This period of market calm could come to an abrupt end next week. A long list of high-risk events is likely to see volatility return with a vengeance and keep investors well-occupied.

A long list of high-risk events ranging from interest-rate decision at the Federal Reserve (Fed), European Central Bank (ECB), Bank of Japan (BoJ) to top-tier data from major economies will be in focus.

But before we discuss what asset to keep an eye on amid the expected volatility, here is a list of key economic releases and events for the coming week:

Monday, June 12

- JPY: Japan May PPI

Tuesday, June 13

- AUD: June Consumer confidence

- EUR: Germany CPI, ZEW survey expectations

- GBP: UK jobless claims, unemployment

- OIL: OPEC monthly oil market report

- USD: US May CPI

Wednesday, June 14

- EUR: Eurozone industrial production

- GBP: UK monthly GDP, industrial production

- USD: Fed rate decision, PPI

Thursday, June 15

- CNY: China retail sales, industrial production

- AUD: Australia unemployment

- CAD: Canada housing starts, existing home sales

- EUR: ECB rate decision

- USD: US initial jobless claims, retail sales, empire manufacturing

Friday, June 16

- JPY: BoJ rate decision

- EUR: Eurozone CPI (final)

- GBP: Bank of England inflation expectations survey

- USD: University of Michigan consumer sentiment

The scheduled data releases and events could translate to fresh opportunities across global financial markets. Our focus lands on the world’s most popular traded currency pair which is set to be heavily influenced by central bank decisions and economic data.

Here are 3 reasons why the EURUSD is on our radar:

- Super central bank combo

A super central bank mashup featuring the Fed and ECB could inject the EURUSD with explosive levels of volatility.

Markets widely expect the Federal Reserve to leave interests unchanged in June with traders currently pricing in a 28% probability of a 25bps hike, according to Fed fund futures. However, the recent hawkish surprise from the Reserve Bank of Australia (RBA) and Bank of Canada (BoC) has left investors questioning the Fed’s next move. All eyes will also be on the updated dot plot, as well as Fed Chair Jerome Powell’s remarks at the press conference. If the Fed moves ahead with a hawkish hold and signals one more hike in July, this could support the dollar. Should the central bank surprise markets by raising rates, dollar bulls are likely to run rampant – rocking the FX arena.

In regards to the ECB, it is expected to raise interest rates by 25 basis points on Thursday, bringing the deposit rate to 3.50 from 3.25%. However, given how the Eurozone has slipped into a recession coupled with the weak economic data and signs of cooling inflation, the central bank could be close to ending its rate hike cycle. ECB President Christine Lagarde’s press conference will be closely scrutinized for fresh clues. Much focus will also be on the ECB’s staff economists fresh forecast for GDP and inflation, which may support the expectations around the hiking cycle coming to an end.

Whatever the outcome of both central bank decisions, expect the impacts to be reflected in the EURUSD.

- Top-tier economic data

Throughout the week, investors will be dished out a generous serving of key economic reports from the United States and Europe. This will range from US CPI, Germany ZEW survey expectations, Eurozone industrial production, US retail sales, and Eurozone CPI (final) among other important economic reports. Given how these releases are likely to influence central bank expectations, we could see increased volatility in the respective currencies.

- Should the pending US/Eurozone inflation report show signs of cooling inflation and other data releases point to slowing economic growth, this could fuel speculation around the hiking cycles coming to an end. Such a development may weaken the respective currency.

- If US/Eurozone inflation runs hot and economic data beat market expectations, bets may jump around interest rates remaining higher for longer – lending support to the currencies.

- Technical forces

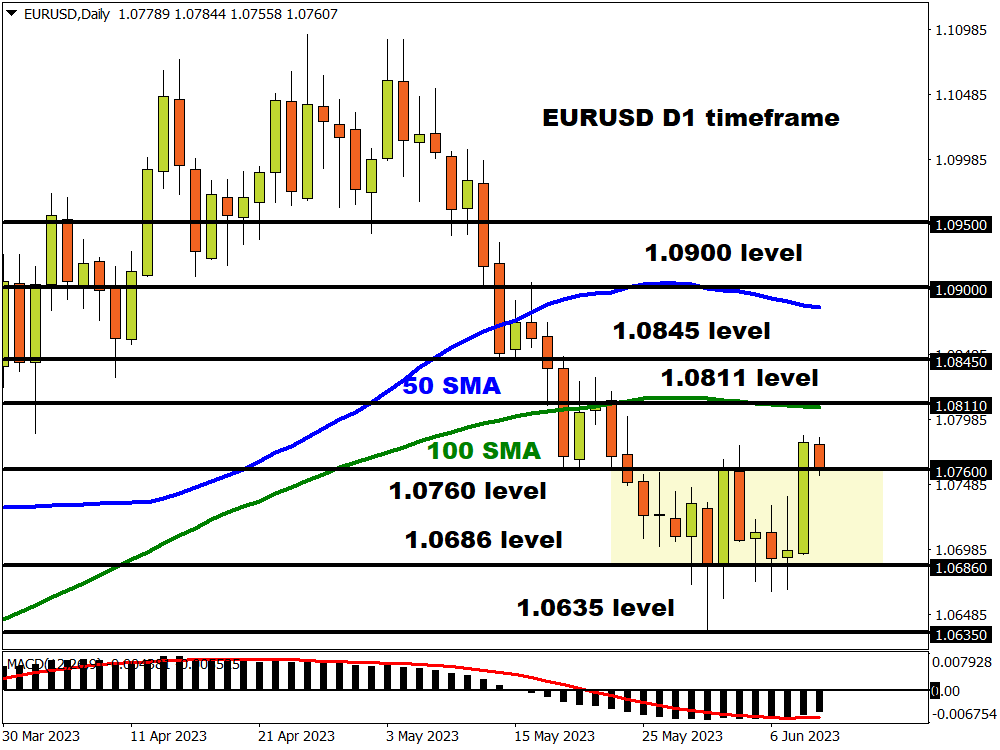

It has been a choppy affair for the EURUSD over the past two weeks but bulls could be making a move.

The recent breakout and daily close above the 1.0760 resistance level could signal further upside in the week ahead. However, the journey north could be challenging for bulls given the multiple levels of resistance, especially the first barrier at 1.0811 where the 100-day SMA resides. A strong daily close above this point could signal a move towards 1.0840 and 1.0900, respectively. Should prices slip back below 1.0760, the EURUSD may test support at 1.0686 before potentially challenging 1.0635 and levels not seen since March 2023 at 1.0550.

At the time of writing Bloomberg’s FX model forecasts a 73% chance that EURUSD will trade within the 1.0640 – 1.0896 range over the upcoming week.