The Dow Jones futures are trading modestly because traders have no clarity regarding when they will receive news about the second stimulus package. The U.S. stock market needs a new catalyst as the European stocks already have their stimulus. This is the reason that we are seeing European stocks outpacing U.S. stocks. Democrats and Republicans need to put their differences aside and address the issue at hand: the U.S. economy is stalling, and U.S. businesses need help.

Stimulus Checks, Jobs Protection and Coronavirus

Regarding the second stimulus package, it seems unlikely that we will get any favorable results within the next two weeks. Mitch McConnel, Senate majority leader, wasn’t very optimistic yesterday when he spoke with Politico. Republicans are working on initiatives that support another round of stimulus checks for Americans and additional jobless benefits. There is also a conversation about securing more funds for a coronavirus testing program.

Trump’s Payroll Tax Cut

Mitch McConnel wasn’t very optimistic about Trump’s agenda of payroll tax cuts either. If the conversation continues in this manner, it is highly likely that the entire process may damage the coronavirus stock market rally or even cause a stock market crash.

Stock Market Crash Could Be An Opportunity

It is essential to keep in mind that such a retracement in the stock market due to the delay in the possible second stimulus package that may include stimulus checks and job protection program for Americans could be an opportunity to bag some bargains. The reason is that the moment we get a green light on the second stimulus bill, the stock market is likely to roar.

Earnings Ahead

The S&P 500 futures, along with Dow Jones futures, are likely to focus on the earnings season. Microsoft, Blackstone Group, Roche, Intel, Unilever, Daimler are just some of the names that are going to be in the spotlight today because of their earnings.

Gold Prices At 11-year High

Gold prices sprinted to an 11-year high and thrashed the psychological resistance level of $1,850. At the time of writing this, the precious metal was trading at $1,857. The next target is not $1,900 but the all-time high of $1,921, which the spot gold prices achieved back in 2011. Most of these gains are due to the loose monetary policy and escalating geopolitical tensions between the U.S. and China.

Silver At 6-year High

Gold isn’t the only precious metal that is enjoying the massive rally. Silver prices also hit a 6-year high yesterday.

Global Stock Market

The global stock market recorded a negative day, the Japanese stock index, Nikki, fell by 0.65%. The HSI index declined 0.31% while the Korean Kospi fell 0.22%. It was the only Shanghai index that posted gains; it advanced 1.16%.

Crude Inventory Data Ahead

In terms of economic data, today, it is all about the U.S. crude inventory data. Both WTI and Brent soared yesterday, and something that can kill the oil rally is the U.S. crude inventory data if it shows that more supply is building up. The forecast is for -2.1 million.

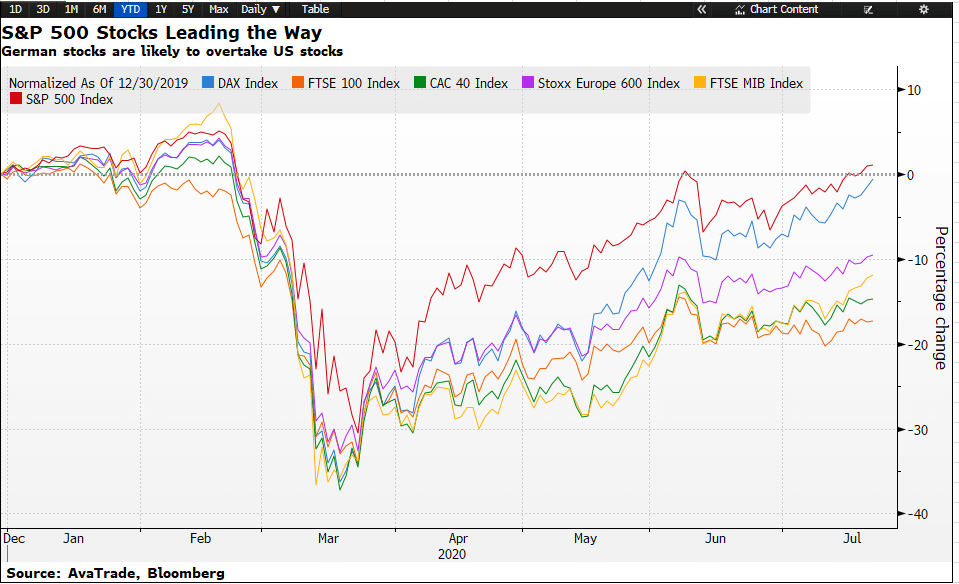

German Stocks Are Leading but Still Behind US Stocks

Although the European stock market rally was much stronger last week compared to the U.S. stock market rally, the S&P 500 stocks are still performing much better than any major European index.

The S&P 500 chart below shows that the S&P 500 index has recovered its Covid-19 losses while all European indices are still negative for the year.

However, the DAX index is on the verge of going positive due to the stimulus help. It is only a matter of time before we see the index crossing the S&P 500 index. This is because the prospects of getting another stimulus package in time aren’t looking that solid.

The chart also shows that the FTSE 100 index is the worst performing index among all European indices. This has a lot to do with the deadlock Brexit situation.

DJIA Index And S&P500 Index: Market Breadth

The stock market’s breadth shows bulls are back in the driving seat. There has been an improvement in bullish sentiment for the Dow Jones index. 50% of the stocks have moved above their 200-day moving average.

The S&P 500 stocks also displayed strength, and 52% of the shares are trading above their 200-day moving average.

Dow Jones and S&P 500 Futures Today

The Dow Jones futures are trading higher by 50 points; investors are trying to keep a positive attitude towards the coronavirus stock rally.

