The Dow Jones futures are trading lower while the US stocks market is headed to finish its best quarter since 2009. European and Asian markets are also on track for the same award, it seems like traders have rewarded the coronavirus stock market rally despite the lingering economic recovery concerns and emergence of the second coronavirus wave in various hotspots.

In the stock market today, investors are optimistic about better than expected US economic data released yesterday and the fact that the US coronavirus cases increased below the last week’s daily average. We also had strong economic numbers out of China and this further strengthens the argument that coronavirus economic recovery is taking place in China and the US—the two biggest economies of the world. China reported better than expected purchasing-manager index for services and manufacturing, and over in the US we had a bow out pending home sales number.

As for the US-China relations, Beijing passed the new national security law for Hong Kong, and the Trump administration has suspended some trade benefits for Hong Kong. The question now is how will China react to this as it has warned the US no to interfere in its domestic affairs. Beijing considers Hong Kong a domestic matter.

The S&P 500 futures along with Dow Jones futures are likely to focus on the Fed Chairman’s testimony to Congress later today. But it is the US confidence data that could initiate more volatility in the markets because traders are going to weigh the coronavirus recovery sentiment based on this data. The forecast is for 91.6 against the previous reading of 86.6

Here is more on this

S&P 500 Stocks Records Best Quarter

The S&P 500 chart below shows that the index is on track to record the best quarterly performance since 2009 while speculators continue to talk about fragile recovery and various shapes of recoveries. The facts are in the hard data and it tells us one thing: those who believed and participated in this coronavirus stock market rally have enjoyed the best quarterly gains in over nine years.

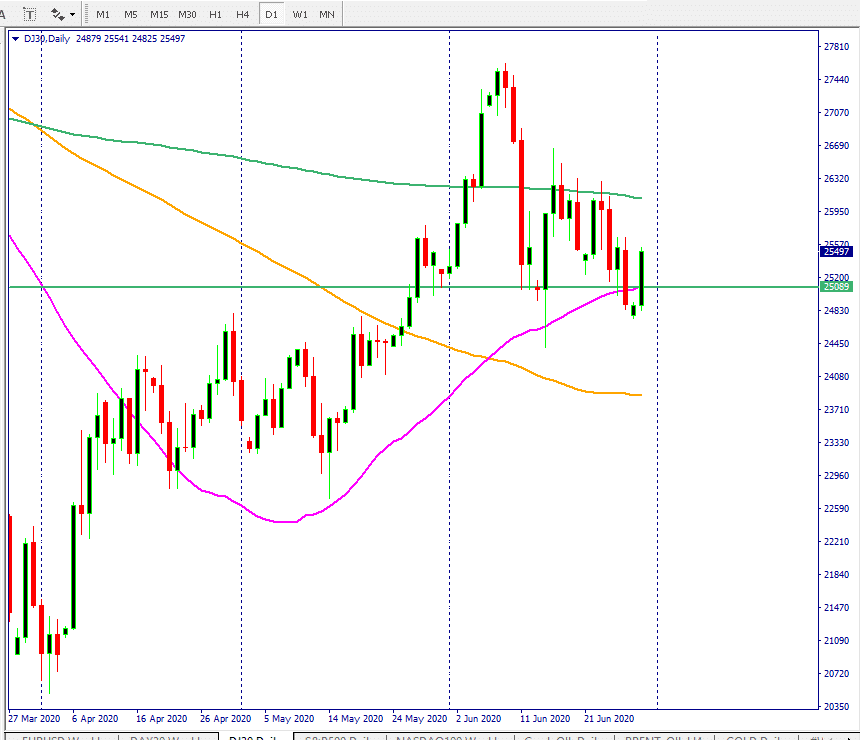

The Dow Jones has also recorded the best quarterly performance since the financial crisis as the chart below confirms.

DJIA Index and S&P500 Index: Market Breadth

The stock market’s breadth shows bulls are back in the driving seat. There has been an improvement in bullish sentiment for the Dow Jones index, 27% of the stocks have moved above their 200-day moving average, which is an increase of 4% (23%) from a day earlier.

The S&P 500 stocks also display strength with 36% of the stocks trading above their 200-day moving average, an improvement of 3% (33%) from a day earlier.

Dow Jones and S&P 500 Futures Today

The Dow Jones futures are trading higher by 100 points, investors are ready to build on yesterday’s gains.

