Gold is known as the safe-haven assets and whenever we see a meltdown in the equity markets or prospects of loose monetary policy, its price starts to shoot up.

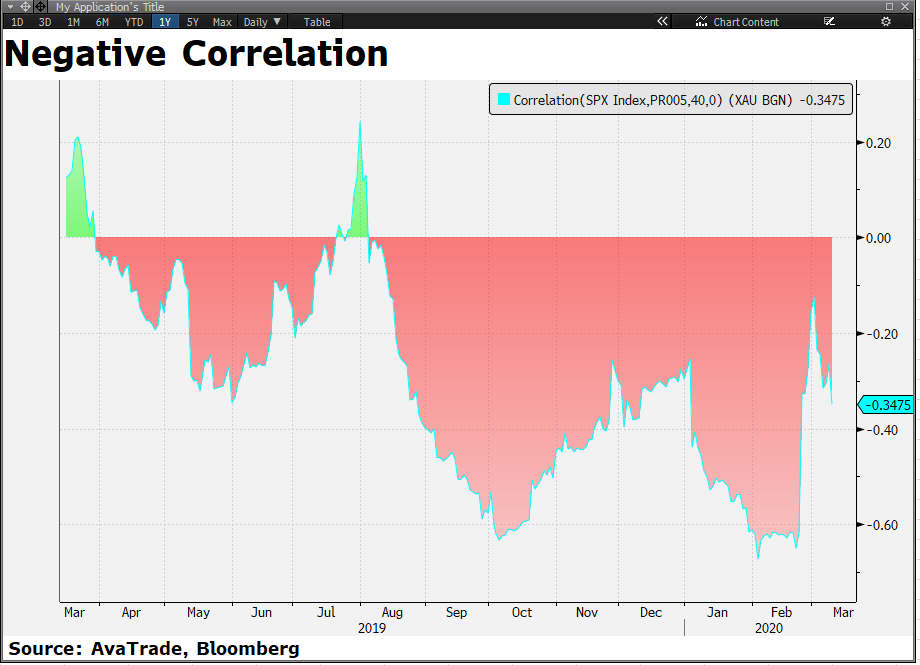

Currently, the gold price has a strong negative correlation with the equity markets meaning when the equity markets fall we see investors pouring money into gold and vice versa.

The fact is that the current wave of short selling in the global equity markets is only just starting; there is a lot more to come. After all, the economic weakness isn’t yet fully baked into the economic data let alone the earnings data. Thus, there is no better time to buy gold than now .

Why?

First of all the equity markets are in major turmoil; a one day 1000 point move in the Dow Jones index has become a norm. Secondly, the Federal Reserve has been pushed into a corner due to the Coronavirus situation. It is being forced to keep its monetary policy on the dovish side.

The Fed has already cut the interest rate by 50 basis points only a couple of weeks back and yet the market expectations are for a further rate cut. I discuss this in detail below.

Gold which is up nearly 10% year-to-date is likely to chalk up some further serious gains in the coming weeks. The reason for this is that we have a situation where, with governments already trying to provide support to fiscal policy, monetary policy itself isn’t enough to calm the markets as well.

For instance, Donald Trump has pitched the idea of no payroll tax for this year in order to soften the blow of Coronavirus. So far, we have not seen a green flag for this idea, which one of the reasons why investors are still nervous.

Donald Trump may likely successfully achieve some of his goals but it will probably prove insufficient because the economic damage he is trying to deal with is simply too great and the reality is that it is still growing because the Coronavius situation is still nowhere close to being under control.

Going back to the monetary policy and why there is some serious potential for the gold price to increase in the coming week is because traders and Wall Street are expecting more interest rate cuts from the Fed during their meeting next week.

An interest rate cut of 50 basis points is the minimum that investors are expecting and bigger banks like Goldman Sachs and JP Morgan are both expecting a cut between 75 basis points and a full percentage point.

The fact that Gold is currently tradingnear $1,661 suggests that an interest rate cut isn’t priced in at all. If itwas then the price should have been trading much higher.

The Play

If the Fed cut the interest rate by 50basis points, this should push the gold price above 1700 again and anythingmore than 50 basis points and especially a whole percentage point could pumpthe price to 1750 or even higher.

The Flow

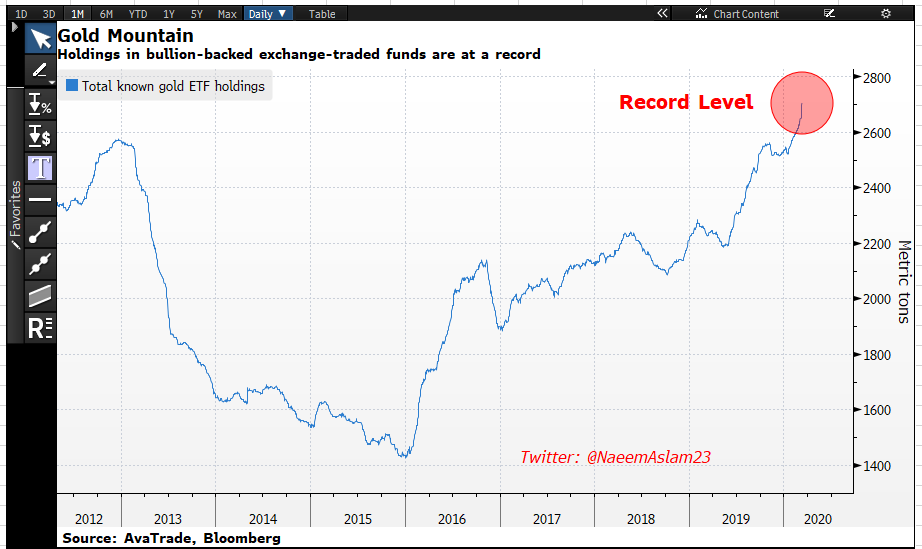

If we look at the total gold ETF holding data, it follows and supports our thesis that the gold price is highly likely to move higher because the total holding in ETFs is sitting at a record level and the inflow just keeps on rising.

It appears that investors are discounting the current weakness in the price and taking this as an opportunity to buy more.

The Bottom Line

I think that the current retracement in the gold price presents an enormous opportunity for traders to get back in the game or add to their position.

This is what institutions are doing giving a further impetus to the price. If for some reason the Fed doesn’t cut the interest rates at the forthcoming meeting, it would only create more panic in the equity markets which would be a further positive sign for the gold price.