The precious metal, gold, is likely to reach a major milestone and touch the critical $1,800 mark. This move is mainly caused by the Fed’s loose monetary policy due to coronavirus and the ongoing geopolitical tensions between the US and China. The biggest question for investors is where do we go from here?

Here is more on this:

Gold Records Seven Straight Quarterly Gains

Gold trading prices have been rallying since the last quarter of 2018, and since then, it has been recording gains for each quarter. The price chart below shows that gold price has the longest quarterly run since the 2007 financial crisis.

Given the momentum, I think it is highly likely that gold may continue its momentous run for another few quarters, especially this quarter. The percentage gain for this quarter is very much dependent on the Covid-19 situation.

There is no realistic expectation that a vaccine will be available before 2021, which means that local shutdowns on a global basis are going to limit the economic recovery.

As we move into Autumn, the flu season is only likely to worsen the already complex situation. This means that there are higher chances of strong percentage gains for the gold price not only in Q3, but also in Q4.

Gold and Stocks

There is also a reasonable positive relation between stocks and gold prices as you can see in the chart below. Historically speaking, gold is a risk-off asset and investors only put money into this asset when they do not believe in the stock market rally. Speaking of which, we have many investors like this today, but the quarterly performance of the US stock market says it all.

Nonetheless, the critical point to pay attention to is that the US stock market is moving higher because of monetary policy support and the reason that we see the momentum in the gold price is again for two reasons.

Firstly, investors do know that the Fed is going to keep their dovish monetary policy for an extended period of time, which means weakness for the dollar. A weak dollar is good news for the gold price. Finally, there are many investors who have not deployed their full capital in the equity markets, and they are hedging their risk by using gold.

Goldman’s Price Target

Goldman Sachs believe that the gold price is likely to continue its move to the upside and their target for the gold price is $2,000

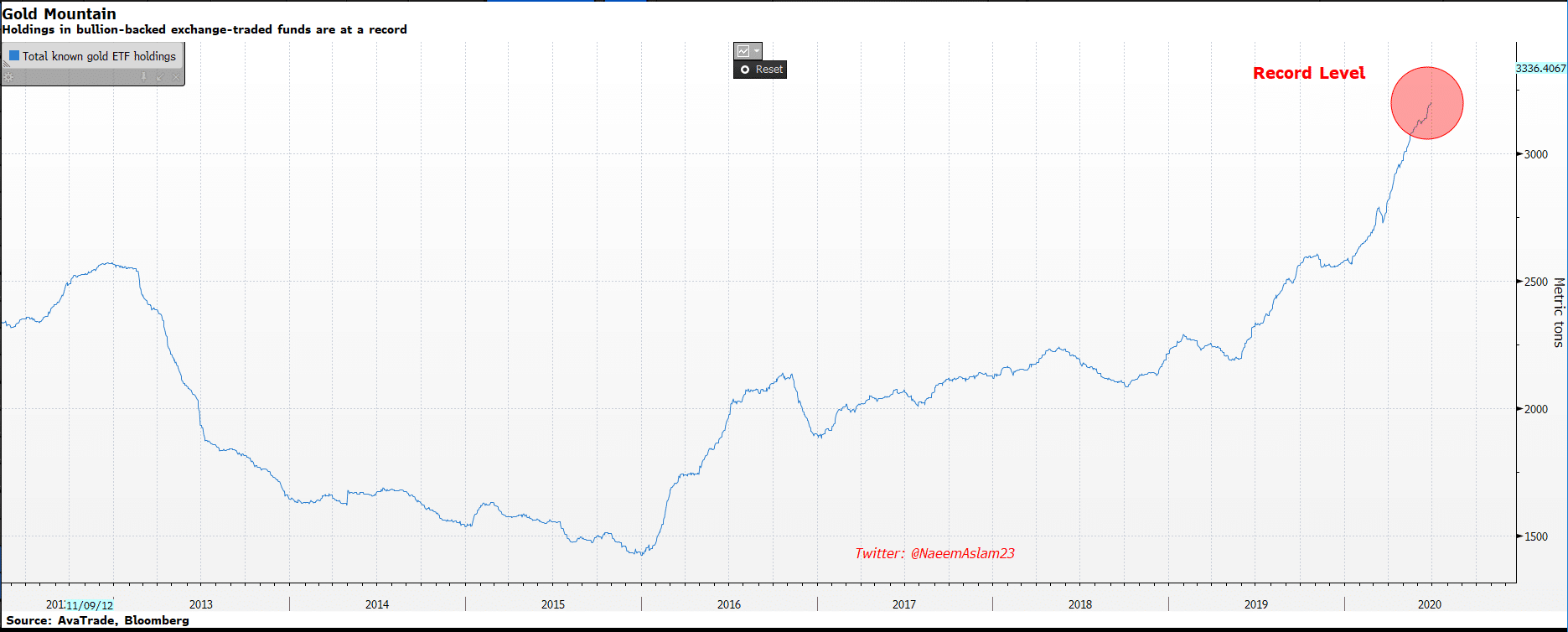

Gold ETF Holding at Record Level

Investors are pouring capital into gold Exchange Traded Funds. Total known gold ETFs show record amount of gold holdings. As long as we do not see this trend ease off, I do not see any reason why the gold price cannot continue its upward journey.