The Dow Jones Industrial Average futures are trading lower ahead of the U.S. initial jobless claims data. Investors are cautious after the S&P 500 index closed near its record high. The Dow Jones index is also getting close to its record high. Having said that, stock traders are optimistic about the plateauing of coronavirus infections rate, and there is also decent optimism for a potential coronavirus vaccine. Trump is pushing for in-person learning and wants schools to reopen. For now, investors have decided to ignore the U.S.-China tensions. However, this can change anytime, as the situation is continuously evolving.

Global Stock Market Near its Pre-Coronavirus Stock Market Level

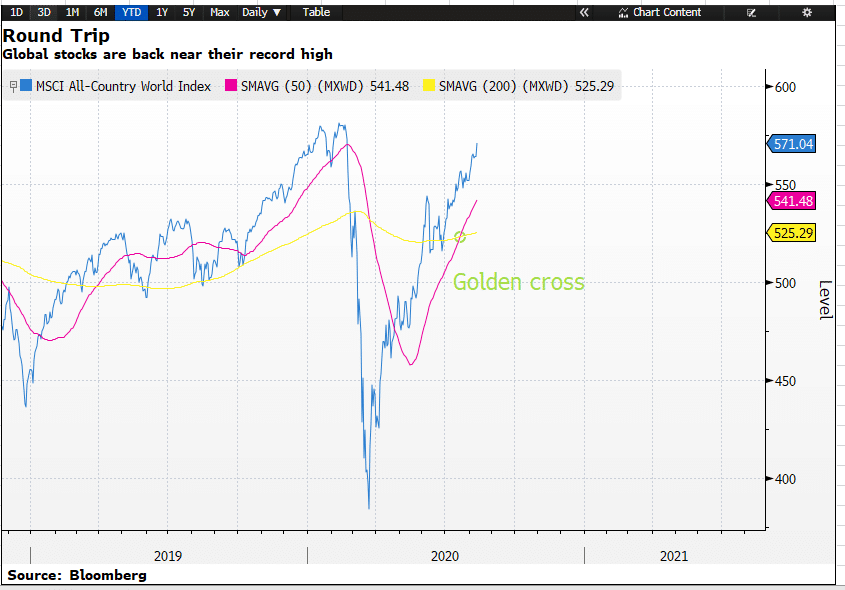

The stock market recovery we have experienced in the U.S. isn’t just in America, but there is evidence of the coronavirus stock market in global stocks. Of course, the primary reason for this recovery has been the cocktail of fiscal and monetary policy support.

The global economy is still immensely fragile, and without the continuous support from both fiscal and monetary policy, the economic recovery can derail.

The below chart for the MSCI all-country world index is near its pre-Covid-19 mark, and this backs the argument of recovery in the global stock market.

U.S. Initial Jobless Claims

The Dow Jones and the S&P 500 futures are likely to remain sensitive to the upcoming U.S. initial jobless claims data. Initial jobless claims fell to 1.15 million from 1.19 million last week. This reassured investors that the U.S. economic data isn’t rolling over.

Stock traders have been wondering if the U.S. economic data is taking a wrong turn, and this will remain the chief focus. The forecast for today’s initial jobless claim is 1.1 million, and the question for traders is how long this number will stay this high, before returning to its pre-Covid level.

The biggest threat for both the Dow Jones Industrial Average and the S&P 500 indices is that the Initial Jobless Claims and Continuing Jobless Claims may not have factored in the impact of the sharp increase of coronavirus cases—also known as the second coronavirus wave. If, and when, we get the reflection of those numbers, it may throw some stock traders off their balance.

Trump Wants to Reopen Schools

Trump is taking things one notch higher, and he has pressured schools to reopen to restart the in-person learning. President Trump downplayed virtual learning. The schools which have now reopened fully, and prematurely, have experienced spikes in the quarantine ratio, due to coronavirus fear among children and tutors. Some schools have re-closed their in-person after opening.

Coronavirus Update:

The U.S. has passed the 5 million coronavirus cases level, while the global coronavirus cases have crossed the 20 million mark. Over 165,000 people have lost their lives in the U.S. due to coronavirus, and Brazil remains the second-worst place hit by the coronavirus. Brazil has over 3 million of coronavirus cases, and nearly 104K people lost their lives due to Covid-19.

Gold Prices Made Another Record High

The yellow metal suffered some more blows yesterday because of better than expected U.S. CPI data. The gold price is holding on to its psychological support of $1,900, and it is still trading above the 50-day simple moving average. All of this assures investors that the current sell-off in the gold price could be an opportunity.