The Dow Jones futures confirm serious bull strength on a daily chart. The Dow’s price has moved above the 50-day moving average and this has strengthened the bull case once again. The next biggest milestone, and a further vote of confidence, will surface when the Dow Jones takes out the 200-day moving average and closes above this average.

The Dow’s weekly chart still faces the same two obstacles, namely, the 50 and 100-week moving averages. The DJIA’s price has challenged both of these averages yet and there is a possibility that sell order sitting at this level may create some problems. However, the tailwind for the Dow Jones index is still in favour of bulls because the price is above the 200-week moving average.

The S&P 500 index has firmly bounced back from its 50-week moving average on a weekly time frame and this shows that the S&P 500 stocks are in no mood of losing their bullish momentum. The S&P 500’ price needs to stay above the 200-day moving average on a daily basis for this bullish momentum to continue.

Stock Market Rally

Investor confidence was boosted by the Federal Reserve’s chairman’s stance who appears to concur that current measures put in place to date are sufficient for the US economy. For him, the economy is in the recovery mode and improvement in consumer spending has taken place “sooner than expected”. In his prepared remarks to Congress today, released ahead of the event, he seems also optimistic about hiring.

The S&P500 index gained its strength back and surged 1.47% yesterday. All the 12 sectors of the S&P 500 index closed in positive territory with industrial and communication sectors leading the way. Boeing was one of the strongest S&P 500 stocks and contributed most of the gains for the index. The S&P 500 index is trading at a price to earnings ratio of 21.5 on a trailing basis.

The Dow Jones index also dug itself out of a black hole and closed with a gain of 580 points. 29 out of 30 DJ30 stocks closed in positive territory.

The NASDAQ composite is also known as the tech index soared 1.14%. Facebook that was under immense selling pressure because of its advertisement revenue, shook all concerns and closed higher by 2.11%

Coronavirus: Arizona Shuts Down Again

Coronavirus cases in the US have finally taken a turn. Yesterday’s 1.2% increase in coronavirus cases in the US was below the average daily increase of 1.6% over the last week according to John Hopkin’s University. However, many US states are still considering altering their reopening plans—a step in the right direction to address the root cause of the spread. New York City is considering adopting the measures put in place by New Jersey where public indoor dining has been halted.

Arizona has issued a new shutdown order as the coronavirus situation is getting worse. The hope is that with these measures, new Covid-19 cases will come under control.

WHO Says Worse Is Still To Come

The World Health Organization is warning that the worst is yet to come. Perhaps, it is poor nations that are likely to suffer the most because of the lack of protective gear and medical equipment. Countries such as India are already in a bad situation, and one can only imagine the level of catastrophe when autumn arrives bringing with it the flu season. So, WHO is not being alarmist.

Trump Economic Team Faces “Exodus”

President Trump’s economic team is facing “exodus”, Bimal Patel, a top deputy to Treasury Secretary, Steven Mnuchin is leaving the Trump administration according to the Washington Post. Without the fiscal and monetary policy support, the economic situation due to coronavirus would have been very different to what it is today.

Having said this, the arrival of the second coronavirus wave has created several challenges for Trump. He not only has to stablise the economy but also needs to deal with the threat of the second Covid-19 wave in order to secure another term. If the top people in Trump’s team continue to leave, it is going to create an extra layer of uncertainty for both Trump and investors when they needed it the least.

Trump Is Failing to Unite Americans, Another non-productive Economic Act

In terms of uniting Americans under one roof, Trump is failing in this task miserably. President Trump retweeted a video of a St. Louis couple who were aiming guns at protestors and before that, he deleted his tweet that shared a video that featured a supporter saying “white power!”. Trump is making his position very clear about protestors and the approach adopted by him is likely to divide an already divided nation further. This will cause some serious adverse ramifications for the US economy and we will likely see many more protests in the US that will hurt the US economy.

Iran Issues Arrest Warrant For Trump

Geopolitical tensions are likely to anchor further after Iran has issued an arrest warrant for Donald Trump. The drone strike that killed Qasem Soleimani, top Iranian general in January, anchored further tensions between the US and Iran. Tehran’s attorney general Ali Alqasi Mehr said that Trump will be prosecuted after his term, semi-official Fars news agency reported. Interpol has made its position clear; it is not going to get involved and “would not consider requests of this nature”. US officials have labelled the Iranian act as a political stunt, but the question is if Trump is going to do something about this, given the fact that he is still the president of the United States.