The S&P 500 and Dow Jones industrial average futures maintain their gains for this week and trade higher today. Investors are quite hopeful about the progress being made for the next stimulus package. However, there is also a tone of caution among investors in terms of buying stocks because of the review of the phase-one trade deal between the U.S. and China. Meanwhile, the gold price has smashed another record high.

Steven Mnuchin: Second Stimulus Deal by the Weekend

Stock futures are likely to remain sensitive to any stimulus-related news. There is no doubt that the U.S. economy needs more help, as the economic data is clearly showing that the recovery is stalling. However, the coronavirus stock market rally is still holding on to its gains, but the fuel seems to be running out. Another stimulus package could provide more fuel, and the U.S. stocks could make another record high.

Republicans and Democrats are under pressure to resolve their differences over another coronavirus aid package. Steven Mnuchin, the U.S. Treasury Secretary, has indicated that a deal can be reached by the end of this week, and this is keeping the hopes alive among investors.

U.S.-China Tensions and Trump

Donald Trump needs to make sure that he sends one clear message: he is the toughest U.S. president for China. He doesn’t care about the cost of this message. What matters for him is that the U.S. elections are around the corner, and Americans should know that he will not bow to China.

The U.S.-China phase-one trade deal, which took nearly a year, is set to be reviewed during this month. The trade negotiators from both sides will be joining this meeting, and the progress of the deal will be reviewed. China pledged to increase its purchase of U.S. goods by $200 billion from its 2017 level. However, coronavirus has clearly made an impact on the purchase, and China is running behind by nearly $77 billion in purchases. The import of agriculture goods, something that Donald Trump was most proud of and something that helped him to become more popular among farmers, is lagging the most.

The Dow Jones futures are likely to react adversely to any outcome that indicates that the U.S.-China trade deal could be in jeopardy. The U.S.-China relation is the most significant risk for the U.S. stock market.

Coronavirus Update: Novavax Vaccine Data

The global coronavirus tracker shows more than 18.4 million cases and over 699,000 people have lost their lives due to this virus. According to state health department data, the positive coronavirus rate in Texas climbed for the third consecutive day. In Houston, the hospitalization rate continues to decline.

Vaccine news is still bringing enormous volatility for pharmaceutical stocks. Novavax stock surged, and shares went wild after its vaccine data was released. Novavax stock declined nearly 34% in aftermarket trading before it pared some of its losses. The experimental Covid-19 drug has pushed the stock up by almost 3,800% this year.

Upcoming Economic Numbers

The Dow futures are likely to face higher volatility as we get two critical economic readings. Firstly, it is the ADP Non-Farm Employment Change data, a data set that usually sets the tone for the US NFP. A reading that is better than the forecast is likely to stimulate a stock rally, and any disappointment may result in profit-taking. The forecast is 1.2 million, while the previous reading was for 2.3 million.

The other relevant economic data is the ISM- Non-Manufacturing PMI number that is likely to shake the S&P 500 futures. The forecast is for 55, while the previous reading was at 57.1.

Global Stock Market Today

The global stock market had a bit of a mixed day. Stocks advanced in China; the stock rally pushed the Shanghai index higher by 0.15%. The HSI index also advanced 0.36% while the Japanese stock index declined by 0.21%. The Aussie stock index, the ASX index fell by 0.55%.

Gold Prices Made Another Record High

The yellow metal, gold, recorded another record high today. The gold price climbed to $2031 per ounce and then retraced to the 2,022 level at the time of writing this report. The path of the least resistance for gold is still skewed to the upside, and there is enough momentum that can push the gold price toward the $2,500.

Dow Index and S&P500 Index: Market Breadth

The U.S. stock market’s breadth shows stock investors are trying to push the coronavirus stock market rally higher. 47% of the Dow Jones stocks traded above their 200-day moving average yesterday.

The S&P 500 stocks confirm that bulls are leading the stock rally. 52% of the shares traded above their 200-day moving average yesterday.

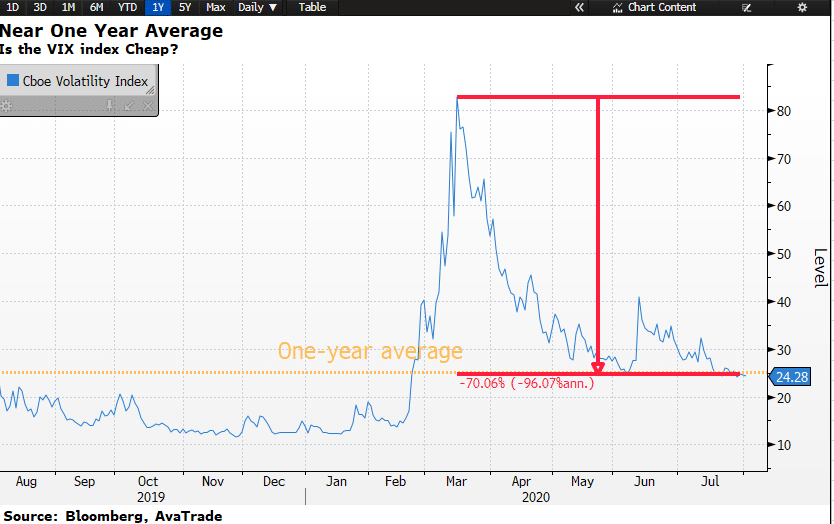

Stock Volatility is Cheap

The volatility index, the VIX index, has dropped sharply over the last few months, but something that traders need to pay attention to is that the volatility index is nearing its one year average. This indicates that many stock traders may consider the volatility index cheap, especially under the current circumstances.

