The Dow Jones futures are lower today as investors search for a new catalyst that can encourage them to push the stock market rally higher. Fiscal policy and economic data have been helping, as is the consistent improvement in the employment and GDP numbers. While this data continues to change the view of smart investors, for now, they are still sitting on the sidelines. The release of “The Room Where it Happened,” a book by former National Security Advisor John Bolton that discusses the critics of Donald Trump’s presidency, dented the sentiment yesterday and is still very much in focus.

The S&P500 futures also confirm a touch of fatigue for the broader US stock market rally. The main concern among investors is still the pandemic and surge in new cases in China. More stimulus and monetary policy support could be on the way as China attempts to restore growth. The People Bank Of China is very likely to push another RRR cut as this boosts lending.

Donald Trump slams sanction against Chinese officials who areresponsible for the violation of human rights. The question that traderscontinue to ask themselves is how far the president can stretch his powerbefore he faces unmanageable retaliation.

The Bank of England’s decision and the US weekly jobless claims data is due later today.

The stock market breadth, something that filters noise andprovides the actual picture of the stock market rally, shows the bull momentumis still intact but may begin to struggle soon.

Here is more detailon these topics:

Dow Jones Futures Today

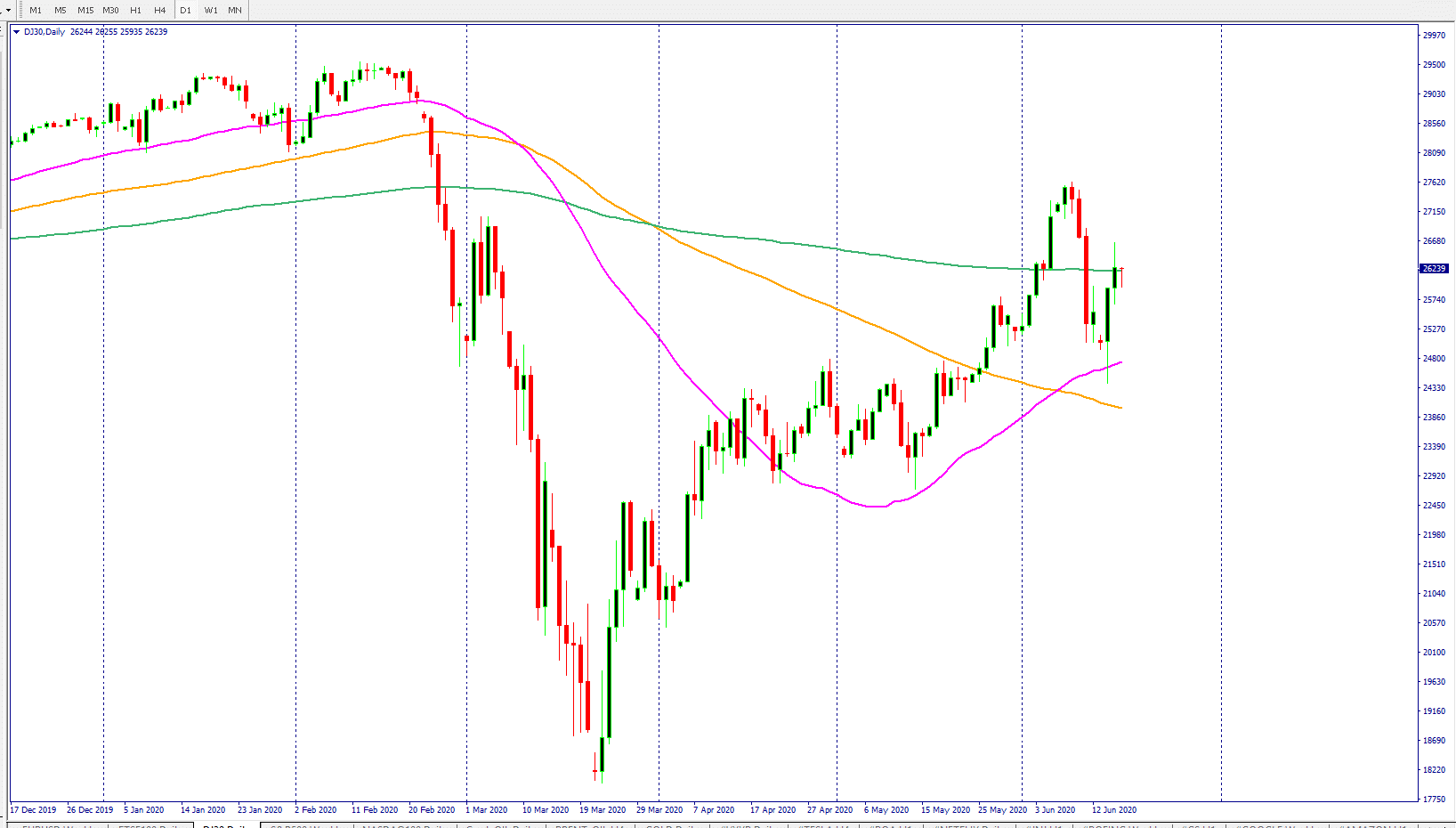

