This will be a big week for Sterling as focus falls on the latest UK CPI figures and the Bank of England rate decision on Thursday.

Sterling is the best-performing G10 currency year-to-date, gaining roughly 6% against the dollar thanks to fundamental and technical factors.

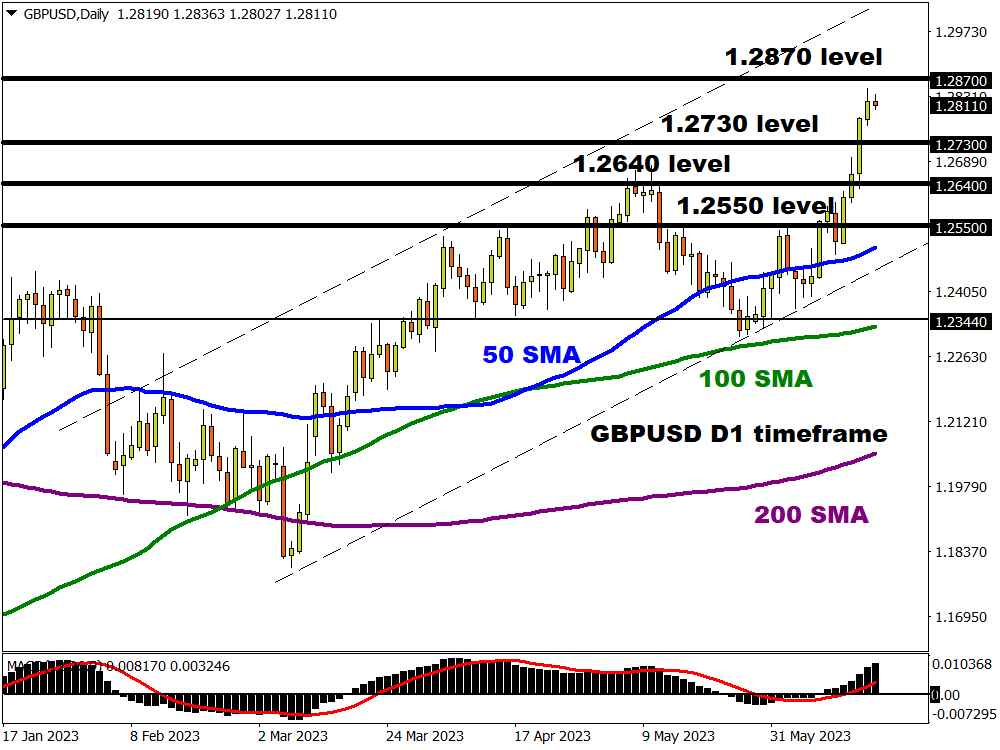

Indeed, investor appetite towards the British Pound continues to be supported by the resilience of the UK economy while hot inflation figures have fuelled expectations around the BoE keeping rates higher for longer. Regarding the technical picture, the GBPUSD is firmly bullish on the daily timeframe was prices trading at levels not seen in 14 months as of writing.

The GBPUSD has the potential to push higher this week and here are 3 reasons why:

BoE rate decision

The Bank of England (BoE) monetary policy decision will be on Thursday 22nd June.

24 hours before the BoE decision, the latest UK inflation figures will be published with markets forecasting CPI to cool 8.4%, down from the April print of 8.7%. Given how this is still more than 4 times the BOE’s target inflation rate of 2%, this is likely to keep BoE hawks in the driving seat.

Markets widely expect the BoE to raise interest rates by 25 basis points. This would be the thirteenth straight rate hike, taking the key rate to 4.75%. Given how UK inflation remains sticky along with strong wage growth, the central bank is expected to take rates close to 6% over the coming months.

- If the BoE strikes a hawkish note and signals further rate hikes, this is likely to push the GBPUSD higher.

- Should the BoE sound more dovish and expresses concern over the economy, this may send the GBPUSD lower as investors re-evaluate rate hike bets.

Jerome Powell’s testimony

Fed Chair Jerome Powell will provide his semi-annual monetary policy report to Congress on Wednesday and Thursday.

Although Powell is widely expected to reiterate comments from his post-Fed meeting press conference, this event still has the potential to trigger dollar volatility due to market sensitivity around rate hike expectations.

- Dollar bulls could receive a boost if Powell sounds hawkish and offers fresh clues on Fed hike timings. A stronger dollar is seen dragging the GBPUSD lower

- Should Powell strike a more cautious tone during Testimony, this could deflate the dollar – resulting in the GBPUSD pushing higher.

