Don’t be fooled by Gold’s current state of calm.

This could be an explosively volatile week for the precious metal due to key economic reports and high-risk events.

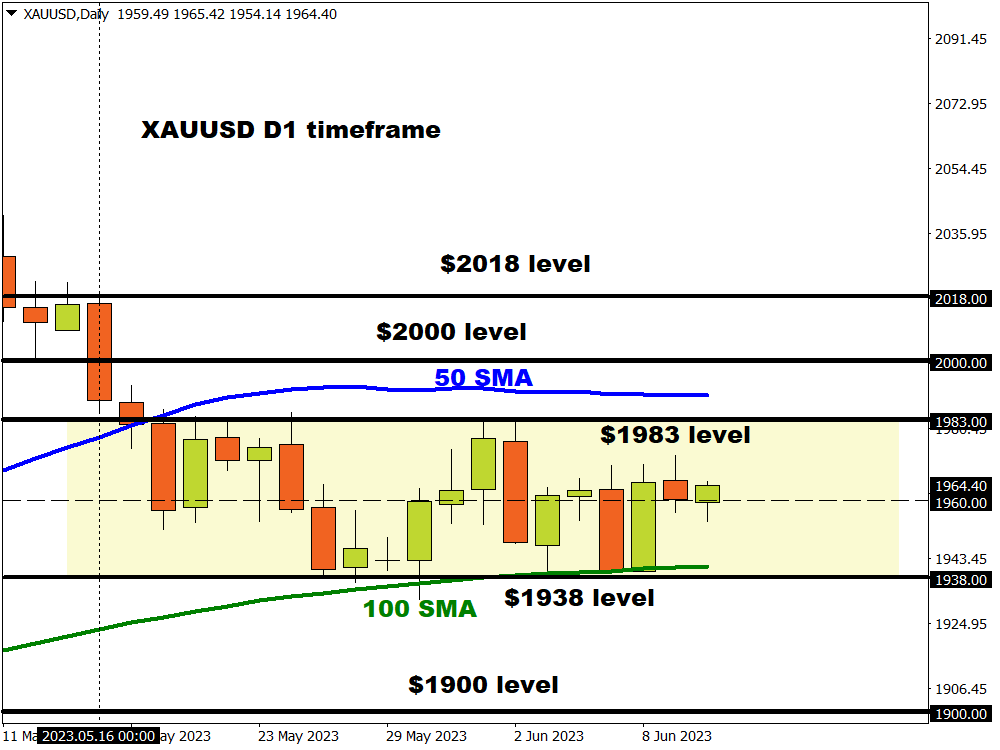

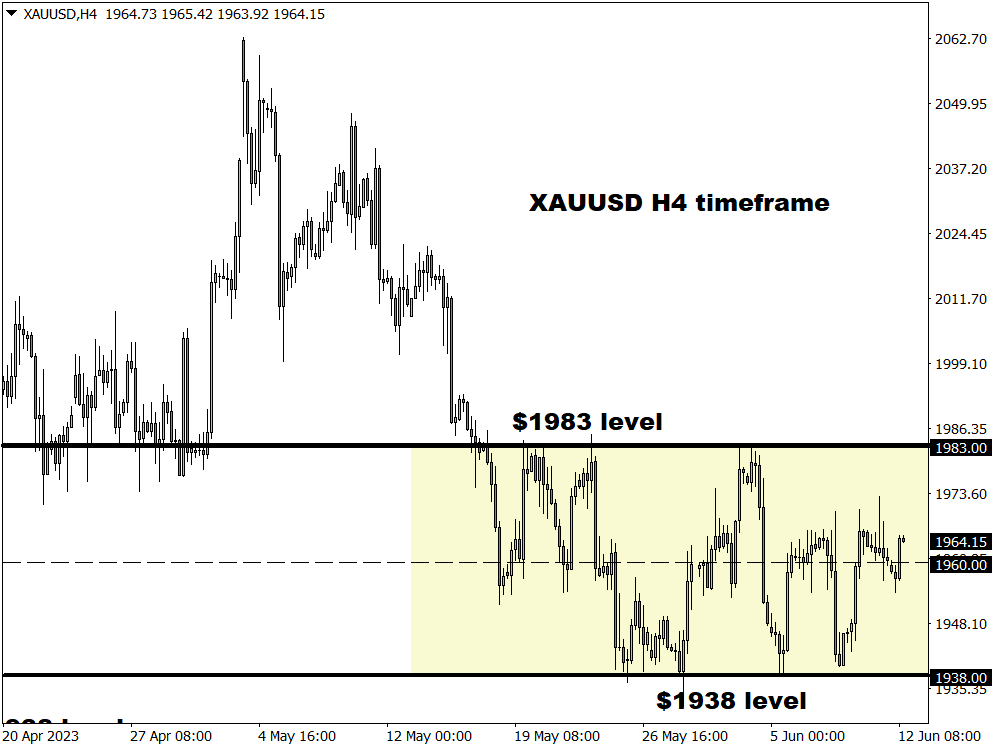

Over the past few weeks, gold has found itself trapped within a range with support at $1938 and resistance at $1983. A major breakout could be around the corner and here are reasons why….

- Key US inflation data

On Tuesday, 13th June the latest US CPI report will be released.

US inflation is expected to have slowed again in May after slightly easing in April. Markets forecast the MoM print to rise 0.2% after the 0.4% increase in April while the annual headline reading is seen falling to 4.1% from 4.9%. When keeping in mind that CPI hit 9.1% in June 2022, the drop in inflation has been a welcome development, driven by falling energy and commodity prices.

However, much attention will be on the Core CPI reading which excludes volatile food and energy prices. Core inflation is expected to remain unchanged at 0.4% MoM while the annual reading is seen cooling to 5.2% from 5.5% in April.

- Fresh signs of cooling inflationary pressures may reinforce expectations around the Federal Reserve ending its hiking campaign. This development could inject gold bulls with renewed confidence ahead of the Fed decision on Wednesday.

- If US inflation continues to run hot, rising more than market forecasts this could drag gold prices lower as bets rise over the Fed keeping interest rates higher for longer.

- Federal Reserve rate decision

All eyes will be on the Federal Reserve interest rate decision on Wednesday, 14th June.

Markets widely expect the Fed to leave interest rates unchanged with traders currently pricing in a 23% probability of a 25bps hike on Wednesday, according to Fed fund futures. Nevertheless, the unexpected rate hikes from the Bank of Canada (BoC) and Reserve Bank of Australia (RBA) have created some element of uncertainty over what to expect from the Fed. Investors are likely to closely scrutinize the updated dot plots, Fed Chair Jerome Powell’s press conference for fresh clues on the central bank's next move.

- If the Fed moves ahead with a hawkish hold and signals one more rate hike in July, this could weaken gold prices – especially if the dollar rises along with Treasury yields.

- An unexpected rate hike may deal with a heavy blow toward zero-yielding gold, potentially sending prices tumbling to levels not seen since mid-March 2023 around $1900.

- Gold in breakout mode?

After swinging within a range since mid-May 2023, gold could be ready to break out.

A strong daily close and breakout above $1983 may inspire an incline toward the $2000 psychological level and $2018, respectively. Should prices breach the $1938 support, where the 100-day SMA resides – this could open a path back toward $1900. Ultimately, how gold concludes this week will be heavily influenced by the US inflation data and Fed decision.