The Dow Jones futures are trading higher,while investors continue to worry about the rise in coronavirus cases in the US.As the numbers keep spiraling up, investors fear that the current coronavirushot spots such as Texas and Florida may hamper the recovery. At the same time, eachstate continues to battle with the process of keeping their economies open.Civil unrest triggered by a Trump tweet may have some correlation with therecent spike as I said before. Nonetheless, investors have a new battle tofight: threats of partial shutdown like in Beijing.

In addition to this, the stock market rally has another significant problem: earnings. No one can accurately say how earnings will look like going forward or even if we have bottomed out. This makes it more difficult for bulls to fight the stock market’s current pessimism, as many feel the S&P 500 to be overvalued or out of touch with reality.

The market breadth of the S&P500 suggests that the bull momentum isn’t that . However, bulls have returned to the commodity space, which is one of the reasons we have seen life return for the black gold, oil. Both WTI and Brent prices are up today. The precious metal, gold, is struggling to hold on to its weekly gain. However, the fact that the US economic numbers are not sending a firm message signaling economic recovery is on track keeps hopes alive for the gold price to continue its climb towards the $1,800 mark.

Several options will expire today on Wall Street, and this usually translates into more volatility.

Here is more on these topics:

Dow Jones Futures Today

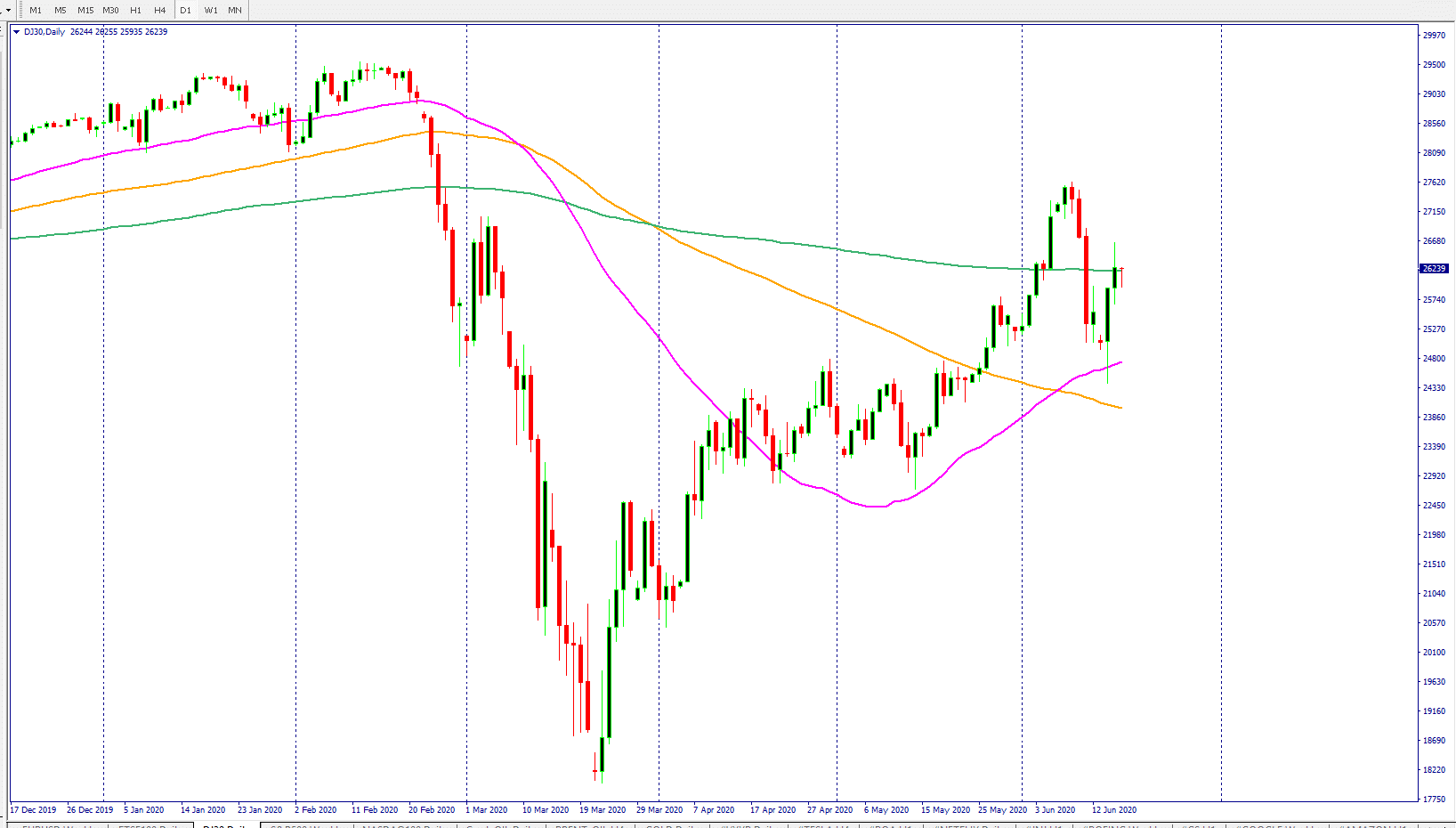

The Dow Jones futures are trading higher as Dow stocks attempt to keep the bullish momentum alive. The chart below shows the Dow Jones price has moved below the 200-day moving average on a daily timeframe, but the battle is still not over as the Dow price retested this average again today.

The Dow Jones industrial average index returned to its mean as the price is close to its 20-day moving average and within the Bollinger Band.

Also,the Dow Jones is still above the 100 and 50-day SMAs,and while it remains above them, the door is open for the index to turnpositive for this year.

See a trading opportunity? Open an account now!

Register Now Or Try Free DemoStock Market Rally

TheUS stock market rally is setto post gains for this week despite the fading of investor enthusiasm.Investors continue to shave profit off the table due to inconsistency in theeconomic numbers. There is no doubt that we have seen some big surprises in specificeconomic numbers this week, such as the US retail sales data, but US weeklyjobless claims have once again failed to confirm any optimism. Therefore, tradersremain on-edge, and smart money still sits on the sidelines. The S&P 500 and Dow Jones stocks need to improve performance to attract more capital,which currently seems a little unlikely.

TheS&P500 index closed higherby 0.06%, and the Dow Jones industrialaverage fell 0.15% yesterday. Energy stocks led the S&P 500 index higher,while 4 out of 11 sectors closed in positive territory. So far, the index is up2.4% this week, and for the quarter, S&P 500 stocks have led the index to again of 21%.