The Dow Jones futures are trading higher by 132 points. The bulls are losing control of the price because the Dow Jones Industrial average has failed to cross above the 200-day smooth moving average (SMA) on a daily time frame. The weekly chart shows that the Dow price has also failed to win the longterm war against the 50 and 100-week SMAs. If the Dow Jones price fails to cross above these two major moving averages and remains below this threshold, the door is likely to be wide open for another Covid-19 related stock market crash.

The S&P 500 futures also show signs of weakness and are trading lower by 21 points. A week that started with lots of optimism and hope has now lost its mojo. The S&P 500 stock index is still trading above the 200-day SMA on a daily time frame, and it is showing a lot better bull strength than the Dow Jones Index.

The below chart shows the Dow Jones price today and its price action concerningthe major moving average

Stock Market Rally

The Federal Reserve’s chairman, Jerome Powell, confirmed once again yesterday in his testimony that specific jobs such as hospitality may not come back quickly. Hence workers in those sectors may need some more help. This message echoes the talking points that Democrats have been using to ask for more stimulus help. He urged the policymakers to extend the extra $600 in weekly unemployment benefit because, without this aid, the economy could be further damaged. The Fed chairman was optimistic about the current recovery, and he believes that things are likely to improve faster than many are anticipating.

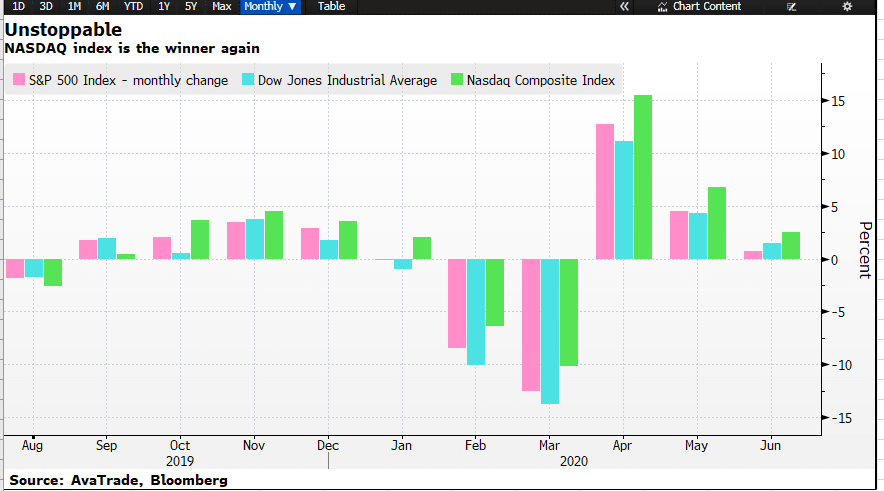

The S&P 500 index declined by 11.25 points or -0.36%, and the Dow Jones stocks dropped 170 points or -0.66%. Both the S&P 500 and the Dow stocks see-sawed between losses and gains during the session, but the energy sector took the brunt of the beating. Real estate and financial sectors also racked up losses. Stock volume was 20% below the 30-day average, and we continue to see higher volatility. This surge in volatility is highly likely to stay here for a little while.

