European markets are set to build on their gains and ready to continue their bullish momentum. Traders have largely ignored another fear-mongering headline about the UK’s jobless claims data that was released yesterday. The fact is that the unemployment claims may continue to rise and the market participants already know that. Investors are more hopeful about the UK’s prime minister going to the UK-EU summit, and considering this is a positive sign because this makes the Brexit deal one step closer.

Here is more on this

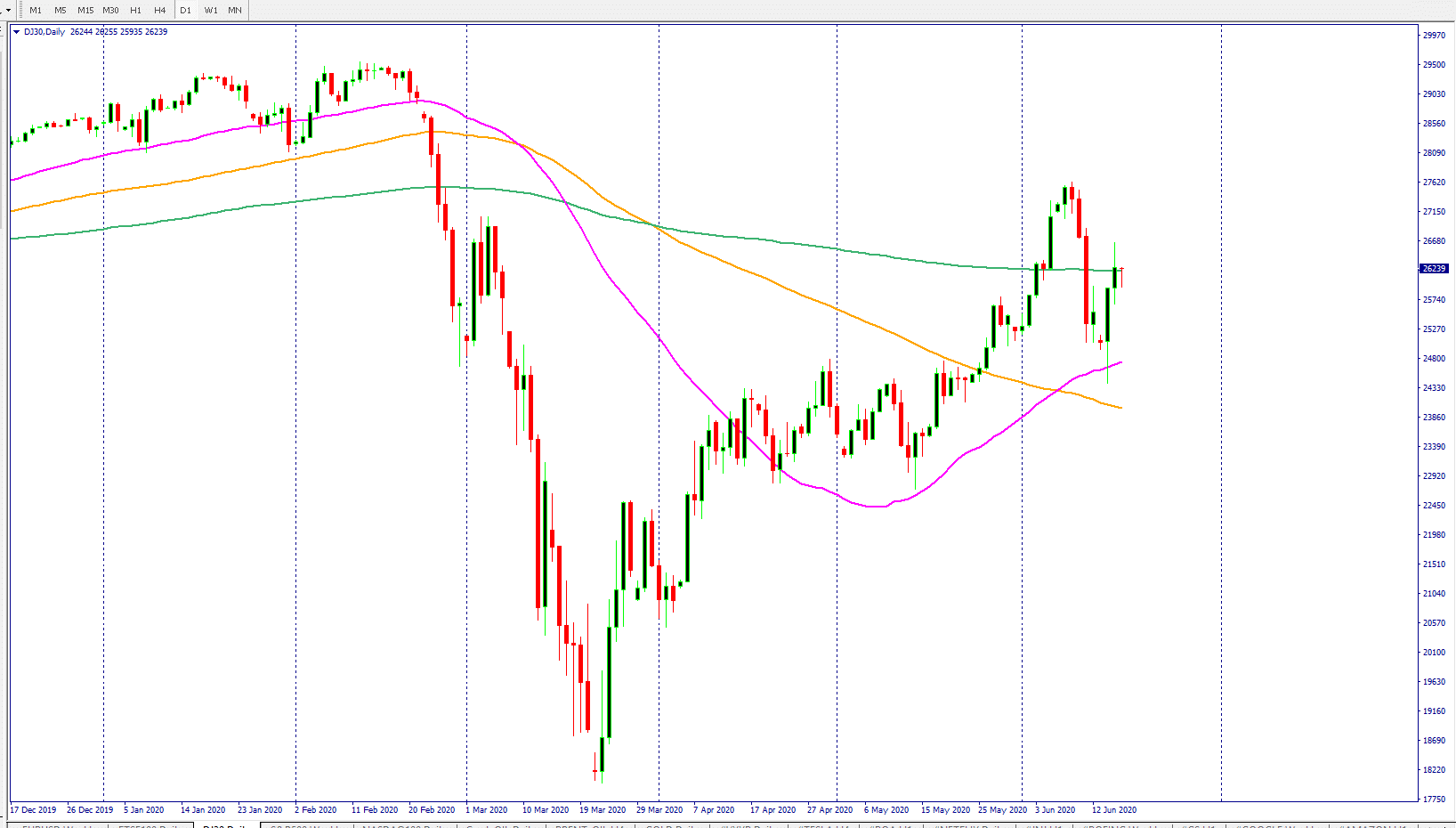

DowJones Futures Today

The Dow Jones futures are trading higher by 45 points. As I mentioned yesterday, the 200-week smooth moving average matters the most, and traders are keeping a close eye on this SMA. Yesterday’s price action did show some sign of exhaustion but that was primarily due to the news out of China. Beijing is likely to close most of its school and another lockdown is likely.

The Dow Jones futures show that the Dow price is still above the 100-Week SMA and there are still chances for the price jump above the 50-Week SMA as well. If the Dow Jones Industrial futures move above the 50-Week SMA and remain above this, it is likely for the Dow to finally recover its Coronavirus stock market losses.

The S&P500 futures are displaying more strength and there is less sign of exhaustion here. Bulls are still very much dictating the terms here. Remember, the S&P500 index is a much better representation of the overall stock market. What I mean by this is that if there is no significant sign of weakness in the price here, it is likely that the bull may try to target the all-time high.

Stock Market Rally

The S&P500 index gained 58 points or1.90% and the Dow Jones stocks jumped 526 points or up by 2.04%. These gains were mainlydue to the super US retail number that blew everyone’s mind. The US retailnumber was better than the forecast and it increased hope among investors thatthe recovery may be shaping up for the US economy.

This is an extraordinary performance but of course, traders do want this momentum to continue. It is likely that the price may continue to consolidate at the current level. The NASDAQ index was the winner again. The NASDAQ stocks helped the index to close the day with a gain of 1.90%.

Stock Market Breadth

Measuringthe market breadth is an important function as it provides a lot more detailabout the strength of the stock market rally and it also helps traders tofilter out the noise.

The S&Pstocks breadth

30% stocks trading above the 10-day smooth moving average- difference fromyesterday +19%

89% stocks trading above the 50-day smooth moving average- difference fromyesterday +7%

42% stocks trading above the 200-day smooth moving average- difference fromyesterday +3%

TheDow Jones stocks breadth

20% stocks trading above the 10-day smooth moving average- difference fromyesterday +7%

83% stocks trading above the 50-day smooth moving average- difference fromyesterday +6%

42% stocks trading above the 200-day smooth moving average- difference fromyesterday +12%

The NASDAQstocks breadth

48% stockstrading above the 100-day smooth moving average-difference from yesterday +12%

83% stocks trading above the 50-day smooth moving average-difference fromyesterday +5%

42% stocks trading above the 200-day smooth moving average- difference fromyesterday +3%

Bottomline: There has been a decent shift in favour of bullish momentum as a goodnumber of stocks have moved above their 200-day moving average.