Gold prices are pricing in bullish factors that could push the precious metal prices to a record high in the coming months. The last time the gold prices hit these highs was in 2011 when the gold spot price touched the $1,921. The factors that have stimulated the precious metal prices, especially the gold spot price, are the loose monetary policy, increase in asset allocation among institutional and retail clients, and coronavirus’s massive impact on global growth.

Wall Street Banks on Record Gold Price Predictions

Citibank thinks the spot gold prices can touch the record high against the dollar. The bank feels that in the coming 6-9 months, we will see the gold price reaching a new record high. Citibank isn’t the only major Wall Street bank that holds a bullish view on bullion. Goldman Sachs and a few other banks also believe that the spot gold price is going to challenge its previous all-time high.

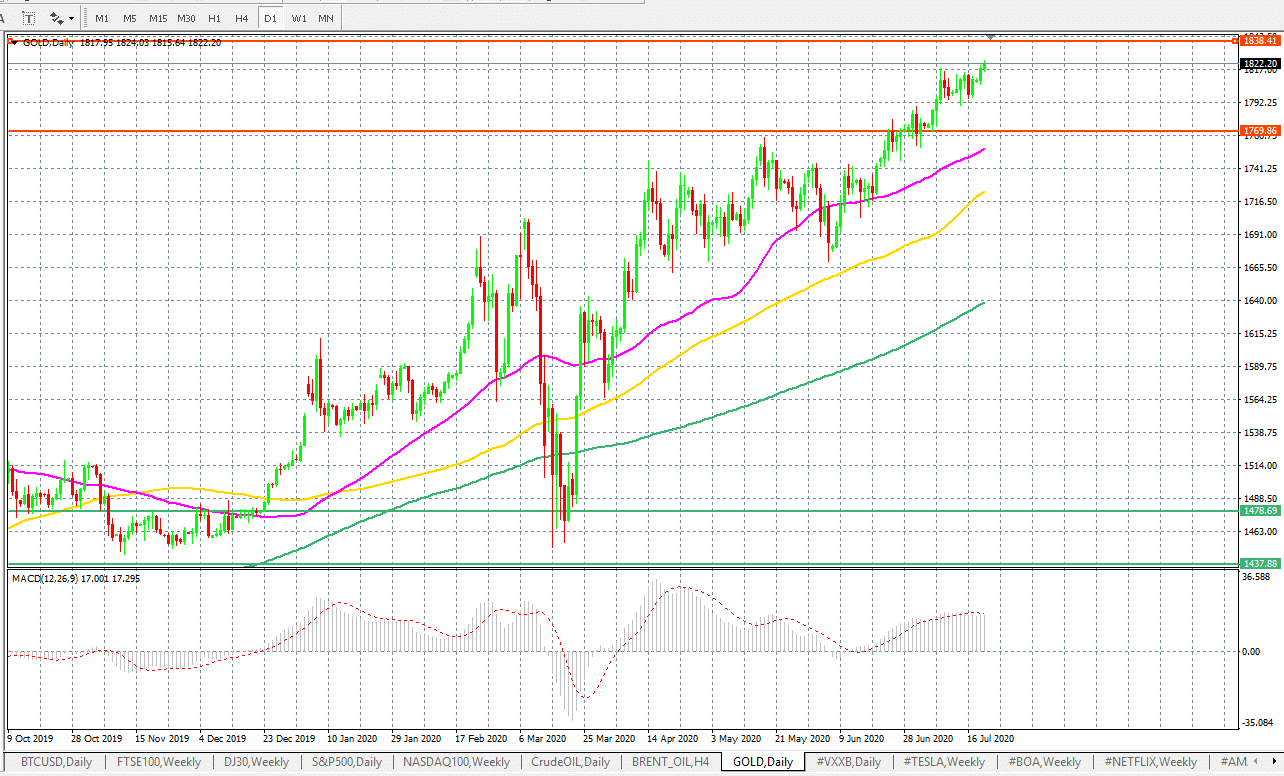

Gold Spot Price Hit the Highest Level In 9 Years

Looking at the performance of gold price, the yellow metal is already up 19% year-to-date. Gold reached the $1,818 price level on June 8th, the highest in nearly nine years. Today, it is trading at 1,810.

Second Stimulus And Scenarios

In the US, the next round of second stimulus talks will begin today. The new stimulus package conversation between Democrats and Republicans is about saving the US economy from stalling.

The emergence of the second coronavirus wave has restrained the economic recovery in the US, and the Covid-19 cases are still on the rise. This has kept investors on edge; they are not comfortable holding riskier assets. In fact, many believe that the current stock market rally is mainly due to the stimulus package and loose monetary policy.

If another stimulus package becomes a reality, a highly likely scenario, it is pretty much a given that the equity markets will rise. However, this will strengthen the argument that the current stock market may not last because stimulus measures power it.

Under those circumstances, we may see even more interest in gold trading. After all, adding any more stimulus into the economy means higher debt for the US economy, which is already at the exploding level. A safe haven, gold, provides an alternative hedge to this.

Another likely scenario that we may see is if we do get another stimulus package from Congress, it may bring initial interest in the stock market, and some retracement in the metal prices. However, the retracement in the gold prices could be an opportunity to get back in the gold trade. This is because the Federal Reserve is unlikely to hike the interest rate or change its monetary policy stance any time soon.

Gold Price Prediction

Traders are still bullish on gold prices and believe that the path of the least resistance for the precious metal is skewed to the upside. When it comes to gold prices, it is not about reaching the record highs of $1,921, it is about testing the psychological resistance of $2,000.