The Dow Jones futures are trading lower as traders are casting some doubts about the reopening of the economy in the hard-hit southern states in the US. There are also concerns that the tensions between the US and China are strengthening every day due to the security law imposed in Hong Kong.

Speculations are that the Trump administration may target the Hong Kong’s dollar peg. For Trump, this could be another way to punish China for its action in Hong Kong but of course the question is , whether the US has the ability to punish China without facing some sort of counter action.

Beijing has the ability to begin a currency war by devaluing the Chinese Yuan. That will not bode well for the US. So far, the idea of targeting the Hong Kong peg has gained much attention but hasn’t yet reached the White House.

The Dow futures, along with the S&P 500 futures, are also paying attention to new warnings from Fed officials who think that the US unemployment rate is likely to remain high despite the fact the US economy is re-opening. Social distancing is one of the things that is going to have an adverse impact on tourism and on the retail industry. Without innovating new strategies, the path to recovery will be arduous.

The global stock market had a mixed trading session. Shanghai and the HSI indices soared 0.94% and 0.17% respectively, while the Nikkei and Korean KOSPI fell by 0.59% and 0.16% respectively.

Here is more on this:

Gold Prices: ETF Inflow Supports Higher Gold Price

For gold, there is one dominant trend that we are consistently seeing: more gold inflow. Gold spot prices are nearing the critical level of $1,800 as investors continue to favor gold because coronavirus has ripped global economic growth.

The cumulative inflow for gold backed ETFs for 2020 has already outpaced the number that we experienced during the financial crisis back in 2009. This shows the extent of interest in gold among retail and institutional investors.

Brexit And Boris Johnson

On the Brexit front, Boris Johnson, the British Prime Minister told the German Chancellor that the UK is ready to leave the EU without a deal if the EU isn’t ready to compromise. Basically, the warning from the British Prime Minister is more of a strong arm move and the chances are that it is likely to backfire because the EU does not usually respond well to such threats.

The OECD warned yesterday that the unemployment rate in the UK can rise up to 15% if the second wave hits the country. The reality is that the emergence of the second coronavirus wave is unavoidable in the UK given how the government has dealt with the coronavirus situation. So, the UK needs to choose its battles very carefully, especially with the EU, if it wants the path to recovery to be smoother.

Market Breadth: DJIA Index and S&P500 Index

The stock market’s breadth shows some losses for the bulls. 37% of the Dow Jones stocks traded above their 200-day simple moving average SMA, a decline of 3% from a day earlier.

The S&P 500 index echoes the same message, 40% of the index stocks traded above their 200-day SMA, a drop of 3% here as well from a day before.

Dow Jones and S&P 500 Futures Today

The Dow futures are trading modestly lower today as traders do need a new catalyst for this coronavirus stock market rally to resume again.

The Dow Jones futures have lost the battle with the 200-day SMA on a daily time frame as the Dow price has moved below this average. This is a sign of weakness, but this doesn’t mean that the bulls are losing control of the price. This is because the DJIA futures are still trading above the 50 and 100-day SMA, and as long as they continue to trade above them, we have a chance for this bull rally to continue its upward rally.

The S&P 500 futures do not show that the bulls have anything to worry about. The price is still trading above all the important moving averages: 50, 100 and 200-day SMA on a daily and weekly time frame.

