The Dow Jones futures are trading lower as investors have genuine qualms about the spike in coronavirus cases in the US. I am skeptical of calling the current spike in coronavirus cases in the US as a second wave because the situation was never under control there, and the civil unrest triggered by Trump’s tweet may have just made the existing situation worse. We do not have any strong evidence for a second coronavirus wave appearing in countries that have opened up after initially controlling the virus.

Additionally, the stock market rally was hoping for a hug from the Federal Reserve, but the lack of the Fed’s confidence in the US economic recovery is also impacting the S&P500 futures and the risk-on sentiment. However, the Federal Reserve is set to keep the interest at a lower rate for longer, which triggered a massive rally in safe-haven assets. Basically, the stock market rally is like a child who wakes up crying and wants the Fed to soothe it.

The market breadth of the S&P500 still seems to suggest that the bull drive hasn’t lost momentum. We have seen bulls returning to the commodity trading space; specifically gold, which surged massively yesterday on the back of the Federal Reserve’s promise to keep the interest lower for longer. However, the gold price seems to have given up some of those gains today, although this can change as trading progresses.

Here is more detail on these topics:

Dow Jones Futures Today

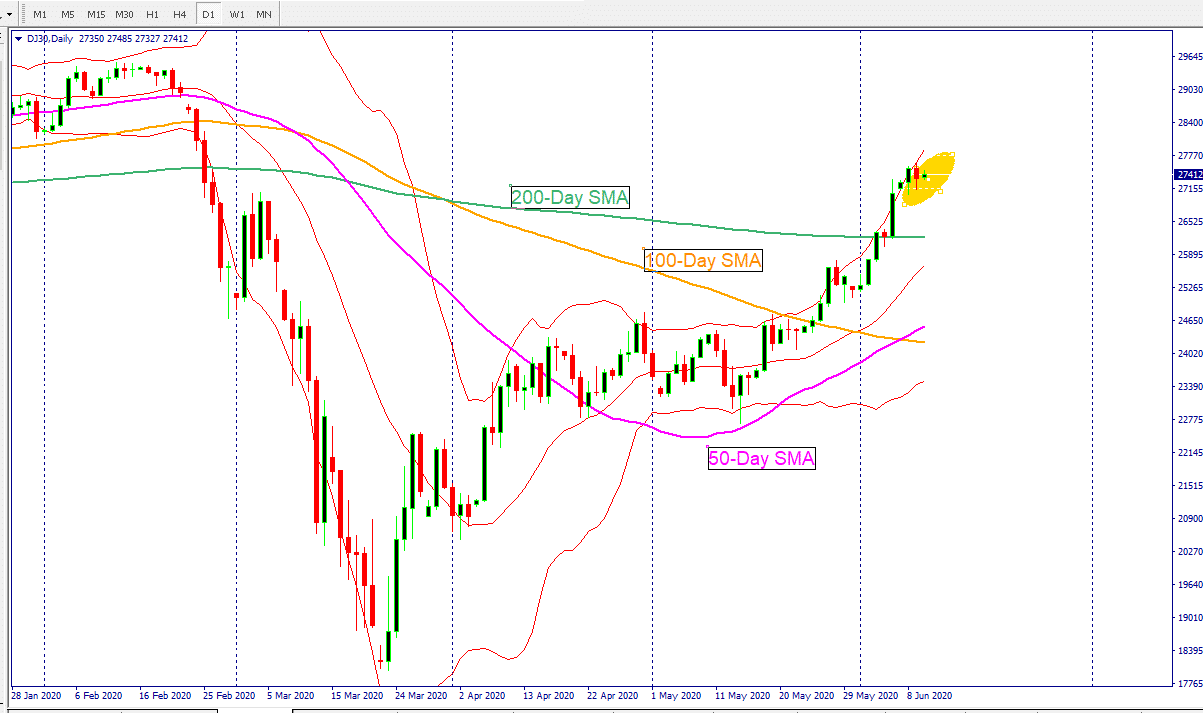

The Dow Jones futures are trading sharply lower by 500 points as the Dow index stocks are still retracing from their recent rally. The Dow chart below shows that the Dow Jones price has moved away from the upper level of the Bollinger band—a level that usually triggers retracement—and is moving towards its mean, which is the 20-day moving average.

