The Dow Jones futures are trading lower as investors take note of the worsening coronavirus infection rates in the US. Traders are cornered that the premature reopening of the US economy has given birth to virus hotspots in the US and it may lengthen the economic recovery.

The current spike in coronavirus cases has made governments admit that there is no quick fix for this problem, that is until we have a vaccine. Prevention measures and restricting people’s movement has had an adverse effect on the US and global economy. The first half of 2020 was preoccupied with the influence of Coronavirus on the economy, and the second half is likely to see another debt tsunami, higher defaults, and bankruptcies. Investors must prepare themselves for another tumultuous period that is likely to fuel higher volatility.

The dollar index can also catch a haven bid during the second half of this year, and we may likely see the dollar index climbing back to its March high.

The S&P 500 futures along with Dow Jones futures are likely to focus on the geopolitical tensions between the US and China. It is expected that both countries may throw new punches that can impact their tech, energy, and air travel industry.

Facebook’s stock is going to remain the talk of the town as the advertisement boycott picks up more momentum. Ben and Jerry’s, Coca-Cola, and now Diago, all announced that they will pull their advertisement from Facebook.

Gold prices are moving higher as investors are favoring a haven bid today. It is highly likely for gold prices to cross the critical level of 1,800 this week and continue its journey towards its all-time high of $1,921. The Fed chairman is scheduled to testify in front of Congress tomorrow and investors will be monitoring this event closely. In other risk-off assets, the VIX index is likely to build on its last week’s gains. It is up over 152% year to date.

The global stock market has started the week on the back foot and red has been the dominant colour in Asian trading. The Japanese stock prices dropped 2.20% and the Korean stock market was the second worst with a loss of 1.97%. European markets are picking up on this momentum and they may likely suffer from some heavy losses as well.

In terms of economic data, this is a big week for traders because we are going to get the US NFP numbers. Nothing is more important than this particular data.

