The Dow Jones futures are bouncing between losses and gains a day after the Dow scored another stellar rally. Investors are largely insulated from the on-going riots and looting in the streets of the U.S. and they are more enthusiastic about reopening the economy. The unprecedented levels of stimulus and hope of more possible support are fueling the coronavirus stock market rally.

The European Central bank is expected to announce another bazooka today in terms of extra stimulus but there is no hope of interest rates moving any lower as they are already sitting below zero.

The US ADP economic data confirmed that the worst may be over for the US labour market and Americans may have good days ahead if Trump can unite the nation. It is the weekly jobless claims data that it is going to influence the Dow Jones stock price today.

Dow Jones Futures Today

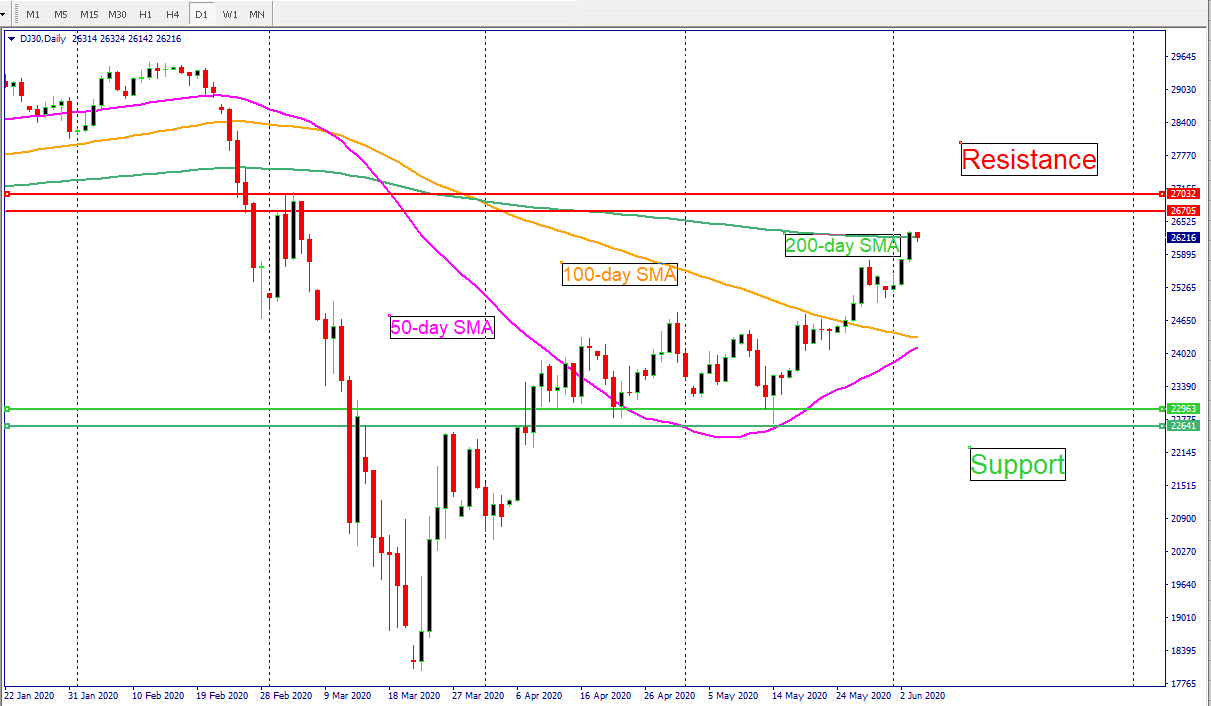

The Dow Jones futures are trading flat today, but the Dow chart below shows that the index is not only holding on to its momentum, but it is also playing a catch-up game.

The Dow Jones stocks have been lagging in terms of the coronavirus stock market rally. The Nasdaq index has been the strongest out of the three major indices, with the S&P500 stocks holding on to the second spot in terms of Coronavirus rally and the Dow index in the weakest position. The chart below shows the relative percentage performance for DJIA and S&P500 futures.

Stock Market Rally

The stockmarket rally continued yesterday as investors continued to bet on the reopeningof the U.S. economy. The Dow Jones industrial average gained 527 points and theDow Index closed with a gain of 2.05%. Wall Street also pushed the S&P500stocks higher by 1.36%. The NASDAQ index challenged its all-time high yesterdaydespite continued civil unrest on the streets of the U.S., with the tech-savvyindex closing with a jump of 0.49%.

Trump News: 1807 Insurrection Act & Chinese Airline

In Trumpnews, Donald Trump, the U.S. president, was blasted by his former employeeyesterday over his aggressive use of the U.S. military to crush protests. Usingstrong language, Ex-Defense Secretary Jim Mattis said Trump has mocked thesystem and the Constitution. He was displeased with the president’s mismanagedphoto op and his approach to national unity. The unrest in the country began afterthe death of an unarmed black man, George Floyd, while under police custody.

AlthoughTrump used to be his boss, the former Defense Secretary does not seem to respectthe president’s leadership. Additionally,none of the state governors seem to be on board with using the military toquell the civil unrest. Given these facts, Trump is likely to face morepressure against the use of the 1807 Insurrection Act that White Houseofficials mentioned yesterday.

While shootings and scenes of looting continued on the streets of the US, so far stock futures have paid little to no attention. Many Americans are unconcerned about curfews, such as the Brooklyn protestors who marched towards Manhattan as the sun set yesterday. Police prohibited their entry while the Pentagon continued to push troops on the streets of Washington, DC.

Trumpbarred Chinese airlines from entering the U.S. and further anchored tensionswith China. However, the response was mainly a retaliatory act because U.S.airlines’ request was ignored to resume their flights to China

Jobless Claims

Ahead ofthe US NFP data due tomorrow, the weekly jobless claims economic number is thelast piece of the puzzle needed to provide more information about the health ofthe US labour force. The weekly jobless claims number shows that the worst may be alreadyover, and Trump is likely to take the credit for this tomorrow if the US NFPnumber echoes the same message. The forecast for the unemployment claims datais for 1820K while the previous reading was 2123K.

ECB Meeting & Stimulus

Today is the European Central Bank (ECB) meeting day. In its meeting later today, the ECB is expected to expand its stimulus program with an additional 500 billion euros of asset purchases.

The ECB isn’t expected to change its ultra-low interest level, but anything less than the widely anticipated stimulus package could send shockwaves in the European stock market.

ECB president Christine Lagarde needs to craft her tone and words are carefully so that she can calm the peripheral bond markets.

Thecoronavirus lockdown measures in the European countries are being eased off, butthe situation is far from being normal and it is likely to remain that way forsome period of time. Therefore, the ECB doesn’t have the choice regardingwhether to delay the stimulus package any further.