In our latest Week Ahead article (posted on Fridays), we offered 3 reasons why EURUSD could see a rebound this week.

And that rebound is in progress, with EURUSD punching its way to a one-week high, at the time of writing.

Traders are apparently pricing in their expectations ahead of the February Eurozone consumer price index (CPI) data release due tomorrow (Thursday, March 2nd).

So far this week, Euro bulls (those hoping prices will go higher) have been treated to some hotter-than-expected inflation data out of some of the Eurozone’s major economies:

-

February 28th: France’s CPI registered at 6.2%.

That’s higher than the market forecasts of 6.1% and also higher than January’s 6% print.

-

February 28th: Spain’s CPI registered at 6.1%.

That’s higher than the market forecasts of 5.8% and also higher than January’s 5.9% print.

- March 1st: The CPI for the German state of North Rhine-Westphalia (NRW) came in at 8.5%.

That’s higher than January’s 8.3% print.

Germany’s national CPI is due at 1:00PM GMT today.

Such CPI prints from member economies are setting things up for a higher-than-expected Eurozone inflation figures tomorrow.

And still-stubborn inflation implies that the European Central Bank will have to raise its benchmark rates even higher than previously anticipated.

Hence, the prospects of ECB rates moving even higher has translated into gains for the Euro currency.

From a technical perspective …

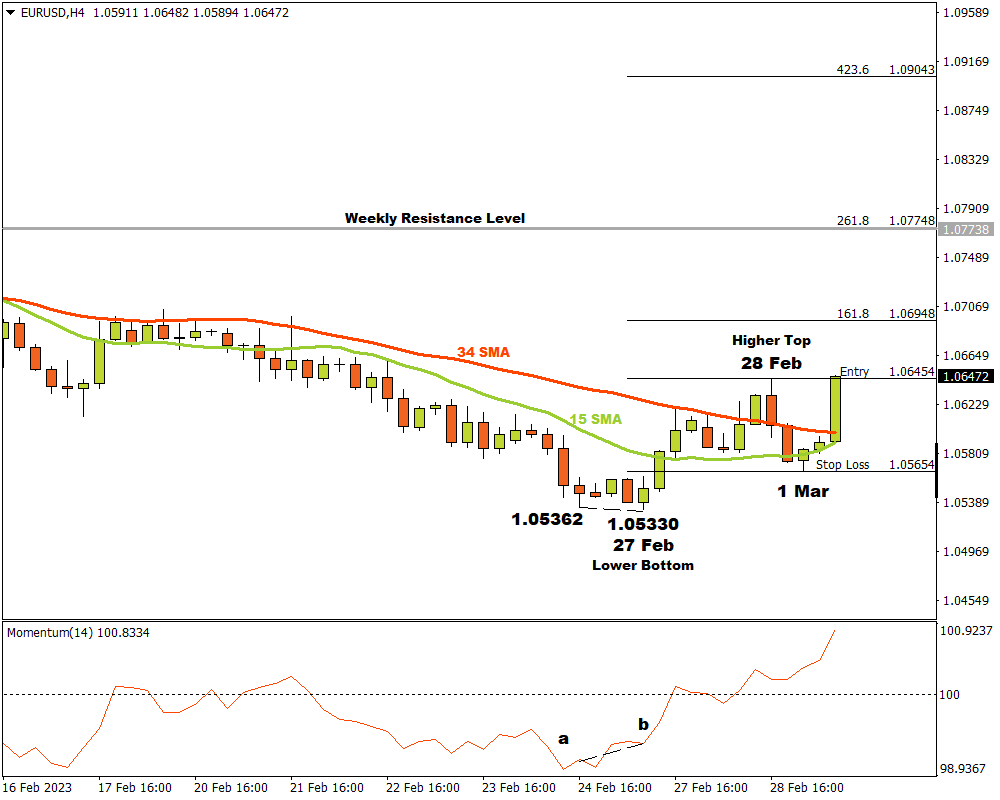

The EURUSD currency pair on the H4 time frame was in an unusually long downward trend that lasted until a lower bottom formed on 27 February at 1.05330.

A look at the Momentum Oscillator reveals positive divergence between points “a” and “b” when comparing the bottoms at 1.05362 and 1.05330.

This would have alerted technical traders that the bears might be losing momentum.

After the lower bottom at 1.05330, the bulls broke through the 15 and 34 Simple Moving Averages and the Momentum Oscillator followed by breaking through the 100 baseline into bullish country.

A resistance level formed on 28 February at 1.06454 and the bears moved in to take over again. The bulls would not allow them and a bottom formed on 1 March at 1.05654.

Later in the same session the price broke through the resistance level at 1.06454 and three possible price targets can be estimated from there.

Attaching the Fibonacci tool to the higher top 1.06454 and dragging it to the bottom of a support level near the 15 Simple Moving Average at 1.05654, the following targets can be established:

-

First target may be considered at 1.06948 (161.8%)

-

Second price target is possible at 1.07748 (261.8%) which is at a weekly resistance level so the bears might retest the bullish resolve there.

- Third and final target might be estimated at 1.09043 (423.6%).

If the support level at 1.05654 is breached, the bullish scenario is no longer valid and any open risk should be managed very tightly.

As long as the bulls keep building momentum and demand overcomes supply, the market sentiment for EURUSD on the H4 time frame will be upwards.