Several Fed members believe that the U.S.’s economic recovery is not V-shape, but it could be more like a W-shape. This assures gold traders that the Fed may not change their narrative on their monetary policy—which will impact the gold price—for some time.

Key Facts

Global Stock Market Today

The global stock market had a mixed session today. Stocks jumped higher in China; the stock rally pushed the Shanghai index higher by 0.47%. The Japanese stock index, Nikkei advanced 1.85% while the Aussie stock index, ASX 200, dropped by 0.86%. The HSI stock index fell by 0.25%.

Dow Index and S&P500 Index: Market Breadth

The U.S. stock market’s breadth provides further evidence of bull strength. 63% of the Dow stocks traded above their 200-day moving average on Friday.

The S&P 500 stocks also echo the same message for the coronavirus stock market rally. 60% of the shares traded above their 200-day moving average on Friday.

Dow Jones and S&P 500 Futures Today

The Dow Jones futures are trading with caution and are down by 50 points. Stock traders continue to keep a close eye on the upcoming U.S. initial jobless claims data—the most significant economic event of the day.

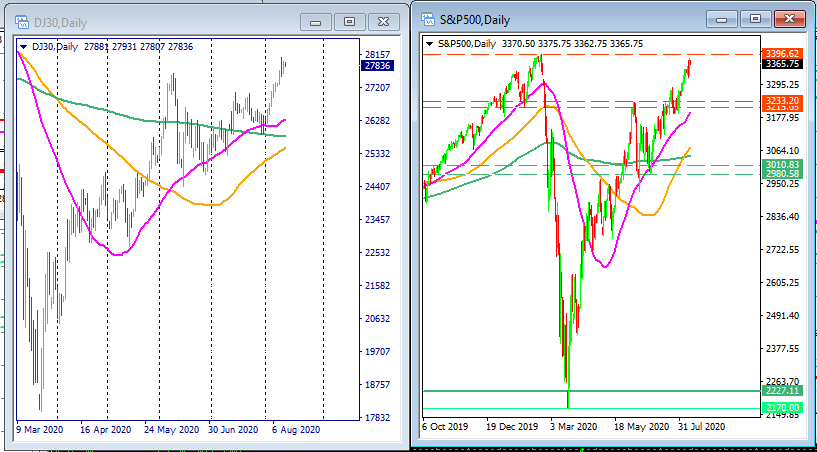

The Dow Jones industrial average futures started the week on the front foot. Today’s price action is already beyond the previous day’s high. It seems that the Dow stocks have backing from the bulls, as the price is trading above the 50, 100 and 200-day SMA on a daily time frame. The 50-day SMA of the Down Jones continues to trade above the 100-day SMA, a true bull signal.

The Dow Jones’s daily chart shows that yesterday’s price action was within the trading range of the previous day. The Dow is trading above its 50, 100, and 200-day simple moving average on a daily time frame, and this confirms bull strength. The next critical resistance level for the Dow remains the all-time high.

The S&P 500 index is sitting near an all-time high. If lagging stocks do not pick up steam, it is likely that the S&P 500 index may end up forming a double top and may face intense selling pressure. From a technical price analysis perspective, the S&P 500 is trading well above the 50-day simple moving average, and this means a retracement could happen. The most prominent bull signal comes from the fact that the 100-day SMA has crossed above the 200-day SMA.

Stock Market Rally

The S&P 500 had one of its biggest roller coaster rides in the last 175 days because first, the S&P 500 stocks crashed from their record highs to coronavirus stock market low, and then recovered all of their losses. This is the fastest rebound for the S&P500 index.

The S&P 500 index closed higher with a gain of 1.40% yesterday. The Tech sector led the gains for the S&P 500 stocks. Ten out of eleven sectors closed in positive territory. AMD stock added the most gains for the index; it was up 7.45%. FLIR was the biggest drag; it declined by 4.67%. The S&P 500 stock index is 1.24% below its 52 weeks high.

The Dow index soared 289 points, and the Dow stocks pushed the index higher by 1.05%. 22 stocks of the Dow Jones Index increased in value, and 8 shares of the Dow index declined. Apple stock jumped the most and increased in value by 3.23%. Boeing stock remained the biggest decliner; it fell by 2.6%.

The NASDAQ composite, a tech-savvy index, gained another 281 points yesterday.