China’s central bank hijacked the headlines on Tuesday morning after unexpectedly reducing a key rate by the most since 2020 to shore up its weak economy. However, Asian markets displayed a mixed reaction with sentiment whacked by a barrage of disappointing China data published after the rate decision.

European futures are pointing to a positive open ahead of the German August ZEW survey. In the currency space, the yuan slipped to its weakened level since November while the British Pound received a boost after reports showed wages grew at a record pace in the second quarter of 2023.

Looking at commodities, gold is wobbling above the $1900 support level while oil prices remain vulnerable as China growth fears hit the demand outlook.

USD and retail sales in focus

As we move deeper into the second half of 2023, dollar weakness could become a major theme if the Fed signals that it has truly concluded its rate hiking cycle.

Despite US inflation edging up in July after 12 straight months of decline, the core figures were encouraging and signal that the Fed’s aggressive hikes are starting to tame the inflation beast. Should price pressures continue to ease and US economic data show signs of weakness, this may eliminate the odds of another hike, especially when factoring in the Fed's current data dependence stance.

All eyes will be on the US retail sales figures later today which could add another piece to the puzzle that determines whether the Fed hikes one more time in 2023 or not. On Wednesday, the Fed minutes might also offer key clues on the central bank’s next policy move. Traders are currently pricing in only an 11% probability of a 25-basis point hike at September’s FOMC meeting, with this rising to 40% by November, according to Fed funds futures. The dollar is likely to weaken if the data is softer or the minutes strike a dovish tone. Any hint from the hawks or signals of more hikes down the road could boost the dollar.

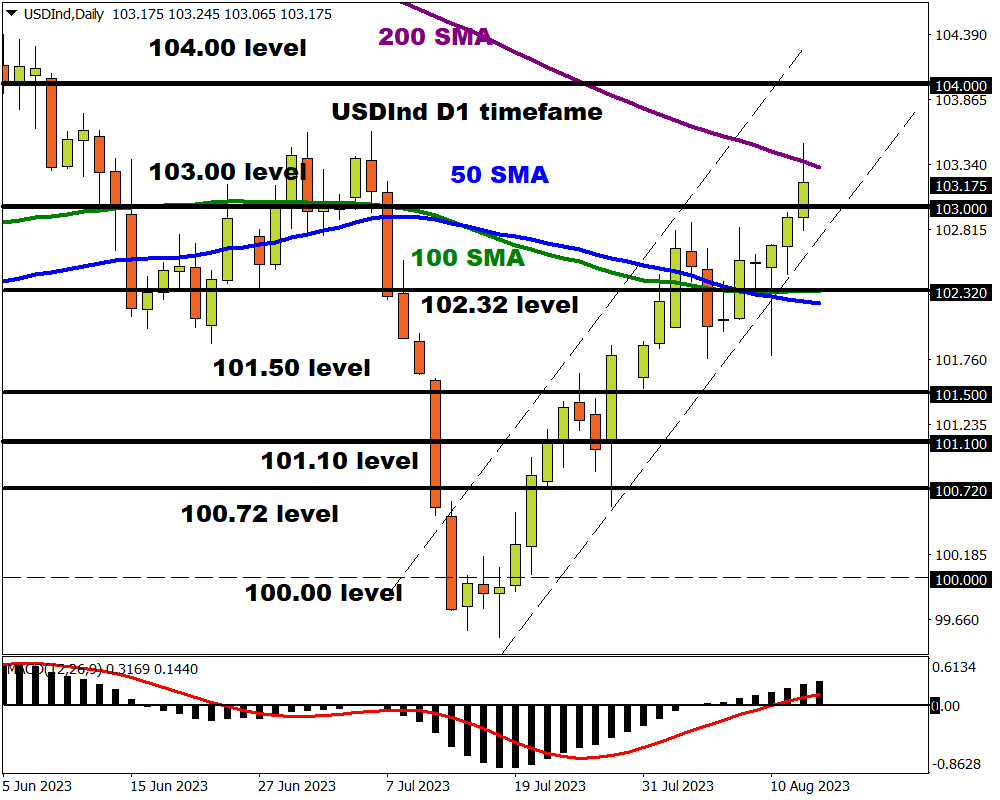

Talking technical, the US Dollar Index is lingering below the 200-day Simple Moving Average on the daily charts. If bulls are unable to conquer this resistance, prices may slip back below 103.00. Should the current upside momentum hold, the next key level of interest can be found at 104.00.