Dow Jones And S&P 500 Futures Today

The Dow Jones futures are higher by 60 points, but caution is also the name of the game among stock traders.

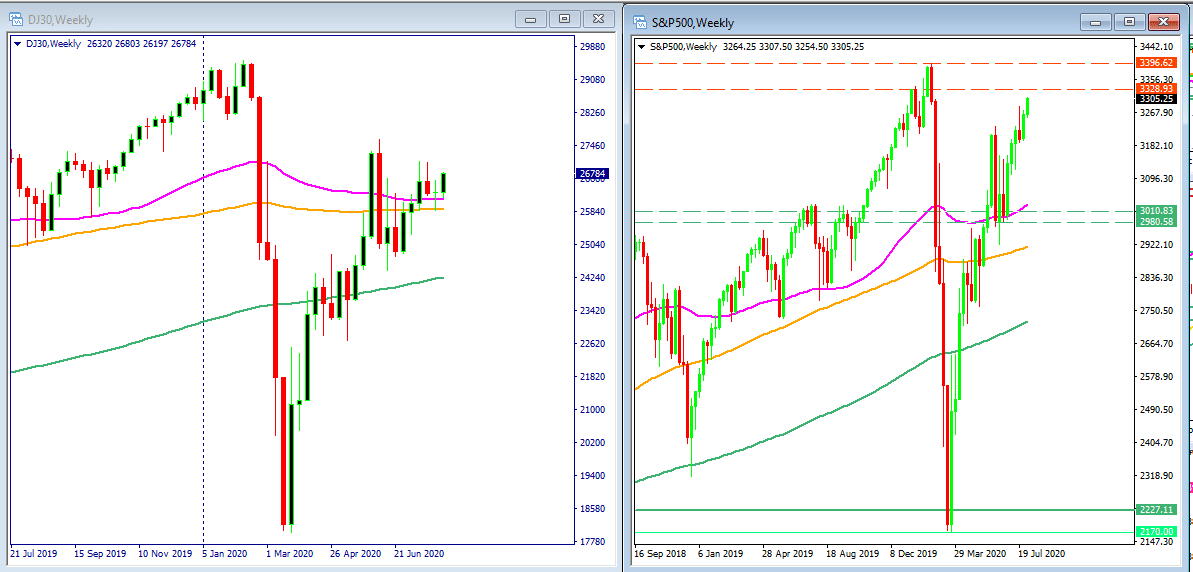

The Dow Jones industrial average futures are building gains this week. It appears that the Dow stocks have support from the bulls as the price is trading above the 50, 100, and 200–day SMA on a daily time frame. The fact that the Dow Jones’s 50-day SMA is above the 100-day SMA and the Dow’s price is also above these averages is a positive for the bull stock rally.

The DJIA index’s futures are trading above all the three important moving averages: 50, 100, and 200 SMA. The Dow Jones Industrial average stocks are pushing the Dow price away from its 50 and 100-week SMA, another positive sign for the coronavirus stock market rally.

The S&P 500 index, the U.S. stock, which shows the overall picture of the U.S stock market, is showing some severe signs of strength. The S&P 500 stocks have pushed the index beyond the last two weeks high, which confirms that the upward trend is mostly intact. This is positive for the coronavirus stock market rally. The S&P 500 stock index is trading above the 50, 100, and 200-week SMA, which confirms that bulls are in control of the stock market rally.

Stock Market Rally

The stock rally that began in April has continued its run for the fourth consecutive month. The Nasdaq index has outpaced the Dow Jones and S&P 500 index so far. The Dow Jones Index has been the weakest link.

The S&P 500 index closed on a positive note yesterday. The S&P 500 stock index soared 0.36%. The energy sector led the gains for the S&P 500 stocks yesterday, and nine out of eleven sectors closed with gains. Mosaic stock contributed the most gains, up 13.5%, and Evergy stock was the biggest drag, dropped 11.6%. The S&P 500 stock index is 2.56% below its 53 weeks high.

The Dow Jones index soared 164 points yesterday, and the Dow stocks pushed the index higher by 0.62%. 20 stocks of the Dow Jones Index soared, and 9 shares of the Dow index declined. McDonald’s stock advanced 2.55% and was the biggest for the Dow while Microsoft stock fell 1.5%, the biggest drag for Dow Jones industrial average index.

The NASDAQ composite, a tech-savvy index, gained 41 points yesterday.