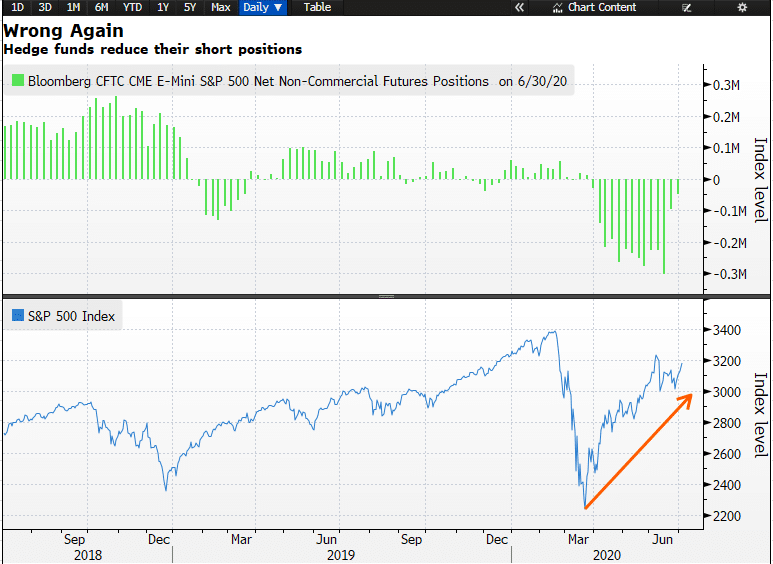

Stock Market Rally

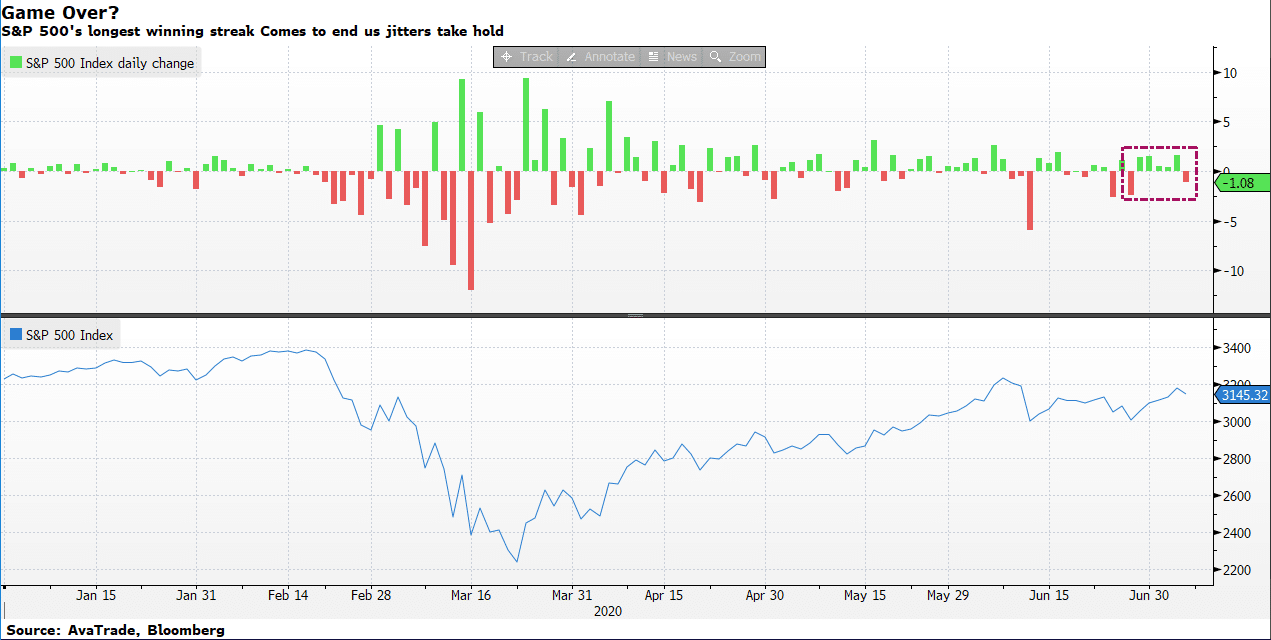

The S&P 500 index has broken its longest winning streak for this year as speculators believe that the tail wind that was helping the index to continue its upward journey may have lost its momentum.

The S&P 500 chart below shows how the longest winning streak has come to an end for S&P 500 stocks.

The S&P 500 stocks declined yesterday, and the index finished the day in negative territory by declaring a loss of 1.08%. Apart from consumer staples, all of the 11 sectors of the S&P 500 index closed with losses. Investors sold the Energy and financial stocks the most.

The Dow Jones industrial average also lost its mojo and closed lower with a loss of 1.51%. Almost all of the DJIA stocks fell, two stocks posted gains. Boeing contributed to most of the decline and fell 4.81%. Walmart provided the safety haven and advanced 6.78%.

The NASDAQ composite, the tech heavy index, eased off from its record highs and dropped the least among the other two indices. The index fell 0.75%.

Coronavirus:

Brazilian President Jair Balsonaro has been tested positive for Covid-19. The president has refused to wear a mask in public previously. The nation has the second highest coronavirus cases and deaths.

Positive coronavirus tests have jumped once again in Florida as the US has passed the 3 million coronavirus number. Places like Sweden where social distancing measures are practiced well, and the economy has reopened, are experiencing a decline in the coronavirus infection rate.