The Dow Jones futures are roaring today as investors try their best to bag some bargains before it is too late. The news of monetary and fiscal policy support created fear of missing out (FOMO) among traders. There is no doubt that the current coronavirus stock market rally, like the financial crisis stock market rally, is fueled and supported by the Federal Reserve.

There is a lot of optimism among investors that Trump’s new $1 trillion stimulus package is what the country needs to lift the US economy from its knees and reduce its eye-watering unemployment rate. In addition to this, the recent data from the US Department of Agriculture shows that phase one of the trade deal between the US and China is well on track. However, the latest events of unrest in Hong Kong due to the Trump administration taking a tough stance against China has stalled the trade deal’s progress.

The stock market breadth, which filters noise and provides an accurate picture of the stock market rally, shows the bull momentum is back.

Hereis more on these topics:

Dow Jones FuturesToday

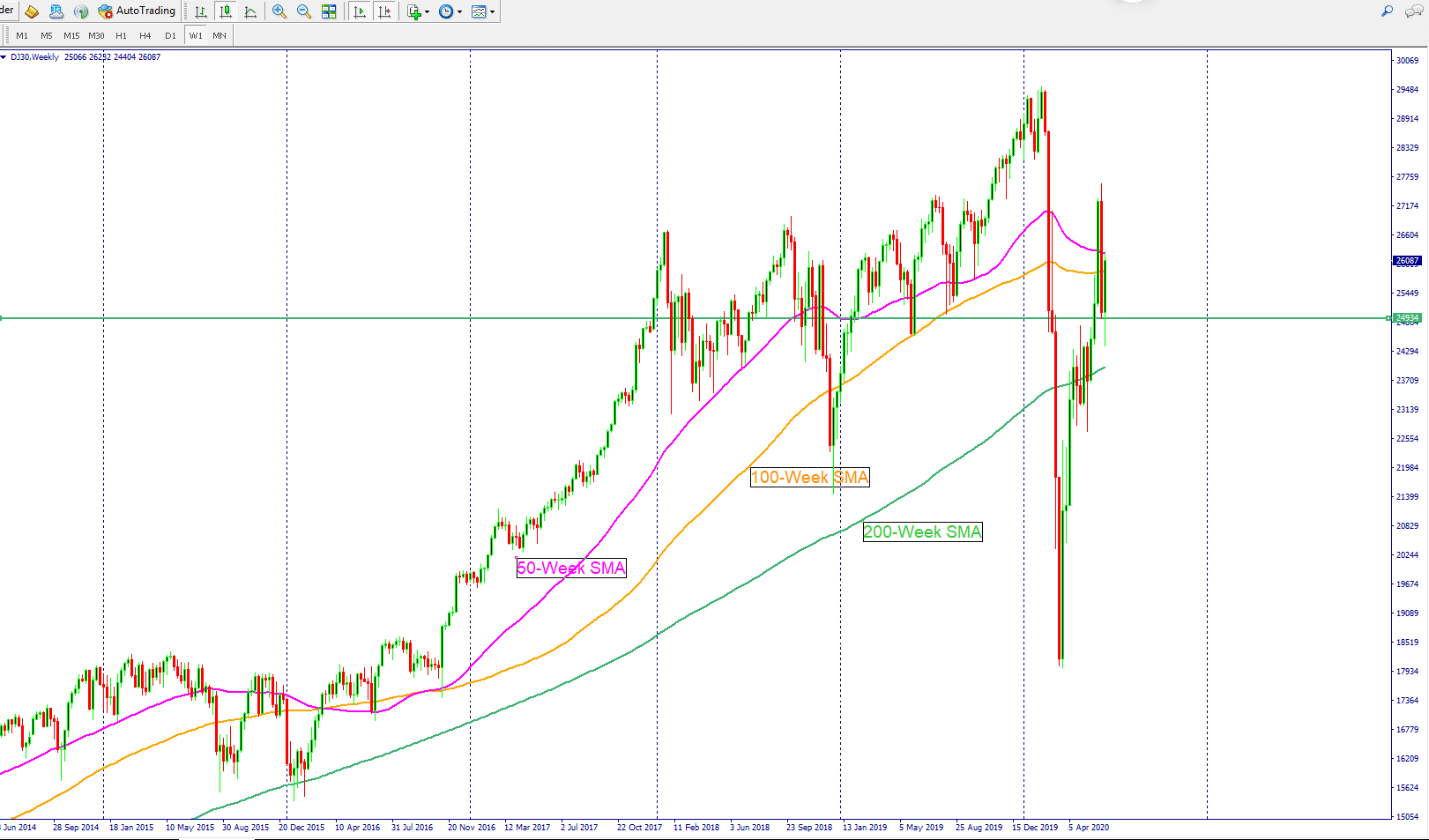

The Dow Jones futures are trading higher by 450 points. Bargain hunting is the name of the game among traders and fear of missing out is likely to get new money involved this time. As I mentioned yesterday, the 200-week smooth moving average was the focal point among investors, and given that the Dow index price remained above this moving average, it helped the Dow index to win the war against the 100-Week SMA as well. The Dow Jones futures show that the Dow price is above the 100-Week SMA, making it highly likely for the price to jump above the 50-Week SMA as well. If the Dow Jones Industrial futures move above the 50-Week SMA and remain above this level, it is likely for the Dow to recover its Coronavirus stock market losses.

The S&P500 futures also show strength. In a way, the S&P500 index is a much better representation of the overall stock market. The weekly chart confirmed that the S&P500 stocks are gaining power as the price moved back above the 50-Week SMA fairly rapidly and never dipped below its 100-Week SMA. In simple terms, the S&P500 stocks gave an early hint yesterday that the stock market rally is likely to fully recover.

