Sterling could kick off the new trading month with a bang as focus falls on the Bank of England rate decision.

After posting a mixed performance across the G10 space in July and gaining roughly 1% versus the dollar, could volatility return in August?

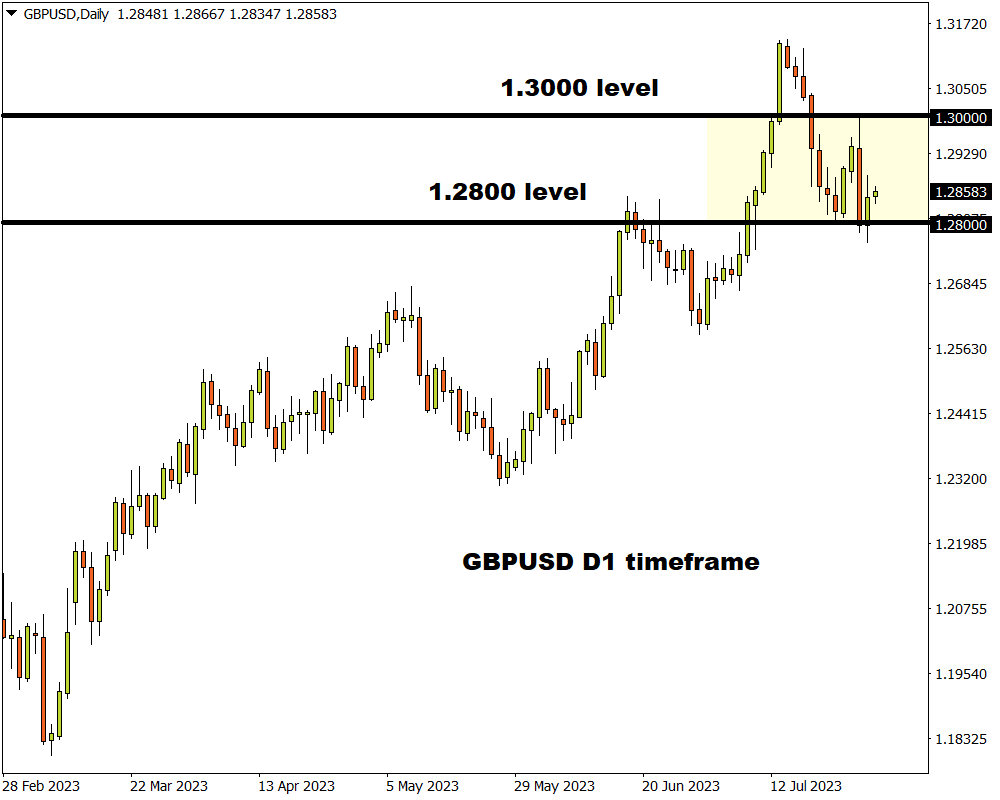

Over the past few weeks, buying sentiment toward the currency has been influenced by conflicting forces – placing bulls and bears in a fierce tug of war. Pound bulls continue to draw strength from rising expectations over the BoE keeping rates higher for longer in the face of sticky inflation. But bears remain supported by growing recession fears as UK economic data disappoints. Regarding the technical picture, the GBPUSD has found itself back within a wide range with support at 1.2800 and resistance at 1.3000.

The GBPUSD could be gearing up for a major move this week and here are 3 reasons why:

1) BoE Rate Decision

The Bank of England (BoE) monetary policy decision will be on Thursday 3rd August.

This will be accompanied by the minutes of the meeting and the quarterly Monetary Policy Report (MPR), making it a Super Thursday combo.

Markets widely expected the BoE to raise interest rates by 25 basis points. This would be the fourteenth straight rate hike, taking the key rate to 5.25% - its highest level since 2008. Despite UK consumer price inflation dropping to 7.9% in June, it remains well above the BoE’s target. This is likely to fuel expectations around more rate hikes despite disappointing economic data fuelling recession fears.

Investors will be paying very close attention to the minutes, quarterly MPR, and BoE Governor Andrew Bailey’s press conference for fresh clues on the BoE’s next policy move.

- If the BoE delivers a 25 basis point hike and signals further rate hikes in the face of still sticky inflation, this could support the GBPUSD.

