The Dow Jones futures are trading slightly higher as traders seek to move past the risk aversion event that jolted the US futures and Asian markets after unclear remarks from Trump Advisor, Peter Navarro. President Trump took matters in his own hands and assured the stock market that the trade deal with China is “fully intact”. Investors are showing little to no concern about rising Covid-19 case counts in the US even though the coronavirus virus is spreading at an alarming rate in Texas.

Both the S&P500 and Dow Jones futures aremaintaining their gains. Meanwhile, geopolitical tensions continue to simmer inthe background as the Trump administration puts further restrictions on fourChinese state media outlets. In retaliation, China has halted its poultrypurchase from a Tyson plant. So far, the reasoning behind the tension is still mainlydue to coronavirus. But the fear is that the phase one trade deal between theUS-China could be in jeopardy, especially if Trump presses the matter.

The global stock market is likely to remain fragile, risk-takers are uncomfortable with so many moving parts, as countries reopen their economies and lift travel restrictions. Investors will be watching the new growth projections by the IMF that are due tomorrow, and there is very little optimism for this event.

The market breadth of the S&P500 maintains its bull momentum. Gold is trading with modest losses, but the upward trend is still intact for the precious metal. Both WTI and Brent oil prices are above the critical price level of $40, and this is likely to bring additional US shale oil production into the market.

Here is more on these topics:

Dow Jones And S&P 500 Futures Today

The Dow Jones futures are trading higher by 20 points. Still, the DJIA index is likely to face a wild day and remain vulnerable because investors are less hopeful about a V-shape recovery. However, the US economy is still opening up gradually, which should continue to bolster the economic sentiment and provide more support for the equity markets.