Here is more on this

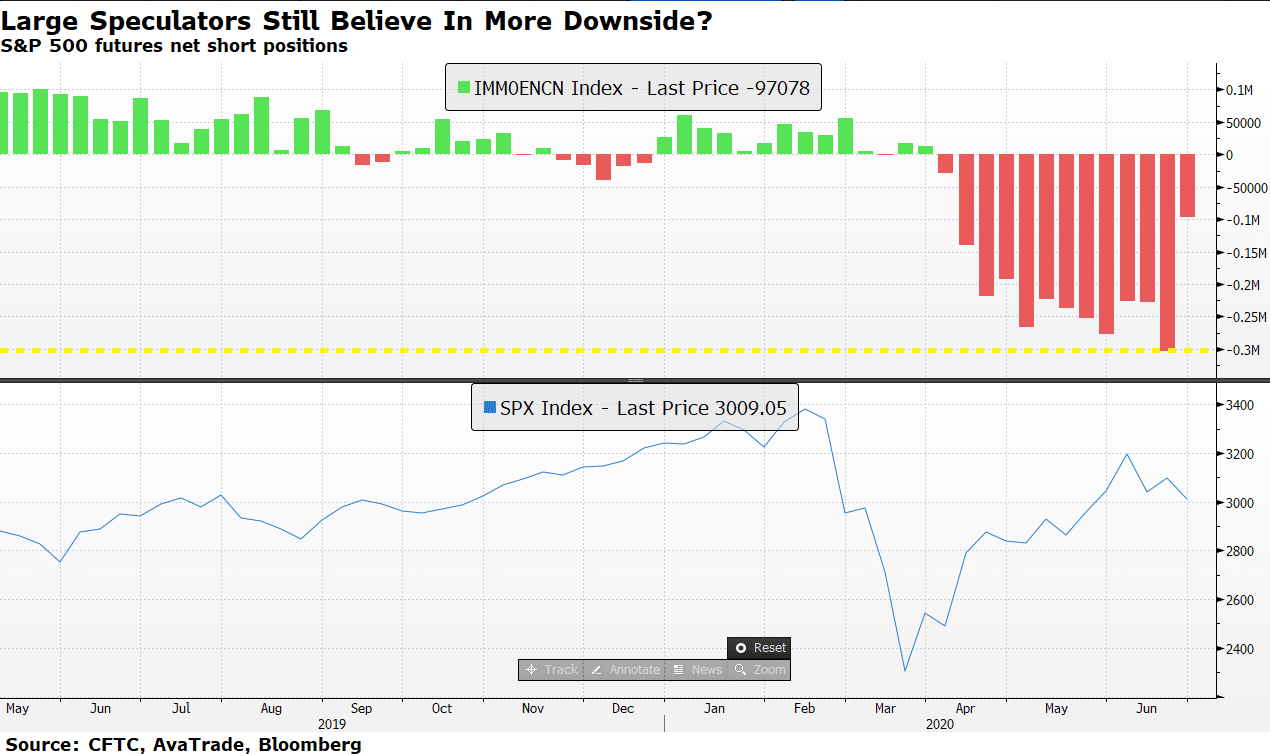

S&P 500 Stocks Not Loved by Hedge Funds?

The S&P 500 chart below shows large hedge funds (net non-commercial) have reduced their short positions according to the latest CFTC data that was released on Friday. This is certainly a massive shift in sentiment because the data before that confirmed the highest short positions on the index in nearly nine years. But the important factor to keep in mind is that the total net position by speculators is still short meaning they expect the S&P 500 stocks to drop more.

DJIA Index And S&P500 Index: Market Breadth

The stock market rally breadth shows a massive shift in favor of bearish sentiment. The DJIA index market breadth confirms more control of the price by bears, only 23% stocks traded above their 200-day moving average yesterday. The number of Dow stocks that traded above this moving on Thursday was 33%.

The S&P 500 index doesn’t show any significant change despite a massive sell-off on Friday. There is no change in the percentage of stocks that are trading above or below their 200-day moving average. The percentage of stocks trading above their 200-day moving average on Friday was 33.

Dow Jones And S&P 500 Futures Today

The Dow Jones futures are trading modestly lower and the futures continue to fluctuate between gains and losses.

