If you thought this was a volatile week jampacked with high-risk events, then just wait until you see what’s in store for the first week of August…

Investors may struggle to catch their breath in the week ahead due to a mashup of key economic reports, more central bank meetings, and a slew of corporate earnings from the largest companies in the world!

The first trading week of August features these scheduled economic data releases and events:

Monday, July 31

- CNY: China manufacturing & non-manufacturing PMI

- JPY: Japan industrial production, retail sales

- EUR: Eurozone Q2 GDP, CPI, Germany Q2 GDP

- UK100_m: HSBC earnings

Tuesday, August 1

- AUD: RBA rate decision

- CNH: China Caixin manufacturing PMI

- EUR: Eurozone & Germany Global Manufacturing PMI, unemployment

- GBP: UK S&P Global/CIPS manufacturing PMI

- USD: US ISM manufacturing, job openings

- SPX500_m: Pfizer earnings

Wednesday, August 2

- NZD: New Zealand unemployment

- JPY: Bank of Japan meeting minutes (June)

Thursday, August 3

- CNH: China Caixin Services PMI

- EUR: Eurozone S&P Global Services PMI, PPI

- GBP: BOE rate decision

- USD: US initial jobless claims, factory orders, ISM services

- NQ100_m: Amazon, Apple earnings

Friday, August 4

- CNH: China balance of payments

- EUR: Eurozone retail sales, Germany factory orders

- CAD: Canada unemployment

- Oil: OPEC+ alliance virtual meeting

- USD: US July nonfarm payrolls (NFP)

Given the high-quality list of risk events, it may be wise to strap up and fasten your seatbelts.

Our focus falls on the US July nonfarm payrolls (NFP) which could rock global financial markets.

The US jobs data could offer critical insight into the Fed's next move, especially after the central bank's recent shift to data dependence. After raising interest rates to the highest level in 22 years in an effort to combat inflation, the Fed has adopted a “wait-and-see” approach for future moves. So essentially, the jobs report has become a critical piece of the equation to determine what the Fed could do at its next policy meeting in September. Note that the Fed wants to see more weakness in the jobs markets which could translate to cooling inflationary pressures.

What are markets forecasting?

- Headline NFP number: 190,000 new jobs added to the US economy in July

- Unemployment rate: 3.6%

- Average hourly earnings: 4.2% rise year-on-year (July 2023 vs. July 2022)

Potential outcomes to the US NFP report

- A stronger-than-expected US jobs report may fuel speculation around the Federal Reserve raising interest rates one final time in 2023.

- A weaker-than-expected US jobs report could support the argument that the Federal Reserve ended its hiking cycle in July.

What are markets forecasting for the Fed’s next rate moves?

- 19% chance of a 25 basis points hike in September 2023

- 37% chance of a 25-basis point hike by November 2023

- 20% chance of a 25-basis point hike by December 2023

Ultimately, these expectations are likely to be influenced by the multiple jobs, inflation, and other key reports published over the next few months.

With all the above discussed, here’s how these 3 assets could react to the US jobs report:

USD Index

Given how the dollar remains sensitive to the Fed hike expectations, we could see some fireworks on Friday.

- A stronger-than-expected US jobs report may fuel bets around the Fed hiking rates one more time in 2023, injecting dollar bulls with renewed confidence. This may propel the USD Index towards 102.35, just below the 100-day Simple Moving Average.

- A weaker-than-expected US jobs report could fuel speculation around the Fed being done with rate hikes, resulting in a weaker dollar. This development could see the USD Index slip back below the 100.72 level.

NQ100_m

Expect some action on the Nasdaq 100 which is jampacked with US tech stocks that are sensitive to US rate hike expectations.

- A stronger than expected US jobs report is seen boosting expectations around Fed hike down the line. Such an outcome could see the NQ100_m slip back below the 15300-support level.

- A weaker-than-expected US jobs report that boosts bets around the Fed’s hiking cycle ending in July could propel the NQ100_m above 15700 with 15947 acting as a level of interest.

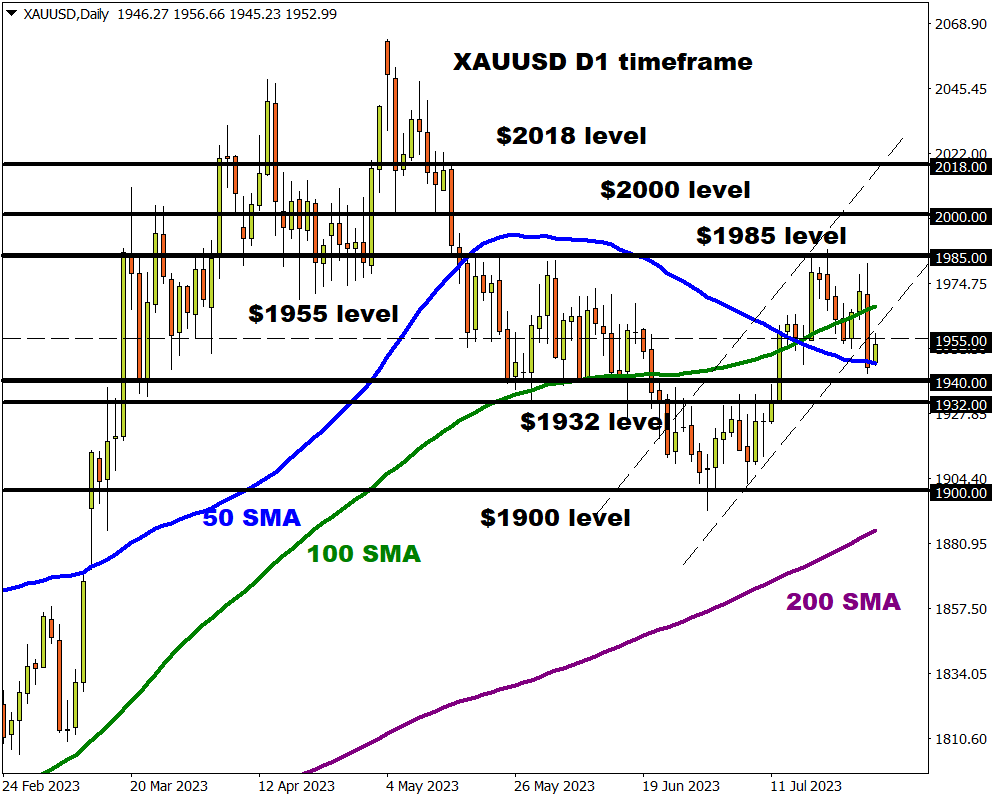

Gold

The pending NFP report could be the catalyst zero-yielding gold has been waiting for to breakout out of its current range.

- A stronger-than-expected US jobs report may lead to higher bets around the Fed hiking rates once more in 2023. This development could drag prices back below $1932 with $1900 acting as a key level of interest.

- A weaker-than-expected US jobs report may support expectations around no more US rate hikes this year. These prospects could push gold higher towards $1985 and $2000, respectively.