The GBPUSD remains choppy on the daily timeframe but bulls linger in the vicinity. Further upside could be on the cards, especially after prices created a potential new impulse wave.

With just over an hour left until the BoE rate decision, here is watch to watch out for on the technical front:

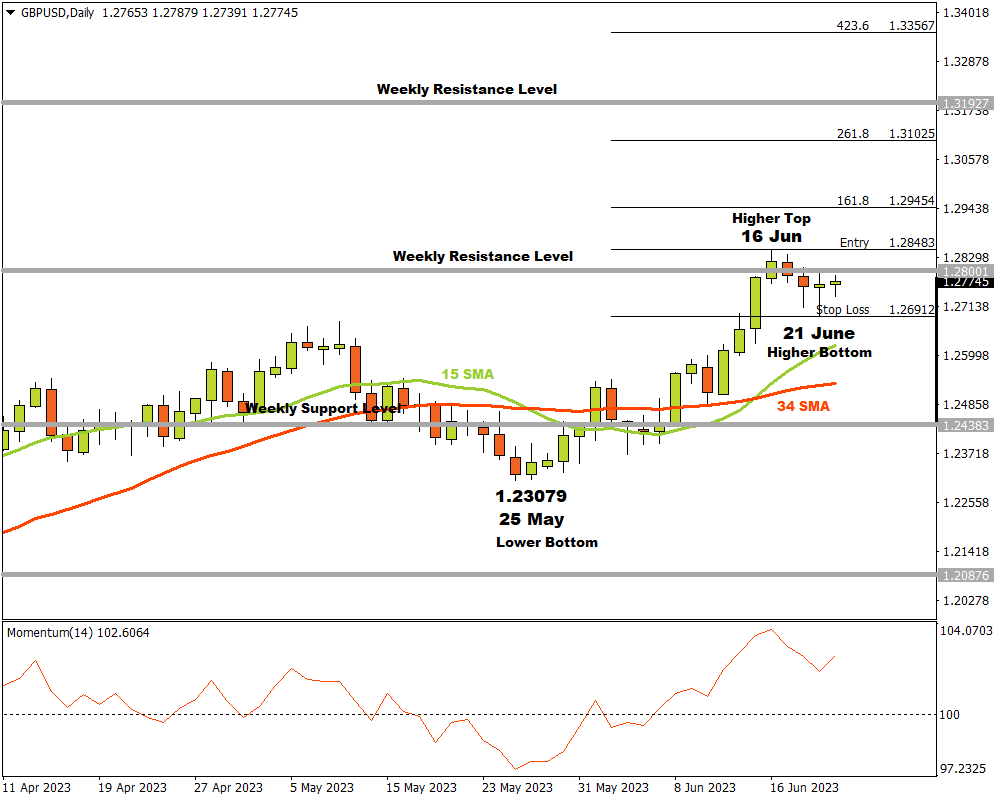

Bulls jumped back into the scene after prices rebounded from the 1.23079 lower bottom on 25 May. Since then, prices have pushed higher, breaking through the weekly resistance level that become a support and was retested by bears. The price reached another weekly resistance level and a higher top was created on 16 June at 1.28483. Although bears tried to pull the price down and succeeded for a short while, bulls seem determined to re-test the weekly resistance level with a higher bottom forming on 21 June at 1.26912.

If the bulls accomplish this feat and manage to drive the price higher than 1.28483, three possible targets become possible from there. Attaching the Fibonacci tool to the higher top at 1.28483 and dragging it to the higher bottom at 1.26912, the following targets can be established:

The first possible target is at 1.29454 (161.8%).

The second price target is likely at 1.31025 (261.8%)

The third and final target may reach 1.33567 (423.6%) if the price is able to break through a weekly resistance level around the 1.31927 level.

If the support level at 1.26912 is broken, this scenario is no longer valid.

As long as bulls can keep up the momentum with demand overcoming supply, the market sentiment for GBPUSD on the D1 time frame will remain bullish.