Technical forces favour bulls

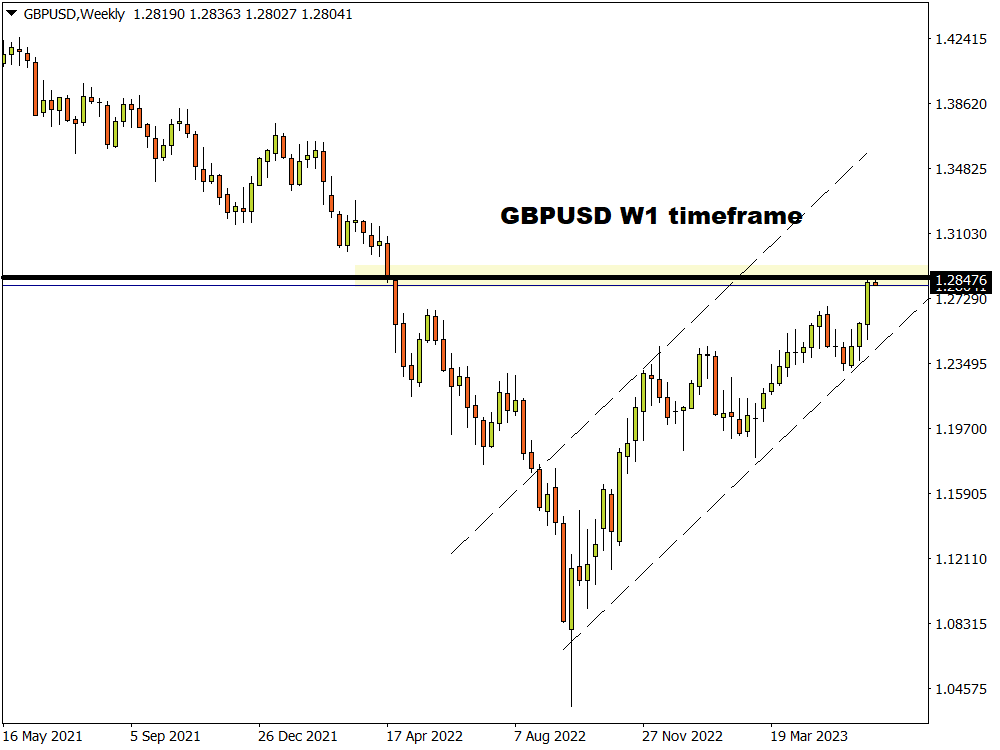

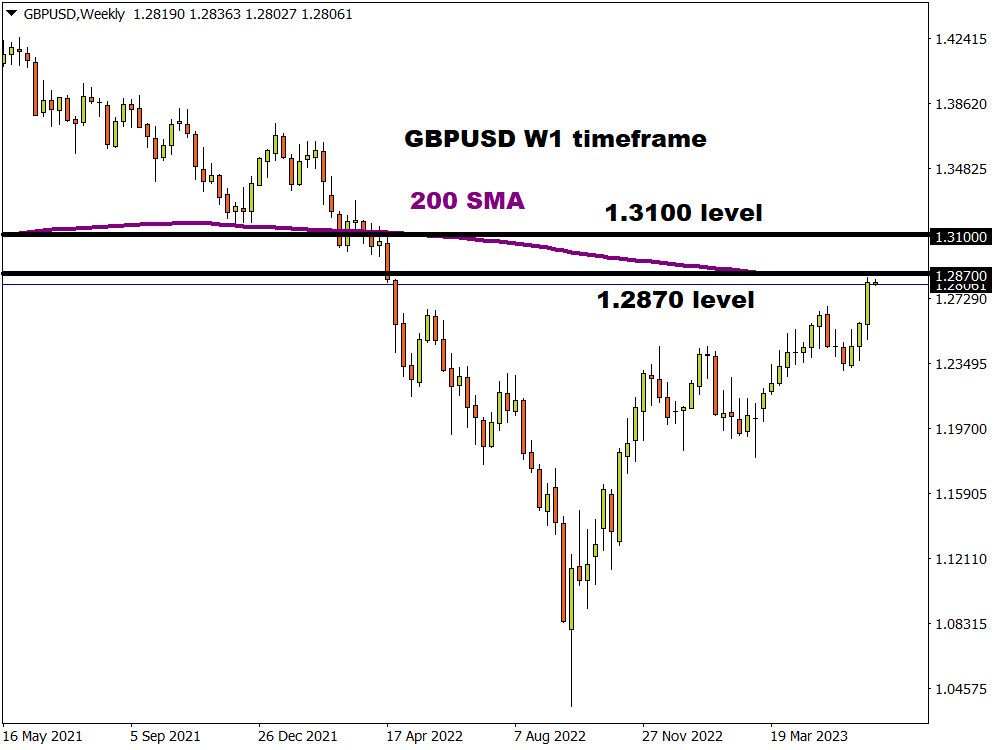

The GBPUSD remains firmly bullish on the daily timeframe. There have been consistently higher highs and higher lows while prices are trading firmly above the 200, 100, and 50-day Simple Moving Averages. Bulls are currently approaching key weekly resistance at 1.2870 where the weekly 200 SMA resides.

A solid weekly close above this level could encourage an incline towards levels not seen since early April 2022 at 1.3100. Should prices slip back below the 1.2730 level, this may trigger a decline back to 1.2640 and 1.2550, respectively.