The NASDAQ index was the champion again. NASDAQ stocks supported the index which closed the day with a gain of 0.33%.

The below chart shows the NASDAQ index in the lead once again, with theDow Jones stocks lagging.

Stock Market Breadth

Measuringthe market breadth is an essential function as it provides a lot more detailabout the strength of the stock market rally, and also helps traders to filterout noise.

The S&Pstocks breadth

26% stocks trading above the 10-day smooth moving average- difference fromyesterday +16%

87% stocks trading above the 50-day smooth moving average- difference fromyesterday +5%

42% stocks trading above the 200-day smooth moving average- difference fromyesterday +3%

The DowJones stocks breadth

10% stocks trading above the 10-day smooth moving average- difference fromyesterday +6%

83% stocks trading above the 50-day smooth moving average- difference fromyesterday +16%

30% stocks trading above the 200-day smooth moving average- difference fromyesterday +0%

The NASDAQstocks breadth

41% stockstrading above the 100-day smooth moving average-difference from yesterday +5%

77% stocks trading above the 50-day smooth moving average-difference fromyesterday -1%

41% stocks trading above the 200-day smooth moving average- difference fromyesterday +2%

Bottomline: Further shift in bullish momentum as more stocks have moved their 200-daysmooth average.

Coronavirus Cases Spike

The infection rate continues to grow in countries ranging from Brasil toChina. Less developed countries like India are facing major catastrophes againbecause of inaccurate testing. Iran is likely to put a lockdown back in effectbecause coronavirus cases have started to rise.

Texas reported an 11% increase in hospitalizations, which is the mostsignificant 24-hour surge since June 4. New cases in Florida rose to their peaklevel since the outbreak of the coronavirus pandemic.

On the other hand, New York City is on track to begin Phase 2 ofreopening on Monday, which means that restaurants will be able to serve food totheir customers.

Trump News: Bolton’s Book WeighOn Trump’s Re-Election Efforts

In Trump news, President Donald Trump took another move against China by signing a measure that punishes Chinese officials that are found guilty for the oppression of Uighurs and other members of Muslim minority groups. The decision came on the same day that a new book alleged Trump encouraged China to build internment camps to house Muslim minorities.

Chinese officials are likely to retaliate against the new sanctions with a proportionate response. Once again, the element that contains the biggest risk –as mentioned before– is the US-China Phase-one trade deal, which is still intact. In the past, Trump has been reluctant to take any action on the issue of Muslim oppression in China.

In other Trump news, President Trump asked Chinese President Xi Jinping to help him win the upcoming US election. Former National Security Advisor John Bolton wrote in his new book that Trump asked Xi to buy more US farm products. WSJ has published these claims as an excerpt. Bolton’s allegations could make things a lot more difficult for Trump as he is already facing many other obstacles in securing a second term.

China News: Hopes ForPBOC Support

In China news, Beijing is showing it means business as it tries to control the virus outbreak. More than 1,200 flights were canceled, and all schools remain closed. The People Bank of China is pledging its support to do more and it is highly expected that the bank may cut the RRR ratio in order to boost liquidity.

The relationship between India and China continue to deteriorate after a deadly conflict on the Himalayan border. India, which already has longstanding differences with its neighbor, Pakistan, has also worsened its relationship with its ally Nepal. The hashtag “China-India border” remains popular in google trends and on twitter.

Ahead Today

Bank of England will be announcing its monetary policy decision today. The bank is expected to leave the interest rate unchanged but, strike an ultra dovish tone because of coronavirus and Brexit. We also have the weekly US jobless claims data, and any improvement there is likely to bolster the risk sentiment among investors. So far, it seems like the bottom is in place for the US weekly initial jobless claims. The forecast is for 1290K while the previous reading was for 1542K.