The Dow Jones futures are trading higher astraders continue to downplay concerns of a new spike in coronavirus cases. Boththe S&P500 and Dow Jones futures made a U-turn today and dug themselves outof losses. Beijing appears to have control of its coronavirus outbreak, whichcalled for celebration amongst traders even though coronavirus cases continueto rise in the US.

The global stock market is likely to remainvulnerable as countries reopen their economies and loosen travel restrictions. In the UK, the government plans to drop the 2-meter social distancingrules and provide additional guidance on facial masks. The Chancellor of theExchequer, Rishi Sunak, is expected to reduce the rate of value-added tax on thegood as an emergency measure next month.

The market breadth of the S&P500 still suggests that the bull momentum is intact. Bullish momentum is healthy for the precious metal, gold. Gold is trading higher as traders remain convinced that the dollar will continue to drop, while the Fed keeps their dovish tone for an extended period.

Here is more on these topics:

Dow Jones And S&P500 Futures Today

The Dow Jones futures are trading higher by 400 points as the DJIA index steadily continues to record more gains. However, traders should take note that volume isn’t high, which usually means that the momentum may not last for long. On the daily chart, the Dow Jones index has moved below its 200-day moving average. If it can’t keep above the 50-day moving average, the coronavirus stock market rally could be in serious trouble.

The DJIA index hasalso moved below its 50 and 100-week smooth moving averages on the weekly chart.This is another bearish signal indicating things are about to take a wrongturn.

The S&P 500 futures—which offer a better representation of the overall stock market—show that the bulls are still in control of the price because the S&P 500 index trades above all the critical 50, 100, and 200-day SMA on a daily time frame.

Stock Market Rally

The US stock market rally reversed its gains on Friday and closed with mild losses. The speculative position net non-commercial future positions have increased their net short positions on the S&P 500 stocks. So, it looks like this group of speculators is expecting more pain for the stock market.

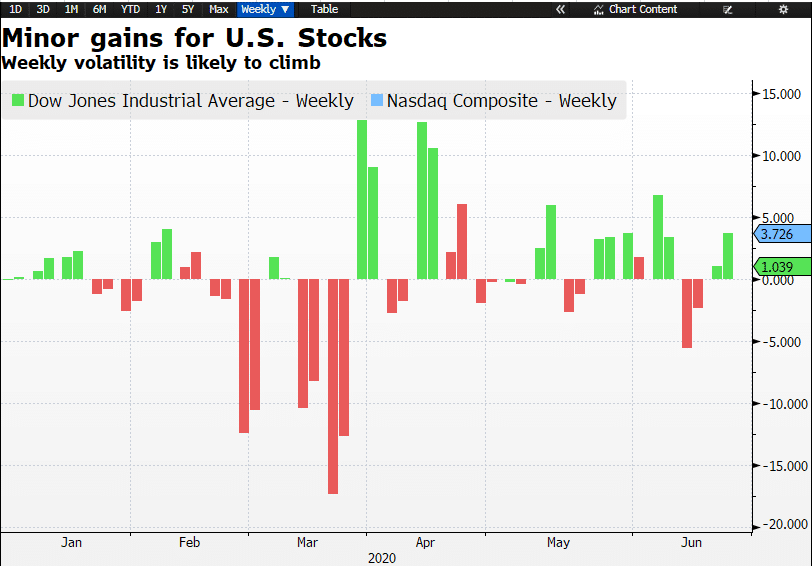

The negative outlook fits as the Dow Jones posted minimal gains over the last week. The NASDAQ index led the gains last week, followed by the S&P 500. The Dow Jones industrial average was the worst performer.

The S&P500 index closed down by 0.56%, and the Dow Jones industrial average sank by 0.80% yesterday. Utility stocks pulled the S&P 500 index lower, and 10 out of 11 sectors showed losses. The S&P 500 is trading at a price-to-earnings ratio of 21.7 on a trailing basis, which makes the index somewhat expensive. The 30-day price volatility declined to 27.41 percent against the previous value of 27.65%, while the average for the past month is 25.43%

Thetech index, NASDAQ closed above the 10,00 mark, but stillrecorded a tiny loss of 0.03%.

Coronavirus: “Tongue incheek.”

In Oklahoma, Trump called virus testing as a “double-edged sword” and urged the medical community to “slow the testing down.” Administration trade adviser Peter Navarro told CNN that the statement was “tongue in cheek.”

Testing is the most critical step in fighting the pandemic, in my opinion, and slowing down this process is like inviting an enemy to live in your house. For traders, coronavirus has become the biggest foe of economic growth. Therefore to restart the economy, we need to hunt it down through testing and then kill it.

UScoronavirus cases have continued to rise. In Florida,new coronavirus cases surged more than the national weekly average, and the situation looks even grimmer in Texas. Accordingto John Hopkins university’s data, there are over 2.27 million infected in thecountry, and the number increased by 27, 476 last week. New York had 664 newcases, and New Jersey recorded a 0.2% increase in cases. There has been anincrease in coronavirus cases in Germany and Brazil remains the hot spot. Beijing reported significantly lower levels of newly infected, and itappears that the situation may be under control.

John Bolton Slams A Trump Second Term

John Bolton, President Trump’slongest-serving national security advisor, believes that four more years of Trumpwould be unhealthy for the United States. In his opinion, the upcoming USelection could act as the last “guardrail” to save the country from a secondterm. US elections are approaching fast, and President Trump is determined to remainin office. Should Trump be re-elected, it’s pretty much a given that he willramp up spending over the next few years to stimulate growth without examiningthe effect this may have on the national debt.