See a trading opportunity? Open an account now!

Register Now Or Try Free Demo

Stock Market Rally

Thestock market rally is back in full throttle, and it ishighly likely for the S&P500 stocks to dig themselves out of the big holethat materialized due to the fear of the second wave of coronavirus. Over thecourse of several daily analysis sessions I’ve previously discussed a numberof reasons why the bear arguments are highly misplaced. The Fed isdetermined to keep this rally going, and their detailed plan yesterday aboutthe purchase of individual corporate bonds changed the momentum in the US stockmarket. In addition to this, we have more fiscal stimulus support on its way –onceall obstacles are cleared –that can propel the economy and the stock market toanother level. I will discuss this in more detail later.

For now, it isenough for the markets to continue their climb, and if we do get more positivenews on a coronavirus vaccine, it will push the sentiment further.

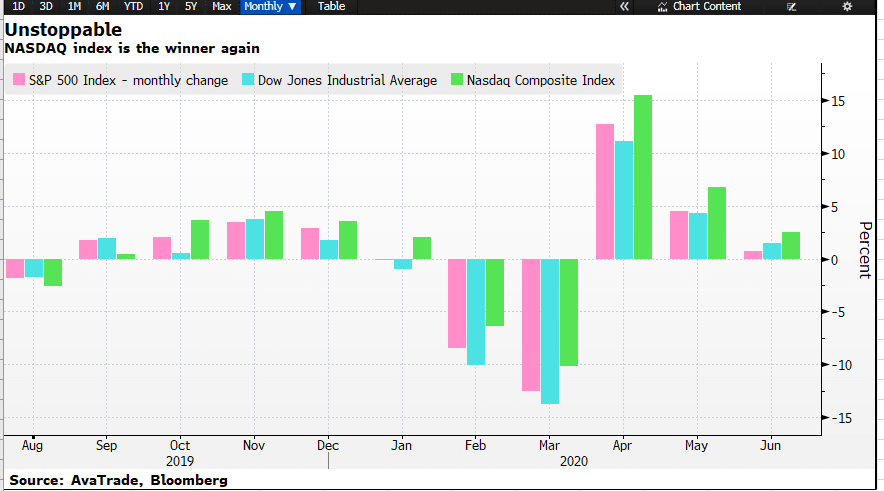

The S&P500 index soared 25 points or 0.83%, and the Dow Jones stocks scored 1577 points or up by 0.62%. This is a remarkable performance because during the early hours of trading both the S&P 500 futures and the Dow Jones futures were trading down by well over 2.50%. At one point, the Dow Jones futures were down over 900 points. So, for the Dow stocks to climb out of a hole this size shows a strong momentum among bulls. The NASDAQ index was the winner again. The NASDAQ stocks helped the index to close the day with a gain of 1.17%.

The below chartalso shows that the NASDAQ index is once again in the lead.

StockMarket Breadth

Measuring the market breadth is an essentialfunction as it provides a lot more detail about the strength of the stockmarket rally, and it also helps traders to filter out noise.

The S&P stocks breadth

11% stocks trading above the 10-day smooth moving average- difference fromyesterday +5%

82% stocks trading above the 50-day smooth moving average- difference fromyesterday +1%

39% stocks trading above the 200-day smooth moving average- difference fromyesterday +3%

The Dow Jones stocksbreadth

7% stocks trading above the 10-day smooth moving average- difference fromyesterday -3%

67% stocks trading above the 50-day smooth moving average- difference fromyesterday +0%

30% stocks trading above the 200-day smooth moving average- difference fromyesterday +3%

The NASDAQ stocks breadth

36% stocks trading above the 100-day smooth moving average-difference from yesterday +11%

78% stocks trading above the 50-day smooth moving average-difference fromyesterday +3%

39% stocks trading above the 200-day smooth moving average- difference fromyesterday +2%

Bottom line: There has been a decentshift in favour of bullish momentum as a good number of stocks have moved abovetheir 200-day moving average.

Coronavirus CasesSpike

Greece opened upits tourism after tackling the pandemic, while the death toll increases inBrasil. China remain concerned about the possibility of an outbreak of thesecond wave of coronavirus in the Beijing market. But it is places like Yementhat are facing the biggest humanitarian crisis because of the lack of medical careand an inability to control the disease spread.

Trump News: $1 Trillion Infrastructure

In Trump news, the US president, Donald Trump, has always spoken of improving the country’s infrastructure. What better time could there be for doing that than now, when the economy is on its knees, and unemployment is through the roof? More importantly, US elections are just around the corner. The Trump administration’s move to enact a $1 trillion infrastructure proposal is likely to pass all the hurdles.

If it becomes a reality, it could change the course of the economy and raise Trump’s chances for re-election. Most of the money would be reserved for the Department of Transportation, and they are also preparing the preliminary version of this stimulus bill. Money is likely to be spent on bridges, roads, and of course, on the development of 5G wireless networks in rural areas.

China News: the US and China Trade Deal

China is not only keeping to the terms of its trade agreement with the US, but according to recent figures, the country has even gone beyond them. When Trump anchored tension between Beijing and Washington over the new national security law in Hong Kong, the biggest fear for the markets was that the US and China trade deal might become dead in the water.

Instead, China has sharply increased its purchase of US agricultural products. China has expanded its import of soybeans in 2020 by 85%, wheat by 1208%, and pork by 339%. All of this confirms that phase one of the US and China trade deal is working well, and this reduces the tail risk for the US stock market rally.