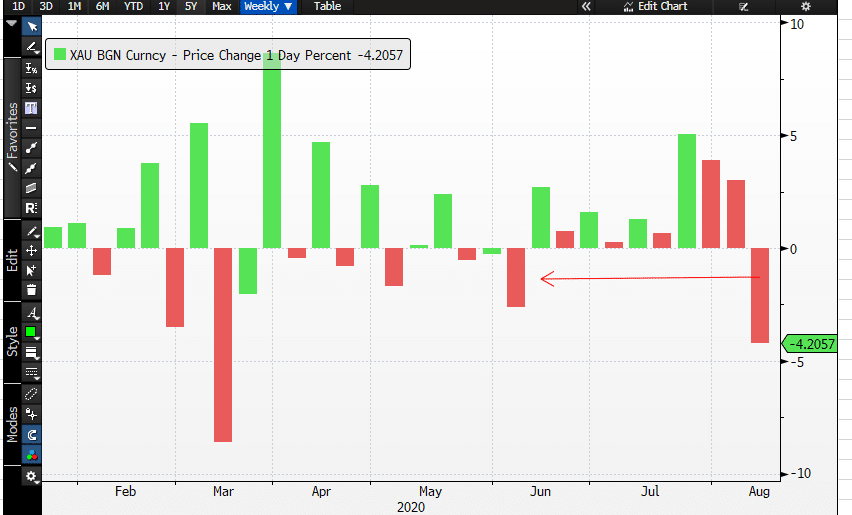

Gold price is trading at $1,935 today, and it made a high of $2,075 on August 7th. The gold price made a low of $1,863 on August 12th, and ever since, the price has been unable to break above the critical resistance level of $2,000. This week, we have seen the most significant sell-off for the gold price, since 2013. The gold price is set to record its first weekly decline since June of this year, as shown in the trading chart below.

The price must break above the $2,000 price level and remain above this critical level for the bull rally to continue.

Are Gold Traders Nervous?

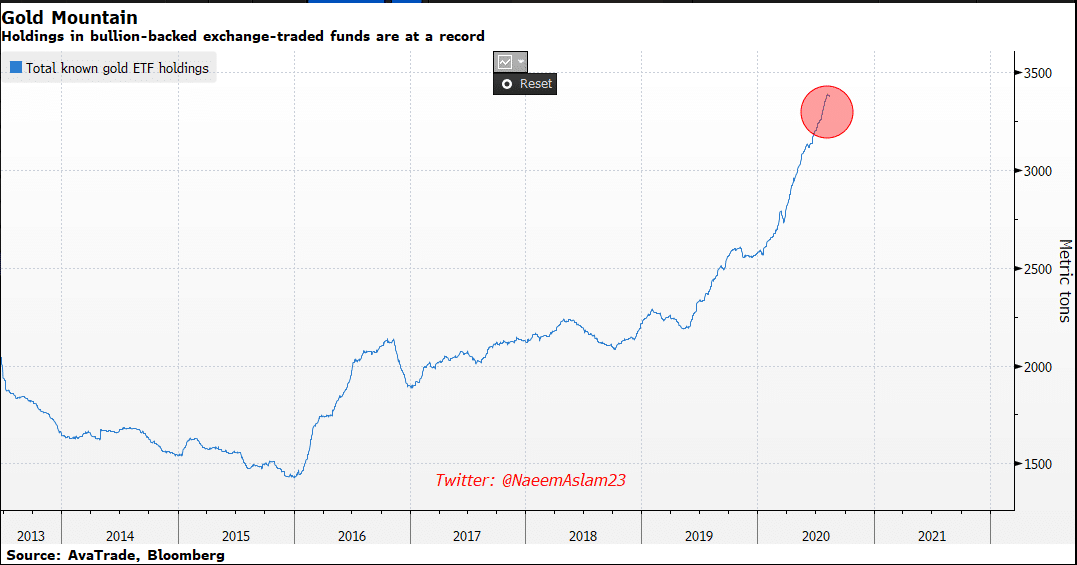

The sell-off in the gold price has got many gold lovers rethinking their investment strategies. The total known gold ETF holding is at a record high, but there is a minor indication of retracement, and this could be an initial sign of an easing in upward momentum.

However, it may be too soon to set this in stone, because we need more data to confirm that traders are not backing gold to the same extent that they were before. There is a degree of nervousness among gold traders.

What is the Overall Economy Saying?

The U.S. economy has shown some improvement in its labor markets, as fewer Americans are filing for Initial and Continuing Jobless Claims. However, this improvement in the U.S. labor market isn’t enough to shift the Fed’s narrative on their low-interest rate monetary policy—the main driver for the gold price. Regardless of the U.S. stock market’s strength, the conversation on the U.S. interest rate isn’t likely to change anytime soon, which means the gold price is expected to move higher.

What Are Pundits Saying About Gold Price?

Jeff Currie, Global Head of Commodities Research at Goldman Sachs Group, said that his company closed the buy recommendation for Silver. However, they are still keeping the buy recommendation open for gold.

The bank believes in the same argument, as mentioned before, that the interest rates in the U.S. aren’t likely to change any time soon. It is critical to say that when the sell-off began for the gold price back in 2012, it wasn’t due to the interest rates moving lower but mainly due to dovish monetary policy coming to an end. The Fed started to taper its asset purchase program, and this took the shine away from the precious metal.

The Bottom Line

It is unlikely to see the Fed easing off the gas pedal yet, but another few positive headlines for the U.S. economy may get the Fed thinking that it is time for them to scale back on their asset purchase program, and that could influence the gold price adversely.