The Dow Jones and S&P futures bounced off from their lows on the back of today’s U.S. Initial Jobless Claims data. The road ahead is full of obstacles, and the path to recovery is going to be long and hard. The U.S. economy is likely to continue to suffer as long as the Jobless Claims number remains as elevated as it is today. On that basis, the only answer, for now, is the second stimulus package.

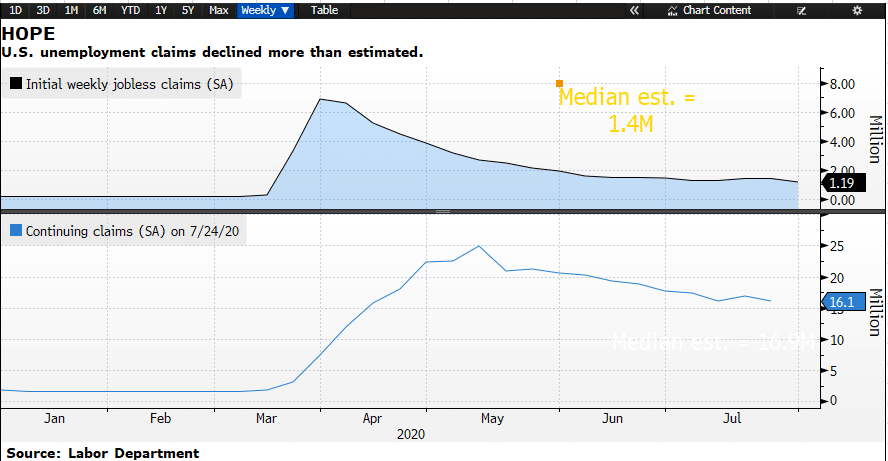

The U.S. Initial Jobless Claims number was a lot more optimistic today when compared to the previous reading. The figure came in at 1.1 million against the forecast of 1.41 million. The Continuing Claims data also ticked lower and produced a reading of 1.61 million, while the forecast was 1.7 million.

Dow Jones Off its Low

Stock traders are hopeful that economic recovery is taking place and that the U.S. data is not going in the wrong direction as it has done over the past two weeks. If the U.S. jobs market continues to improve, it will also push the U.S. stock market higher.

Having said that, Dow Jones isn’t likely to pick up more steam, as stock traders want to see a number of readings before they can say definitely that the U.S. jobs market is back on the path to recovery.

As the economic data was released, the S&P 500 spiked, and the gold price moved lower. Gold acts as a safe haven; traders favor the stock market when they feel confident, which leads to a decline in gold prices.

Second Stimulus Hope

There is also a lot of hope among stock investors about the second stimulus package, which is currently being discussed in Washington. From the outset, it may seem that both Democrats and Republicans are far apart and that the second stimulus aid package may never see the light of day.

However, if this was the case, the Dow Jones and the S&P 500 indices would not be trading where they are. The whole reason that we are seeing the S&P 500 back in the positive territory and also the S&P 500 futures inching closer to a record high is because this coronavirus stock market rally is led by stimulus support.

Traders know that a second stimulus package will be approved, and perhaps this could be the factor that took the kink out of the Initial Jobless Claims data as well.

Bottom Line

By looking at the U.S. jobless claims data, it does appear that as we got to the end of July, there was some improvement in the labor market. The question now is whether this will translate into a strong U.S. jobs report, due tomorrow. It is critical to note that the second regional shutdowns in the U.S. may not necessarily be reflected in tomorrow’s U.S. jobs report. Hence, the picture will remain so.