- If the BoE surprises markets by delivering a 50 basis points hike, this could inject Pound bulls with enough confidence to break out of its current range.

- A scenario where the BoE delivers a dovish hike, expressing concern over the UK economy could send the Pound falling.

2) US Jobs report

All eyes will be on the US July nonfarm payrolls (NFP) on Friday which could offer critical insight into the Fed’s next move - especially when factoring in the central bank's recent shift to data dependence.

The US economy is forecast to have added 190,000 new jobs to the labour markets in July while the unemployment rate is expected to remain unchanged at 3.6%. Given how the US report will act as one of the key pieces that determine whether the Fed raises rates one final time in 2023 or not, this could translate to increased dollar volatility.

- A stronger-than-expected US jobs report may fuel speculation around the Federal Reserve raising interest rates one final time in 2023. Should this result in a stronger dollar, this could drag the GBPUSD lower.

- A weaker-than-expected US jobs report could support the argument that the Federal Reserve ended its hiking cycle in July. If this sees the dollar weaken, the GBPUSD may push higher.

3) Technical forces

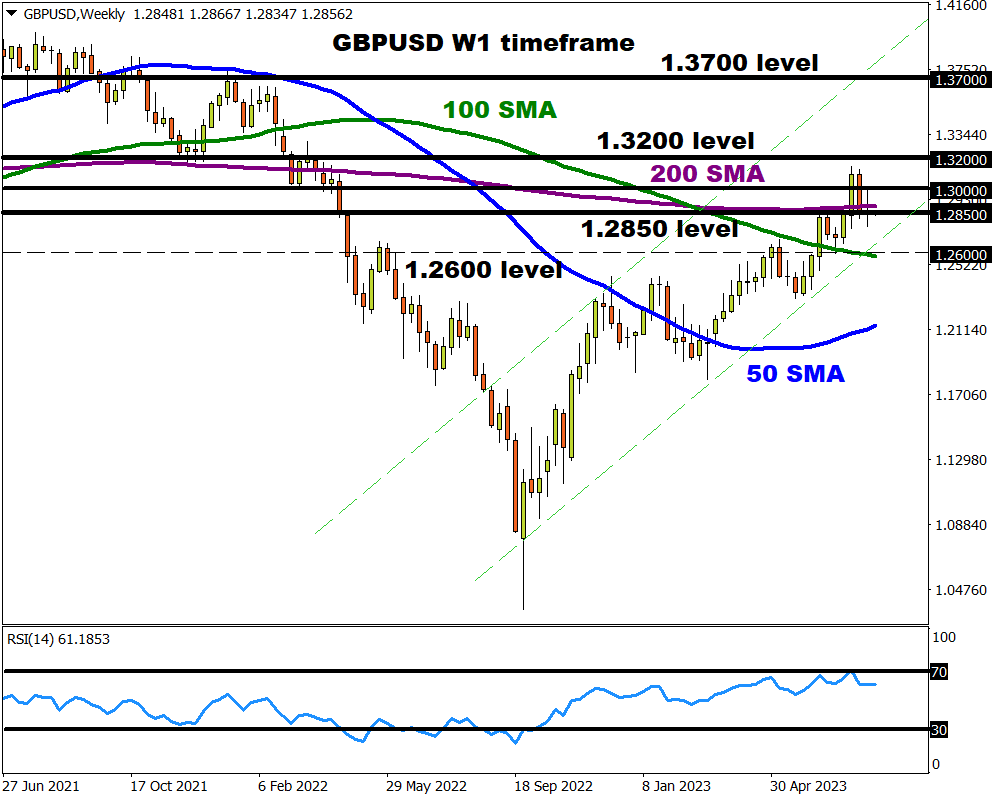

The GBPUSD remains in a bullish channel on the weekly timeframe. However, prices are trading around a significant pivotal point at 1.2850 just below the 200-week SMA. If bulls can keep above this level, and leverage this support to push beyond 1.3000, the next key resistance can be found around 1.3200. However, a breakdown below 1.2850 may see a decline towards the 100-week SMA at 1.2600.

On the daily charts, support can be found at 1.2800 and resistance at 1.3000. A solid breakout above 1.3000 may open the doors towards 1.3140 and 1.3200, respectively. Should prices slide below 1.2800, bears may target 1.2600.