The Dow Jones futures are trading modesty lower as investors continue to reward the stock market. The rally is heavily based on the optimism surrounding the reopening of the global economy as more and more countries ease their coronavirus restrictions.

Despite the Minneapolis Police Department incident, Donald Trump isn’t ready to support ending local police forces, although he is calling for gentler police action. Although no one seems to know the details of how he suggests they accomplish this.

Trump begins his re-election campaign as his approval rating begins to plummet due to the mishandling of George Floyd’s tragic death in police custody. The World Bank has given a somber outlook concerning global growth, and both scenarios do not paint an optimistic picture.

Let’s review these issues in more depth:

Dow Jones Futures Today

The Dow Jones futures are trading slightly lower today, and the Dow chart below shows that the index may be due for a small correction, as the price has pierced the Bollinger band’s upper level. This indicates that the stock rally has been too aggressive. However, the upward momentum is still strong because the price is still above all the major, 50, 100, and 200-day smooth moving averages.

Stock Market Rally

The stock market rally continued yesterday, and the S&P500 stocks reclaimed their coronavirus losses. The S&P500 stocks closed with a gain of 1.20% while the Dow index soared 1.70%. Yesterday’s rally was led mainly by real estate stocks, but with all nine sectors of the index contributing.

This all comes at a time when speculators continue to view the current stock market rally as the market’s most unloved, but in reality, it doesn’t make a difference. The only thing that matters is that stocks have recovered their losses, and the only target left for the S&P500 index is to touch its record high.

There is an ample amount of cash sitting on the sidelines and an enormous fear of missing out simmering among investors. One can only imagine the performance of the index once that cash is deployed. Although this remains a separate question: stocks may be overvalued based on earning basis, but since the economy has started to reopen, this argument loses its weight.

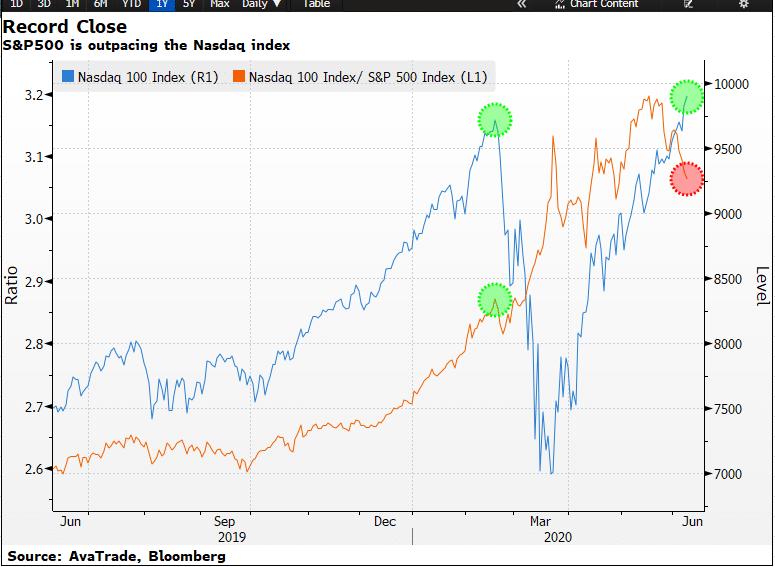

The NASDAQ, the tech index, closed at a record high yesterday with a gain of 0.79%. This may look immensely encouraging at the outset, but the index’s performance looks lackluster when we compare it to the broader S&P500 stock rally. The S&P500 index and the NASDAQ index (in the below chart) show that the ratio of the NASDAQ to the S&P500 has dropped during the current coronavirus stock market rally.

This wasn’t the case before the coronavirus stock crash as both indices were enjoying the same rate of gains. Having said this, it is crucial to keep in mind that the recovery was much faster for the NASDAQ from its coronavirus crash, and additionally, the sell-off was a lot less brutal than for the Dow Jones industrial average and the S&P500 stocks.

The chart below shows the NASDAQ index performance on the right-hand side and the ratio for the NASDAQ 100 stocks to S&P500 stocks on the left-hand side.

Coronavirus: No New Deaths

Investors are cheering the news that the coronavirus situation has improved in two of the market’s most important cities. London reported no-new deaths that are related to coronavirus. This is an encouraging sign as the British Prime Minister is set to announce the easing of measures concerning the lockdown today. The infection rate in New York has fallen to its lowest level as life starts to return to the city. Still, things are not rosy everywhere because the infection rate has surged above the key threshold of 1.0 in Germany.

Trump News: Re-election Campaign Begins and Police Reform

In Trump news, Donald Trump, the US president, is expected to resume his re-election campaign today, and he is likely to take credit for saving lives because of the lockdown. According to one study, nearly half a billion lives may have been saved due to global lockdown measures.

Trump is also likely to continue to take credit for the strong position of the US economy as compared to the rest of the world. He may point to the performance of the US stock market and a falling unemployment rate in the US to support this claim.

The funeral commemorating George Floyd’s death may have marked the peak of the civil unrest in the US, and we could see some semblance of normality on the streets as Trump has floated the idea of gentler police tactics. Although no details are forthcoming from Trump or his administration on the specific nature of these proposed tactics. The White House has rejected the police reform bill that has been introduced by congressional Democrats.

In the upcoming elections, Trump’s opponent, former Vice-president Joe Biden, has increased his lead during the past few days due to the complete chaos that occurred after Trump’s tweet regarding the protests over the killing of a Black man, George Floyd, while in police custody.

World Bank Triggers More Pessimism

The World Bank has warned that the global economy is likely to face its worst contraction since World War II due to Covid-19. It expects output to shrink for the first time in nearly six decades, which will impact income and spending. The Bank’s forecast is for the global economy to shrink 5.2% this year, with developing economies shrinking by 2.5%.

The World Bank has projected two main scenarios: one in which the pandemic causes another lockdown, thus sparking a contraction of the world economy by 8%. The other scenario would take place if social distancing and lockdowns keep the disease under control, which may contract the global economy by only 4%. Both scenarios do nothing to lift the market sentiment.