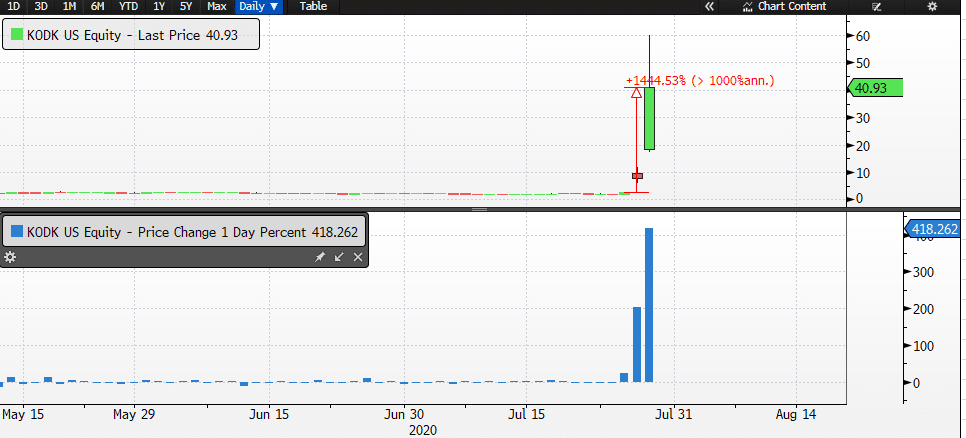

Kodak stock is up over 300%. This activity triggered nearly 20 trading halts today. Kodak shares increased three-fold on Tuesday, and the stock is up over 1,450% approximately this week. At the beginning of the week, Kodak stock was trading at $2.77. Today, it reached a high of $60.

Kodak won a government loan to produce ingredients that are used in critical generic medicines to battle the coronavirus. The company secured a $765 million loan under the Defense Production Act. The intention is to speed up the production of the drugs that are short in supply, specifically drugs that are critical for the treatment of Covid-19.

This is not Kodak’s first time getting involved in the drug sector. In 1990, Kodak was engaged in the production of drug ingredients. Consumers are familiar with Kodak because of aspirin.

Kodak’s stock valuation has soared to just under two billion (at the time of writing this), which is a remarkable comeback for the company. Prior to this, Kodak’s shares were devasted after the industry shifted from film to filmless cameras. Now, Kodak sees itself more of a chemical company.

Kodak shares experienced over twenty-three times more volume today than its average volume. Insiders hold a twenty percent stake, and during the past six months, we have seen them increase their shareholdings by 2.6%. The stock is highly popular among retail investors. Retail traders have been highly active since the beginning of the pandemic, and stock brokerage companies have experienced a massive demand over the past three to four months.

These retail investors have been keeping a close eye on the coronavirus related stocks. This is one reason we have seen massive volatility in coronavirus vaccine-related stocks.