The Dow Jones futures are trading higher today after traders caught their breath from the coronavirus stock market rally that added $21 trillion to global stock markets.

The S&P 500 futures are also indicating that traders are ready to dig the index out of its black hole, which occurred yesterday when the index turned negative for this year.

Although rigorous price action is likely as the Federal Reserve comes out with their monetary policy decision, it is not a definite. Market expectations are that the Fed will maintain their dovish stance and that is likely to push the US stock market rally higher.

New Zealand officially becomes coronavirus free and this is an encouraging sign. Trump continues to fuel tensions not only within the US but also outside America as well, such as when he speculated that the protestor injured in Buffalo could be Antifa. Michael Pompeo, the US Secretary of State blasted HSBC for supporting China over the new national security law in Hong Kong.

Here ismore on these topics:

Dow Jones Futures Today

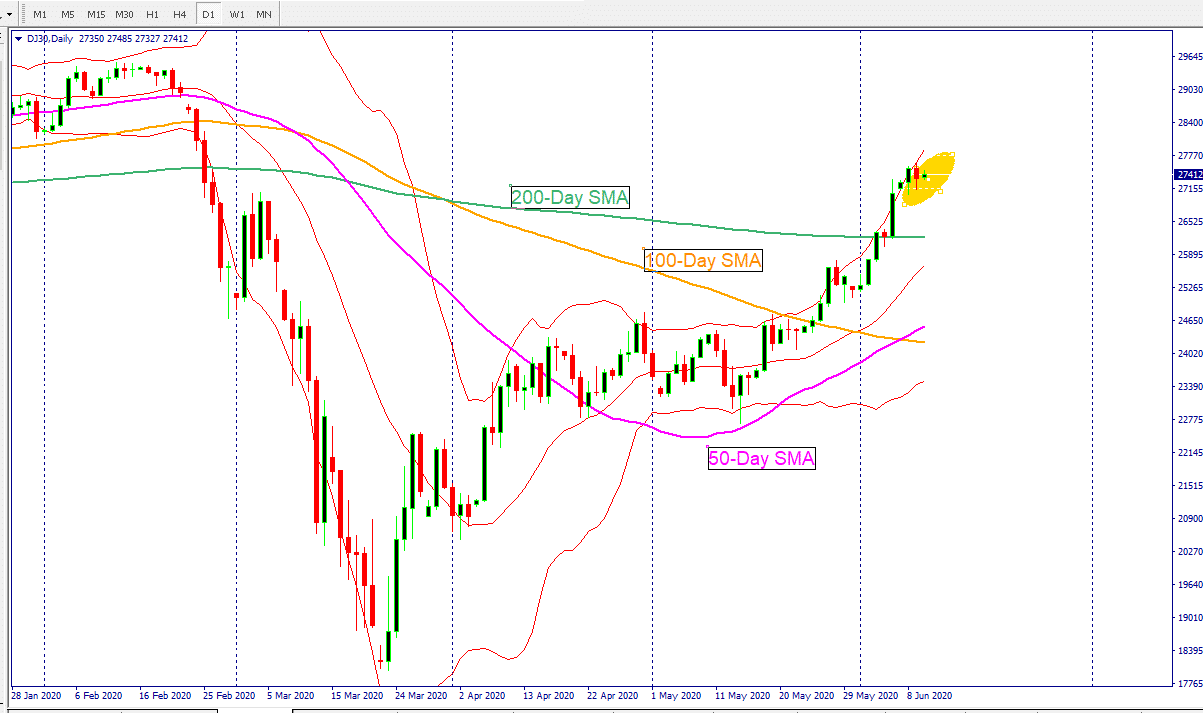

The Dow Jones futures are trading higher and the Dow industrial average chart below shows that the Dow is done with its correction. The Dow Jones industrial average is set to resume its upward journey.

The Dow briefly pierced the upper level of the Bollinger Band, an indication that signals that a minor retracement may be due. However, this is no longer the case, and the Dow Jones index is back within the Bollinger Bands.

Once again, the bulls are confident that there is nothing to worry about in terms of the bull momentum because the price is trading above the three critical smooth moving averages. These are 50, 100, and 200-day smooth moving averages. One of the biggest signs for the Dow comes from the 50-day smooth average which has crossed above the 100-day smooth moving average, and this means that this bull market still has a lot more room to run.