The tech index, NASDAQ, closed above the 10,00 mark with a gain of 0.30%.

StockMarket Breadth

The stock marketbreadth shows that there has been a major shift in favor of bearish momentum

The S&Pstocks breadth

25% stocks trading above the 10-day smooth moving average- difference fromyesterday -45%

85% stocks trading above the 50-day smooth moving average- difference fromyesterday -11%

41% stocks trading above the 200-day smooth moving average- difference fromyesterday -8%

The DowJones stocks breadth

10% stocks trading above the 10-day smooth moving average- difference fromyesterday -80%

80% stocks trading above the 50-day smooth moving average- difference fromyesterday -13%

30% stocks trading above the 200-day smooth moving average- difference fromyesterday -13%

The NASDAQstocks breadth

41% stocks trading above the 100-day smooth moving average-difference from yesterday -25%

76% stocks trading above the 50-day smooth moving average-difference fromyesterday -12%

42% stocks trading above the 200-day smooth moving average- difference from yesterday -2%

Coronavirus Cases Spike

Coronavirus cases have increased in the US, and the situation looks a lot grimmer in Texas. Hospitalization rates increased for seven consecutive days there. California has recorded 4,084 new virus cases, the most significant daily increase since the crisis. New York Governor Andrew Cuomo said yesterday that he might order a quarantine for visitors from Florida as the situation worsens.

Still, it’s not easy to think how such policies can work in reality. The public is tired of lockdowns, and they started to celebrate once economies began to reopen. However, we still need to respect the seriousness of the coronavirus situation because the consequence of being careless and not adapting to a new reality are lethal.

Trump News: DACA And Decoupling From China

In another major blow for President Trump,the US Supreme Court blocked his administration’s plan to destroy an Obama-eraprogram, the Deferred Action for Childhood Arrivals program, or DACA. DACArecipients celebrated the ruling as the program protects more than 650,000so-called DREAMers from deportation.

Chief Justice Jon G. Roberts Jr., calledthe administration attempt “arbitrary and capricious” while speakingfor the 5-4 majority. The stock market seemed to like the Supreme Courtdecision as there was a visible bounce for the S&P 500 around the time ofthis news.

However, something that is keeping traders’concerned is the US-China relation. Tensions have increased once againafter Trump said that the US could pursue a “complete decoupling fromChina.” This is one of the most forceful statements by Trump, and tradersare concerned about the possibility of this materializing into an actualreality.

Donald Trump is not “fit for office”were the comments of former national security adviser Jon Bolton. His book “TheRoom Where It Happened” has created more obstacles for Donald Trump, andthis comes at a critical time when the US elections are just around the corner.