Riots, Looting and Protest in U.S. Over George Floyd’s Video

Dow Jones futures are trading higher despite the on-going riots and looting in America. Several places like Minneapolis, Chicago, San Diego, California, Washington have been in the news because of local reaction to the video that showed the killing of George Floyd.

Business owners are trying their best to protect their property while remaining unsure whether riot damage is covered by insurance. One thing that is certain is that the riots are illegal, and Trump is pushing for the National Guard to restore order, but it seems like things are getting out of control.

National Guard, Curfew and Threat for US Equity Markets

There is also a notion that Americans are angry because of higher unemployment triggered by the coronavirus. Some believe that while the George Floyd video is a catalyst, the actual reason for the civil uprisings is the lack of jobs and the unfair system of enforced unemployment.

Speaking of Covid-19, the on-going riots in many of the US states also bring into question if coronavirus cases will rise due to the riots. Social distance measures aren’t being respected in these places, and if these rules aren’t followed, the likelihood of virus cases shooting up in the US is much stronger.

The fact is that if the social unrest isn’t addressed it can prolong the recovery process in the U.S. The Federal Reserve has worked hard to restore confidence in the US equity markets and if investors continue to see National Guards and threats of curfew, it would hurt their confidence level.

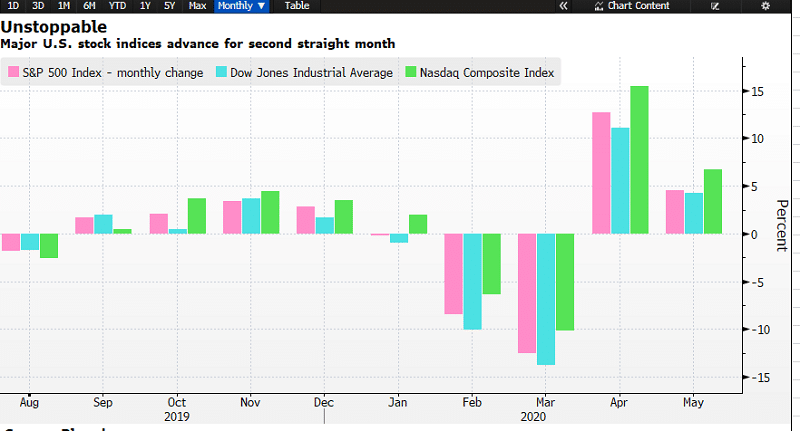

So far, the three major indices, the S&P500, the Dow Jones, and the Nasdaq have performed exceptionally well since their Covid-19 lows. The chart below shows that the U.S. equity markets have posted two consecutive months of gains.

OPEC+ To Discuss Oil Supply Cut Extension

OPEC+ is set to discuss the possibility of an oil supply cut extension. The cartel is considering whether to meet earlier than expected and bring forward its meeting by a few days to Jun 4. It was the current oil production cuts that helped oil prices recover from their 2020’s oil price crash.

The current proposal is to extend the production by at least one month and for a maximum of three months. If agreed, the move can further strengthen the WTI crude oil price and Brent oil prices.

The WTI crude oil price has already jumped above $35, but slid back today by a small percentage. The Brent price has surged to $37, but it is now down again by 0.21%

Trump Avoided Tough Sanctions on China

Hong Kong’s stock market rallied today as investors expressed relief that President Trump refrained from announcing tough sanctions on China over a new national security law for Hong Kong imposed by Beijing.

He did promise some direct and indirect sanctions against Chinese and Hong Kong officials responsible for eroding Hong Kong’s autonomy but went short of identifying individuals.

The key takeaway is that Trump’s news conference on Hong Kong’s security law didn’t escalate affairs further between the two superpowers and this is positive for the risk-on sentiment. Had he escalated the tensions between the U.S. and China it would have put the US-China trade deal in jeopardy. This would have also threatened the recovery in both countries—the single biggest threat for the stock markets.

Asdiscussed last week, Trump’s response on Friday was nothing but a slap on thewrist. Trump wants to project himself as tough ahead of the U.S. elections byshowing that he is not afraid of China, but he also knows the importance of theU.S. China trade deal that took nearly a year to execute.

Hong Kong’s Unrest and Hang Seng’s Biggest Jump

The Asian index, the Hang Seng jumped 3.4% today, the biggest one-day percentage gain since late March, as investors rushed to bag some bargains because the index was beaten badly last week due to the fear of tough U.S. sanctions on China. The Shanghai stock index and the South Korean KOSPI index also surged on the back of this optimism.

Coronavirus and Chinese Economic Data

China continues to report an ongoing recovery from Coronavirus, causing speculators to keep asking if the coronavirus numbers coming from China are real? The economic data confirms that the Chinese economy has started to recover from Coronavirus.

The Chinese Caixin manufacturing PMI data released today supported that this economic reading is back into expansion territory. The reading came in at 50.7 against the forecast of 49.7. A number below 50 points to contraction and numbers above point to expansion. Yesterday’s manufacturing PMI was also above 50, with a reading of 50.6, but this was a little short against the forecast of 51.1.