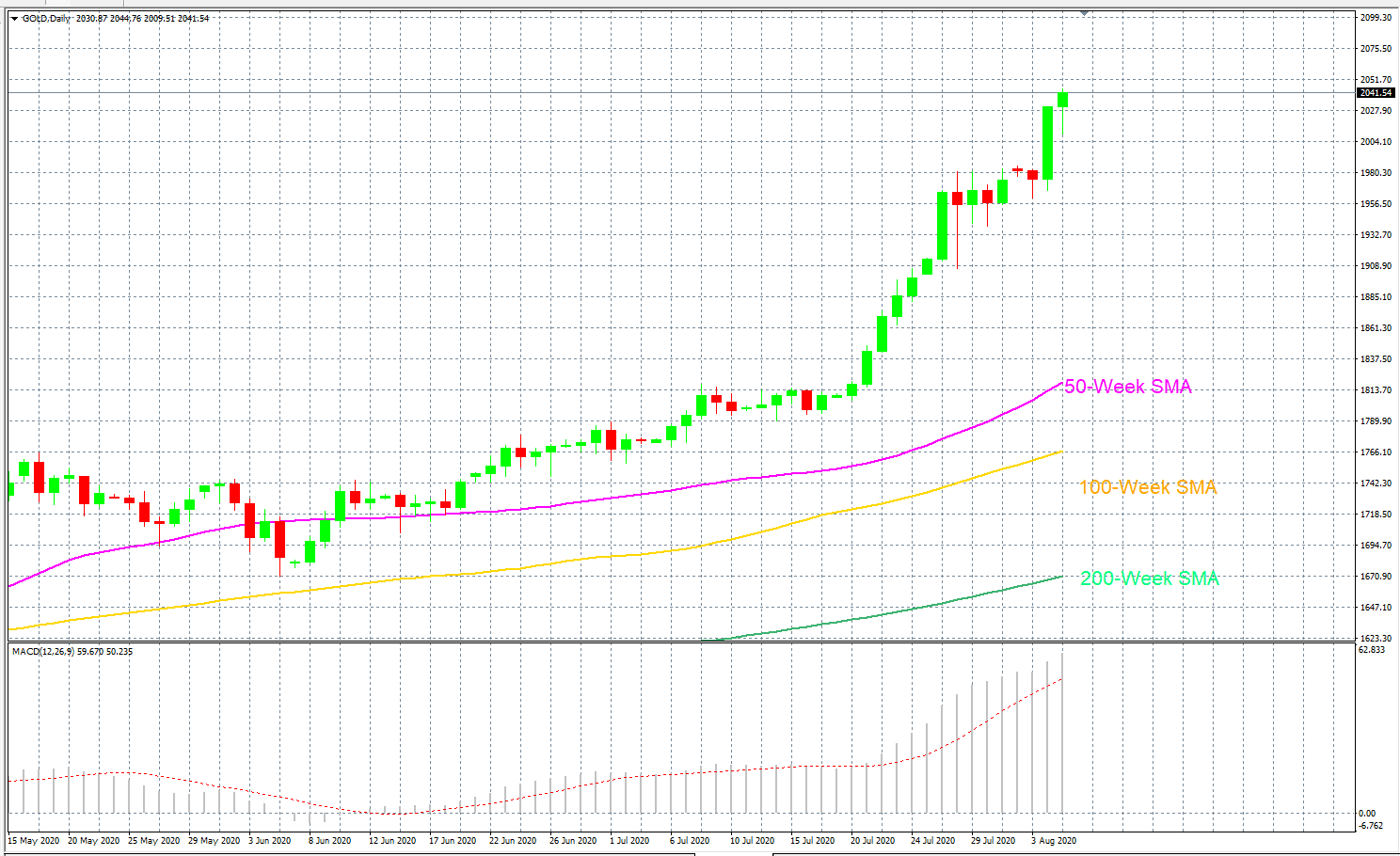

Gold prices have crossed the $2,000 mark for the first time, and investors wonder where is the next stop for the gold price.

Are Gold Prices Going Up?

The price of gold is up nearly 32 percent year-to-date. Gold has made a high of $2,044 per ounce. The $2,000 mark was a significant psychological resistance level. This comes after gold broke its all-time high of $1921, which was formed back in 2011.

Are Gold Prices About to Crash?

Gold prices have been rising for eight consecutive months now, and a retracement is due. However, it doesn’t seem like a crash is imminent. The dollar is still getting ramped as a result of the Fed’s dovish tone around monetary policy. The Fed is highly unlikely to change its stance this year, as they need to offer support to the U.S. The recent economic data shows that the recovery in the U.S. has stalled. To keep the economic growth going, the Fed needs to provide more help, which means there are possibilities that they may lower their interest rate or increase their asset-buying program.

Geopolitical tensions are soaring between Washington and Beijing. There are no signs of them easing off any time soon. Donald Trump wants to show the world that he is the most robust U.S. president. Given the fact that the U.S. elections are just around the corner, it is highly likely that he will continue to ramp up the tensions between the U.S. and China.

Who is Buying Gold?

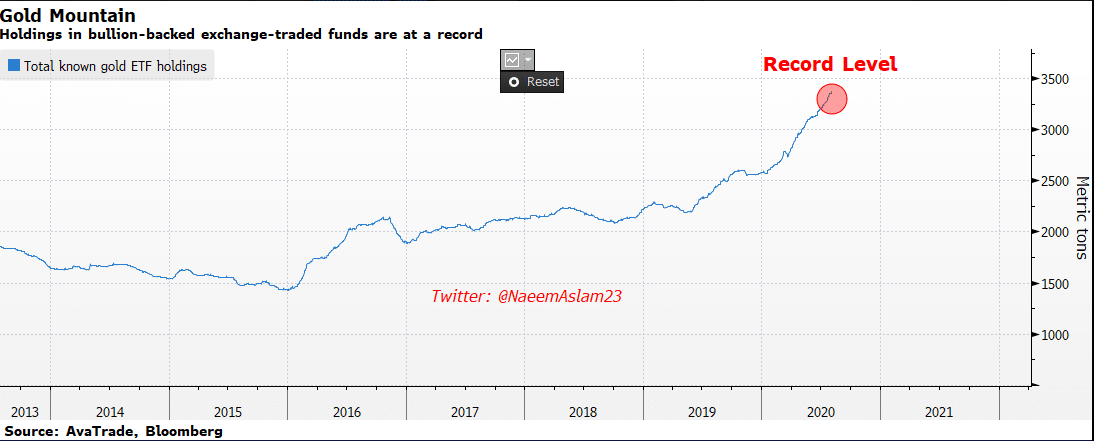

Gold is not only popular among retail investors, but there has been ample demand from institutional investors as well. The recent CFTC data for gold non-commercial positions shows demand for this precious metal.

In addition, total known gold ETF holdings are also sitting at another record high. This confirms that the current gold price is supported by actual demand.

Chart 2

How High Can Gold Go?

Gold prices are likely to continue to their next psychological resistance level of $2,500. This can happen as early as the end of this year, or early next year.

What Is the Biggest Risk Event For This Week?

The biggest risk event this week for the gold price is the upcoming U.S. NFP data release. So far, we have clear evidence from the U.S. jobless claims that the Americans have started to file more Initial jobless claims—indicating that the labor market is off the recovery track.

If the U.S. unemployment data also confirm the same and the unemployment rate ticks higher, it could bring enormous buying pressure for the gold price.

However, if the U.S. NFP data confirms another reading, it is likely that the dollar may strengthen, and the gold price may well ease off.