I do not think that the current sell-off is anything more than just profit-taking because the Dow Jones industrial average is still trading above the important 50, 100, and 200-day moving averages.

The Dow Jones is likely to bounce from its 200-day moving, but if it fails to stay above the 200-day moving average, it would mean that the bulls are losing some control of the price.

Stock Market Rally

The stock market rally is taking a beating, and investors are eagerly taking profit off the table. The current sell-off for the Dow Jones and S&P 500 stocks does not come as a major surprise as I mentioned two key factors ahead of this sell-off during the past two days.

The S&P500 index closed lower by 0.53% and the Dow Jones industrial average fell 1.04% yesterday. Once again, it was the energy sector that led the losses for the S&P 500 stocks, and apart from the Information technology sector, all other sectors closed lower. The financial and industrial sectors plunged by 3.74% and 2.38%, respectively.

Federal Reserve Chairman Jerome Powell’s statements on the central bank’s interest rate and monetary policy were taken by the markets as ultra-dovish comments. This is mainly because he phrased it as the Fed is not even “thinking of thinking increasing the interest rate hike”. This shows that the lower interest rates are here to stay indefinitely.

The tech index, NASDAQ, closed above the 10,00 mark for the first time yesterday and scored gains of 1.20%.

Stock Market Breadth

Measuring market breadth is an importantfunction as it provides a lot more detail about the strength of the stockmarket rally and also helps traders to filter out the noise.

Key takeaway: more stocks have fallen below their 200-day moving average across all major indices

The S&P stocks breadth

70% stocks trading above the 10-day smooth moving average- difference fromyesterday -17%

96% stocks trading above the 50-day smooth moving average- difference fromyesterday -1%

49% stocks trading above the 200-day smooth moving average- difference fromyesterday -5%

The Dow Jones stocks breadth

90% stocks trading above the 10-day smooth moving average- difference fromyesterday 0%

93% stocks trading above the 50-day smooth moving average- difference fromyesterday 3%

43% stocks trading above the 200-day smooth moving average- difference fromyesterday -10%

The NASDAQ stocks breadth

66% stocks trading above the 100-day smooth moving average-difference from yesterday -12%

88% stocks trading above the 50-day smooth moving average-difference fromyesterday +4%

44% stocks trading above the 200-day smooth moving average- difference from yesterday -4%

Coronavirus Cases Spike

Coronavirus cases have surged in the US, and the situation looks even direr in Texas. There are concerns that a second wave is coming as the economy begins to open. The recent civil unrest over the death of George Floyd may also have some part in this.

This also raises questions of whether these numbers are going to shoot up even more as the US elections are just around the corner, and it seems like Trump administration is ready to kickstart mass rallies. If and when these mass rallies begin, they are likely to push up the coronavirus cases. At least this is the preliminary conclusion by some experts in the light of riots happening in the US and the re-opening of the economy. The chief scientist in the US continues to warn that we still have a long way to go.

The fact is that there is a serious question mark in labeling the current spike in coronavirus cases as the second wave because the US never got the situation under control before it began to open up the economy.

A large majority of coronavirus cases were from New York, and this state did do a great job in controlling it. However, the rest of the country failed to get things under control resulting in the current situation.

We have not seen any strong signs of a second wave in those countries that have done a good job in infection control. So, it may not be wrong to relabel the current coronavirus spike in the US as an uncontrolled spike.

Total cases of coronavirus in the US are now 2 million according to the John Hopkins University data. Nearly 2,052 new cases have emerged in Texas and this is the highest one-day spike since the pandemic started. In California, the hospitalization rate has also surged to its highest level since May.

The WHO has also warned that a persistent increase in the coronavirus infection rate in Latin America is a deep concern.

US Weekly Jobless Claims Data

After the jaw-dropping US unemployment rate released last week, traders are going to dissect the weekly jobless claims data more intensively. So far, the continuous claims data is likely to become cumbersome for the US policy officials because if we do see this number keep increasing or staying at current levels for longer, it would mean more pain ahead for the US stock market and for the Trump administration. Today’s forecast is for 2 million, a small drop from the previous number of 2.1 million. As for the initial jobless claims, the forecast is for 1550K, again a small improvement against the last week’s reading of 1877K.

If the overall message from this data shows that we have seen the bottom and things are likely to improve, then we could see improvement in the Dow Jones industrial average and the S&P 500, which have both been beaten down during the past two days.