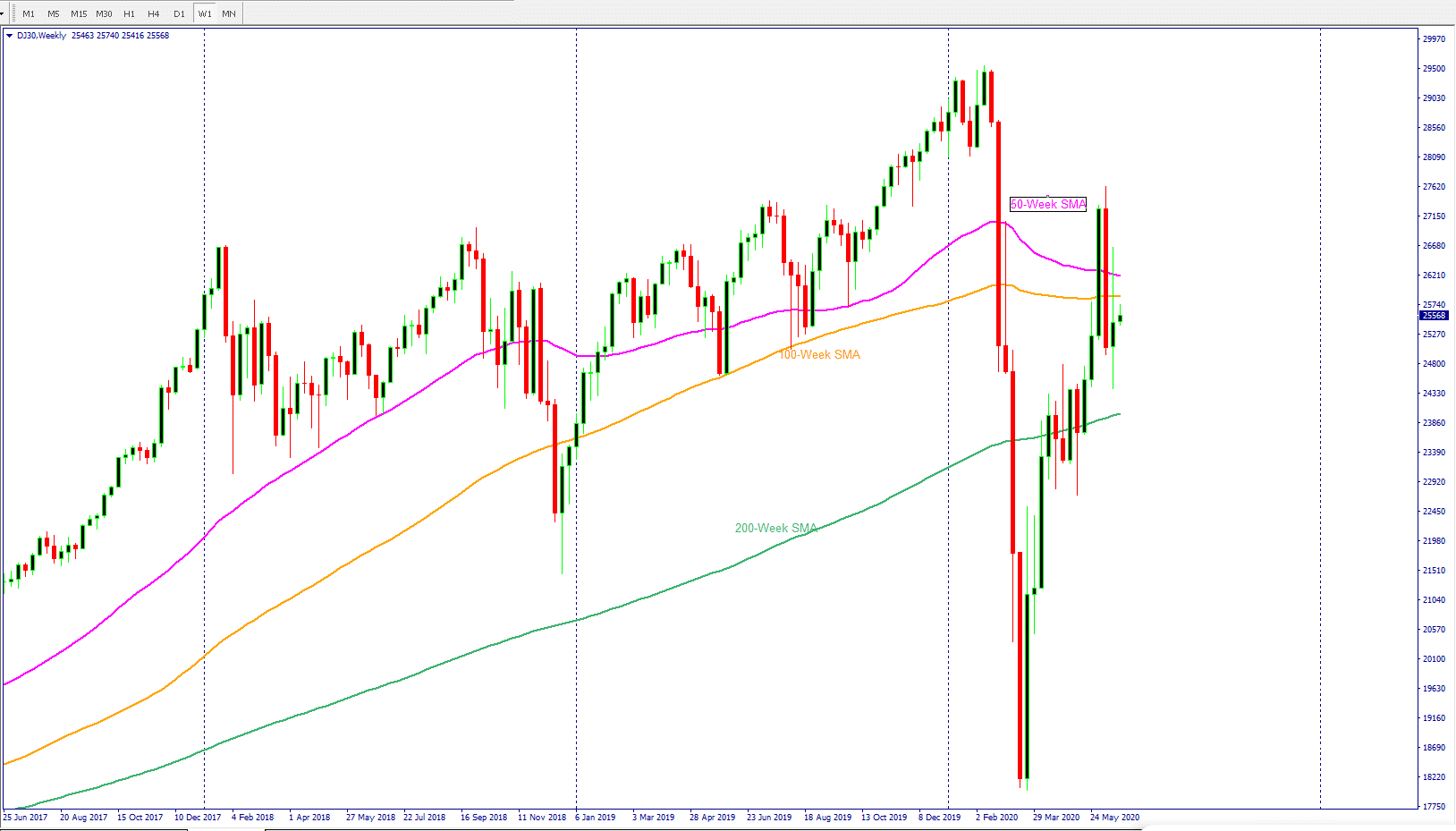

The daily chart for the Dow Jones index confirms that the Dow still lackes some momentum because the Dow futures are trading below the 200-day moving average. If the Dow stocks fail to push the trend upwards, bearish sentiment in the stock market could drag the Dow Jones below its 50-day moving average. If this becomes a reality, then it is likely the Dow will revisit the coronavirus stock market low.

The DJIA index has challenged its 100-weekmoving average on a weekly time frame, and this is a positive sign. If the DowJones moves above this average, we have a strong hope for a new upward trend.

The S&P 500 futures, which show a better representation of the overall stock market, continue to confirm the bull momentum is intact as the S&P500 index trades above all the important 50, 100 and 200-day SMA on the daily chart.

Stock Market Rally

The US stock market rally closed in positive territory yesterday, with the tech sector primarily leading the gains. The VIX futures’ July contract exploded overnight and surged more than 3% as traders became highly concerned about the US and China trade deal.

This move confirms a critical factor. If threats continue to assault the US and China trade deal, traders may hedge their bets by looking at this particular asset. In simple terms, a drop in the US stock markets is likely to push volatility higher, and the July contract for the VIX futures represents a potential hedge.

The S&P500 index closed higher by scoringgains of 0.65%, and the Dow Jones industrial average jumped by 0.59% yesterday.Information technology stocks led the gains of the S&P 500 index and 7 outof 11 sectors closed in positive territory. American Airlines stock was thebiggest drag on the S&P 500 index.

The S&P 500 is trading 8.12% below its52-week high that formed on February 19, 2020, and 42.2% above its Covid-19 lowreached on March 23, 2020.

The tech index, NASDAQ, continued its climb. Most of the gains were fueled by Apple stock due to its ongoing tech conference. The NASDAQ closed higher with a gain of 1.22%.

Coronavirus: Closing Last Option

Coronavirus cases continue to rise in theUS, and people have tested positive for coronavirus in Texas at an alarmingrate. Texas governor has called the recent surge in coronavirus unacceptable.However, he remains firm that closing the economy is still the last option.

H-1 B Visa And Other Visas Suspension

The H-1 B visa became the target ofPresident Trump’s new policies as he suspended the entry of some foreignworkers until the end of 2020. According to a senior official, Trump’s visasuspension move could open up 525K jobs to Americans. However, it is unclearhow the administration reached this number as no explanation was given.

President Trump has also suspended the H-2Bseasonal worker visas commonly used by landscapers, J-1 holders, and L visas. Thebusiness community has raised concerns about the president’s current move asthey believe it is likely to stifle economic recovery.

Trump Assures US-China Trade Deal

President Trump assured Americans yesterdayabout the phase one trade deal with China after confusion over Peter Navarro’scomments. The President tweeted “The trade deal is fully intact. Hopefully,they will continue to live up to the terms of the Agreement!”.

Adviser Peter Navarro ignited a panic afterhe responded to a pointed question about the agreement by Fox News interviewerMartha MacCallum. Traders became highly concerned over Navarro’s response,“It’s over. Yes” and this triggered a temporary stock slump. It appears that tradersmisinterpreted his remarks, and the president’s tweet was a direct answer toremove any conspiracy theory. The tweet is another signal that the matter isvery important for both the president and the US stock markets.

The most significant key takeaway from this is that the trade deal matter needs ultra attention. The Chinese Yuan move and the US futures can pick up some serious momentum if China pulls out of the deal because of the Trump administration Trump continues to push on issues that China considers to be internal matters with no need for external interference, such as the spread of coronavirus and the new security law in Hong Kong.