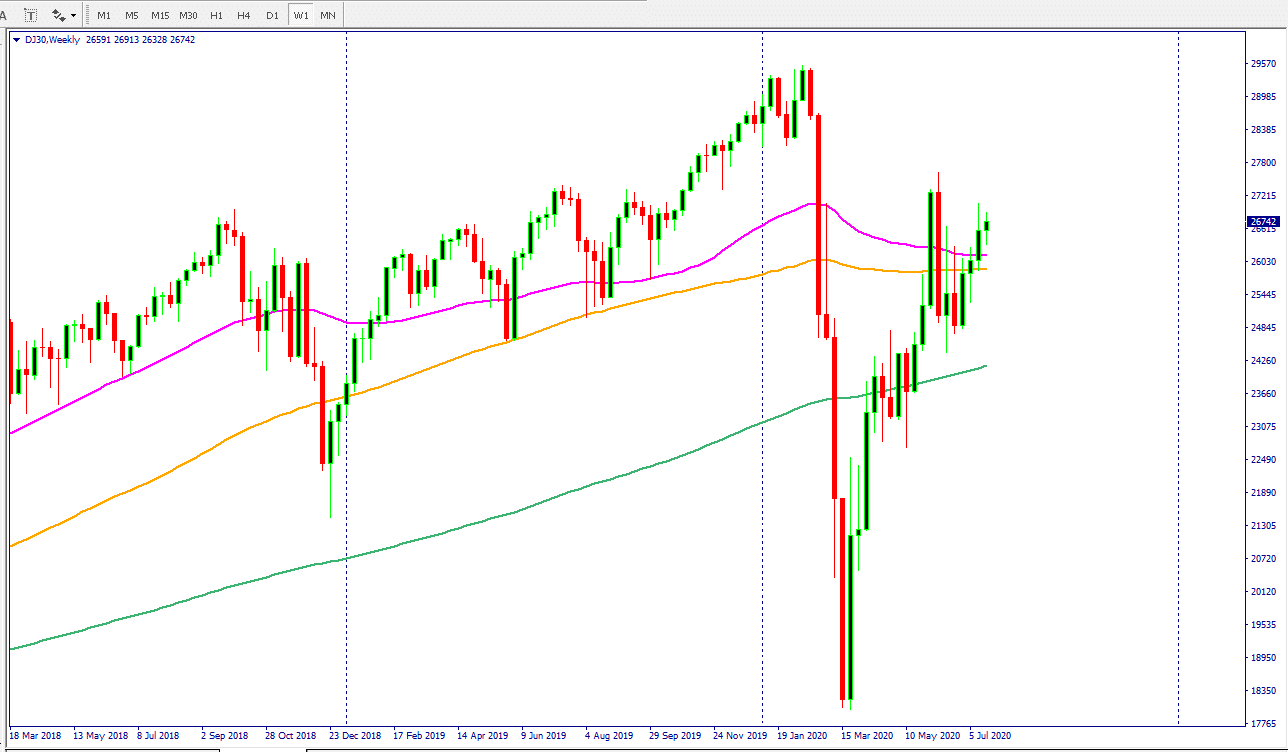

The Dow Jones futures confirm that bulls are in control of the price. The Dow’s price is trading above the 50-day moving average, and this has strengthened the bull case. The next most significant milestone, and a further vote of confidence, will surface when the Dow Jones’s 50-day moving average cross above the 200-day moving average on a daily time frame.

The Dow’s weekly chart shows that we are still within last week’s high and low. The DJIA’s price is trading above all the critical 50, 100, and 200-week moving averages, which means that there are fewer obstacles for the Dow stocks to continue their upward journey. The Dow Jones index can get more tailwind if we cross above last week’s high.

The S&P 500 index is trading nearly 20% higher than its 100-day price average, which means a retracement may occur. However, this doesn’t mean that there is anything to worry about because bulls are still ruling. The S&P 500’s price is trading above the 50, 100, and 200-week moving averages. The S&P 500 index needs to stay above the 50-week moving average on a weekly frame for this bullish momentum to continue.

Stock Market Rally

The S&P500 index gained its strength back, and it is positive for the year. It surged 0.17% yesterday. All the 11 sectors of the S&P 500 index closed in positive territory with consumer discretionary and information technology sectors leading the way. Occidental was one of the strongest S&P 500 stocks and contributed most of the gains for the index. The S&P 500 index is trading at a price to earnings ratio of 23.6 on a trailing basis.

The Dow Jones index also advanced yesterday and closed with a gain of 159 points. 21 out of 30 DJ30 stocks closed in positive territory.

The NASDAQ composite, also known as the tech index, declined 1.09%. Tesla was the biggest drag for the index. Tesla stock price fell 4.54% yesterday.

Coronavirus: E.U. Regulators and CDC

Coronavirus global tracker shows there are more than 14.9 Covid-19 cases, and the death toll has topped the 615K mark.

E.U. regulators also came out with significant news and said that the first coronavirus vaccine might be approved this year. This will be a massive factor because we all know that the pandemic can be stopped only by a vaccine. Having a vaccine also means the economic activity can return to its average level.

Centers for Disease Control and Prevention released data yesterday, and it confirms that there are more people infected with coronavirus than previously reported in the U.S.

Trump Says Coronavirus Situation will “Get Worse Before It Gets Better”

Donald Trump gave his first Covid-19 press conference since April, and he conceded that the coronavirus situation would “get worse before it gets better” This clearly shows that the U.S. still has significant problems in controlling the spread of coronavirus.

Trump is also finally supporting wearing masks. In order to slow the coronavirus spread. Trump said in his news conference, “if you can, use the mask.” Trump continued, “If you’re in a group, I would put it on…I have no problem with the masks.” He added, “I have the mask right here. I carry it, and I will use it gladly…I view it this way – anything that potentially can help, and that certainly potentially can help is a good thing.”