The DJIA futures, along with S&P 500 futures, have paused their strong rally as the dollar index has pared some of its losses. However, investors are still very much paying attention to the stock market rally over in Asia that pushed Chinese shares higher.

Many investors are comparing the rally in the Chinese stocks with the 2015 bubble, but the reality is that the current stock rally is different because investors are not taking the same kind of leverage as they did back in 2015.

Basically, investors are happy to back riskier assets because the economic data is confirming that an economic recovery from coronavirus is taking place. The fact that traders are more interested in buying stocks is because the equity market situation is not as bad as it was when the pandemic started.

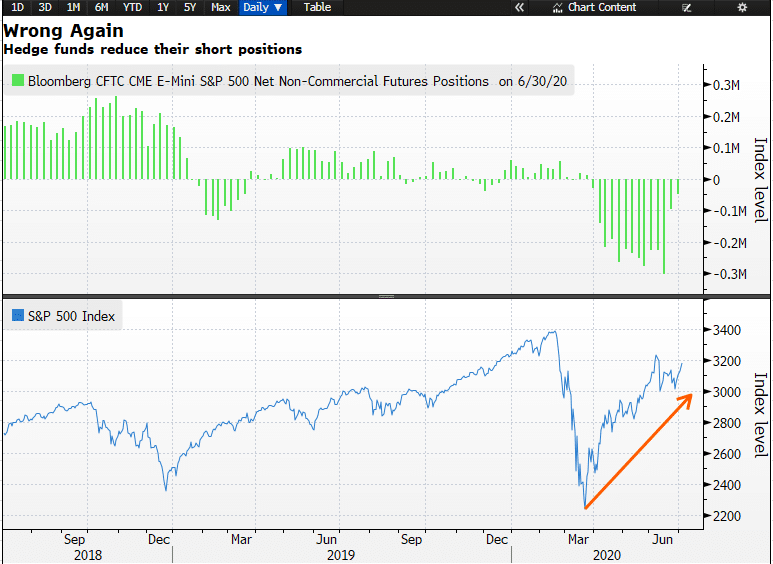

The S&P 500 index may see a bullish rally in the coming days. The CFTC data continues to confirm that hedge funds are on the back foot and they were wrong in betting against the coronavirus stock market rally. The latest data from the CFTC confirms another reduction in the short positions in S&P 500 futures index.

The global stock market had more of a mixed trading session. Korean shares closed with minor losses but the Shanghai index finished the day with decent gains of 1.61%. The Japanese index fell by 0.62%.

Here is more on this:

US Stock Market AndUS Economy

Wall Street was once again surprised yesterday when the US ISM Non-Manufacturing PMI not only jumped back in the expansion territory, but the number actually thrashed the forecast by printing a reading of 57.1. The forecast was 47. This confirms that the US recovery is solid and the drop in the US unemployment rate was no surprise or coincidence. There is clearly an echo of robust economic recovery in a wider set of economic numbers, and this is exactly what investors want to see.

DJIA Index and S&P500 Index: Market Breadth

The coronavirus stock market’s breadth shows bulls are gaining more ground. Yesterday, 40% of the Dow Jones stocks closed above their 200-day moving average–a highly encouraging bullish signal as we inch closer to the 50% mark. This is an improvement of 7% from a day earlier.

The S&P 500 stocks also gained more bullish momentum. There are 43% of the stocks that are trading above their 200-day moving average, an improvement of 2% from a day earlier.

Dow Jones And S&P 500 Futures Today

The Dow Jones futures are trading modestly lower and are down by 100 points. There is still a lot of optimism amongst investors and the current weakness is nothing more than a pause.

The DJIA index is in battle with 200-day simple moving average on a daily chart. Yes, the Dow Jones index closed above this important moving average yesterday, but bulls need to make sure that the DJIA index remains above this moving average. If we fail to have another positive strong close today, the Dow Jones price may begin its consolidation once again.

The S&P 500 futures shows that there is a lot of bull power as the S&P 500 index has already scored a higher high this week in comparison to last week’s S&P 500 index price. The S&P 500 futures are trading above all the important 50, 100 and 200-day simple moving averages on a weekly time frame and this means that bulls are in strong control of the price.

Stock Market Rally

The S&P500 index clinched another day of gains and closed higher with a gain of 1.59%. Except for the utility sector, all the sectors closed in positive territory. The consumer discretionary and communication sectors led the gains for the S&P 500 stock index.

The Dow Jones index closed higher with a gain of 1.78% or 459 points. The DJIA stocks are backed by bullish momentum and this helped the 28 stocks score gains and only one stock fell.

The NASDAQ composite, the tech heavy index, scored another victory and another record high yesterday. The index has had five consecutive days of gains. Yesterday, it closed higher by 2.45%.

Coronavirus: Beijing Reports No New Covid-19 Cases

Beijing has shown the world that it has the ability to control coronavirus. There were no new cases reported in nearly a month. However, the Covid-19 situation is still getting worse in other parts of the world. India, Australia and Tokyo, are all suffering from the second coronavirus wave and the Covid-19 cases over in the US have topped the 3 million mark—the highest in the world. New Jersey is seeing the highest coronavirus cases in nearly 10 weeks.

Overall, there are 11.5 million cases of coronavirus over half a million have died because of coronavirus. US chief scientist, Anthony Fauci said that the coronavirus vaccine may offer only “finite” protection while Trump appears to be losing ground in states where the situation is getting out of hand because of coronavirus.

Gold Prices: Bulls Control Momentum

Gold prices have marked an 8-year high today and the precious metal’ price has moved close to its target of $1,800. There is no doubt that traders are pouring money in gold ETFs for the gold demand has strengthened due to virus concerns. Falling interest rates around the globe, and the weaker dollar are keeping the rally alive for the gold price.

There are speculations that gold–once again–may become the world’s reserve currency given the amount of debt that the US has piled on. The reality is that the US debt situation is not likely to improve anytime soon. The money supply is likely to continue to increase and that will only increase the metal’s shine.

In addition to this, we have many investors who are still betting on an unstable economic recovery due to Covid-19. India has officially taken the number 3 position in terms of coronavirus cases, the economic recovery process for the developing country is unstable.