Stock Market Rally

The stockmarket rally snapped its winning streak yesterday, but the important takeaway isthat the S&P 500 stocks pared some of its losses near the close of thestock market. The S&P 500 futures are trading higher today and there is anindication that the S&P 500 index may recover its losses today.

The S&P500 stocks closed with a loss of 25 points or 0.78% and the Dow Jones dropped by 300 points or 1.09%. The losses were mainly led by the energy sector as 7 of 9 sectors fell yesterday. The S&P500 index is 5.49% below this year’s 52-week high on Feb 19 and the coronavirus stock market rally has pushed the S&P 500 stocks 46.3% above from its coronavirus crash point.

Speculatorsdo believe that the current stock rally was too fast and aggressive, and it islikely that the stock market rally may begin to consolidate. But I think thereis still more juice left in this rally. The reasoning is that this rally ismassively stimulated by the Fed. If we have learned anything from the financialcrisis crash, it is this that when fighting the Fed the chances are high forbrutal bruises.

The NASDAQ, the tech-savvy index, crossed a psychological level of 10,000 and briefly traded above this point yesterday. The NASDAQ index was the only index that closed in the green among the US indices as investors continued to pour their money into tech stocks.

The rally for the NASDAQ index was mainly pushed by Apple and Amazon. I think Apple’s shift to its own main processors in Mac computers as announced by the company is a game-changing event in terms of their margin. The NASDAQ 100 stocks closed with a gain of 65 points or 0.66%.

Investors may need tread cautiously in their approach because of recent CFTC data. Based mostly on speculative bets and a week lagging data, the CFTC shows that net short bets are at their highest level since 2015 although we have seen some decrease in short bets in the past week. Traders take short bets when they believe that the market is overvalued and likely to fall. However, if they are proven wrong, capitulation also takes place, usually leading to a mammoth rally in the stock market.

Stock Market Breadth

Measuring the market breadth is an important function as it provides a lot more detail about the strength of the stock market rally and also helps traders to filter out noise.

The S&P stocks breadth

87% stocks trading above the 100-day smooth moving average

97% stocks trading above the 50-day smooth moving average

54% stocks trading above the 200-day smooth moving average

The Dow Jones stocks breadth

90% stocks trading above the 100-day smooth moving average

90% stocks trading above the 50-day smooth moving average

53% stocks trading above the 200-day smooth moving average

The NASDAQ stocks breadth

78% stocks trading above the 100-day smooth moving average

89% stocks trading above the 50-day smooth moving average

47% stocks trading above the 200-day smooth moving average

Coronavirus: Hugs and Handshakes are back

New Zealandhas fully opened its economy without any restrictions after the country pushed itscoronavirus cases to zero. People in the country can be outside and go to publicplaces such as movie theaters. Prime Minister Jacinda Arden says she isconfident that the spread has been halted in the country. However, theborder remains shut to everyone except citizens and residents and individualswho enter the country still need to self-quarantine.

Trump News: Pompeo Blasts HSBC

In Trumpnews, the US president failed to improve the situation as the country continuessuffering from civil unrest over the death of George Floyd. A 75-year-oldprotestor was injured in Buffalo, New York on June 4th and remainsin critical tension. President Trump said he appears to be an Antifa“provocateur”.

TheUS-China tensions are likely to degrade further after Michael Pompeo, the USSecretary of State, blasted HSBC to support the Chinese narrative on newsecurity law in Hong Kong. Previously, Trump has also publicly criticizedthis new security law and imposed sanctions on China. The Chinese officialshave not immediately replied to Pompeo’s comments, but it is only a matter oftime before we hear another warning for Trump administration to not interferein– what China calls– domestic issues.

Fed Decision: US Growth and Employment

The FederalReserve’s rate decision is the main event for traders, and it will be takingplace later today. The Fed is expected to keep the Fed Fund rate at its currentlevel, 0.25%, and there is no expectation of any new supportive measures aswell. The Fed is likely to utilize this event to provide more information on differentlending plans.

Growth and employment targets from this event are likely to move the stocks, currencies, bonds, and commodities. This will be the first time that the central banks will be making the announcement on this and the path of their future monetary policy will be measured by these metrics. In other words, this is going to be the yardstick for the Fed to gauge the impact of their current monetary policy.