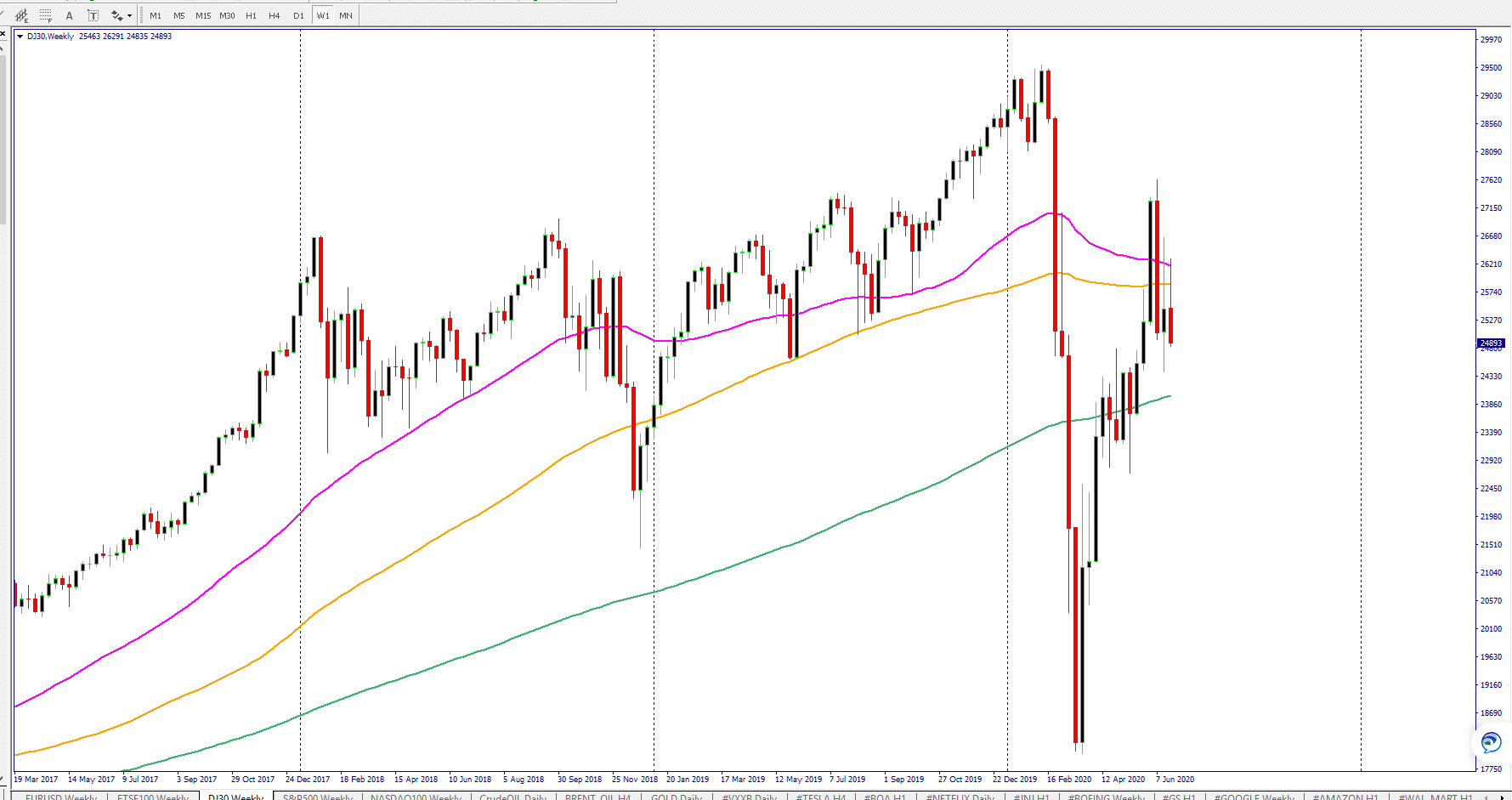

The Dow Jones futures chart shows that the Dow ’s price has broken its 50-day moving average and it was already trading under its 200-day moving average on a daily time frame. This confirms that the bulls have lost control of the Dow’s price. The only hope for the bulls is the 100-day moving average because the DJ30’s price is still trading above this average.

The Dow’s weekly chart shows that bears are dictating most of the terms because the price is trading below the 50 and 100-week moving average on a weekly time frame. The DJIA’s price closed below these average last week as well. The Dow Jones index is still trading above the 200-week moving average, and speculators will be watching the Dow Jones’ battle with this average. A close below this average will confirm that we are heading toward the Covid-19 stock market low.

The S&P 500 index is still showing a lot better bull strength as the S&P 500 stock index didn’t close below its 50-week moving average on a weekly time frame. If the stock market is changing its direction, then we must see the S&P 500 price staying below this average throughout this week.

Stock Market Rally

The US stock market rally has shaken confidence among traders however, the US indices are supported by technical price levels. Of course, there is a lot of qualm among investors about the second spike in coronavirus cases, but the reality is that we are better equipped to handle the situation. However, the second-quarter is coming to an end, and this may keep some smart money on the sideline as they know that there isn’t much hope for good news from corporates because the recovery process may have prolonged due to coronavirus hotspots. This means stocks are likely to drop and a better opportunity could be around the corner.

The S&P500 index plunged on Friday and recorded a loss of 74 points or 2.42%. The S&P 500 erased all of its gains for the month of June and it is down 1.2% this month. The S&P 500 index is 11.3% below its 52-week high that was formed on February 19, 2020. The communication sector led the losses for the index and the financial sector was second worst for the S&P 500 index. All the 12 sectors of the index closed firmly in negative territory.

The Dow Jones index also crated on Friday and dropped 730 points or 2.85%. Out of all the DJ30 stocks, only one stock closed in positive territory and rest recorded losses.

The tech-savvy index, the NASDAQ composite closed below the critical level of 10K and closed with a loss of 2.50%.

Coronavirus Cases Surpass 10 million

Coronavirus deaths have exceeded over 500,000 worldwide and the infection rate has gone beyond 10 million. This is a nerve-wracking reminder for investors. The second wave of coronavirus in the US– I have my reservations calling it second wave because the coronavirus situation wasn’t handled properly– has increased the number of coronavirus cases. Florida experienced a 6.4% jump in coronavirus infection on Sunday and Arizona’s new cases have topped the weekly average for four consecutive days.

The arrival of summer heat has not made the situation any better as previously thought. President Trump was hopeful that the summer heat may kill the virus, but due to a combination of factors, the coronavirus situation has become worse in a large number of US states and the reopening of the US economy has become cumbersome.

The biggest fear for markets is that the situation is likely to become poorer as the flu season arrives in autumn and if the US and other countries aren’t prepared for this, another economic and human catastrophe is unavoidable.